This article is machine translated

Show original

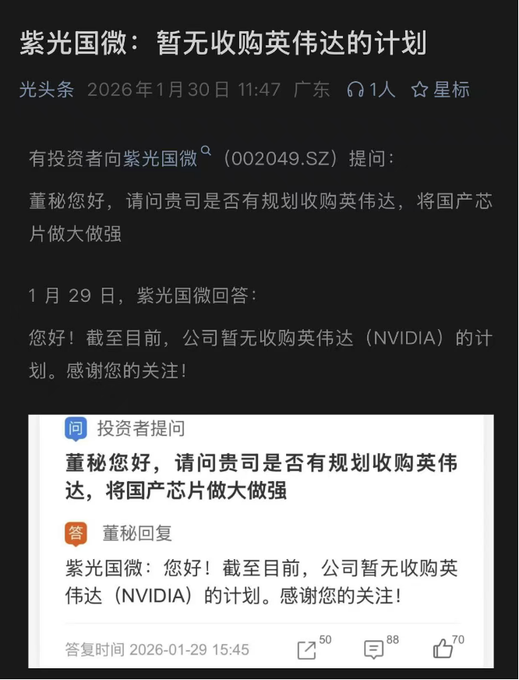

An investor asked Unisplendour Microelectronics, an A-share listed company: "Does your company have any plans to acquire Nvidia?"

The company secretary replied: "The company currently has no plans to acquire Nvidia."

While we now consider this a joke,

the Unisplendour group does indeed have a tradition of "acquiring everything." Its former leader, Zhao Weiguo, was known as the "chip fanatic."

In 2015, he made a $23 billion offer for Micron Technology.

Those who trade US stocks know that Micron is the world's fourth-largest semiconductor manufacturer and the only DRAM memory giant in the US, sharing the market with Samsung and SK Hynix.

At the time, Micron's market capitalization was less than $20 billion, meaning Unisplendour was offering a 19% premium.

If successful, China would have directly acquired a core player in the memory chip industry, completely reshaping the industry landscape.

However, Micron refused, reportedly due to a direct intervention from then-US President Obama.

That same year, Zhao Weiguo also publicly challenged Morris Chang to acquire TSMC, stating that Taiwan's semiconductor industry was doomed if it didn't open up.

In six years, Tsinghua Unigroup completed over 60 acquisitions, its assets ballooning from 1.3 billion to nearly 300 billion.

In 2021, its debts collapsed, leading to bankruptcy reorganization. In 2025, Zhao Weiguo was sentenced to death with a two-year reprieve, while TSMC's market capitalization reached $1.77 trillion that same year.

Time has no time to mock anyone; everyone simply goes their own way.

Your writing skills are excellent; that last sentence is so evocative!

Tsinghua Unigroup's chips are so bad they're difficult for even my grandma to use, and they still want to acquire Nvidia? 🤪

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content