The hot search list includes our biggest gains in 2022, and also hides the best survival guide for 2023.

By Frank, Foresight News

2022 has passed in a flash, and the industry this year has been even more volatile, especially after experiencing several "black swan" events, which have subjected the entire crypto market to extreme stress tests in many aspects, and have also contributed enough attention and topic popularity inside and outside the industry.

All that is past is prologue. This article counts the user search results of Foresight News this year, and merges the uppercase and lowercase letters of the same concepts, thus compiling the 2022 hot search list (including the site hot search list and the Mirror hot search list).

Through this list, we can not only get a glimpse of the projects or tracks that are the hottest and most watched by users this year, but also perhaps learn from it to discover the sparks hidden behind them and gain a survival guide for 2023.

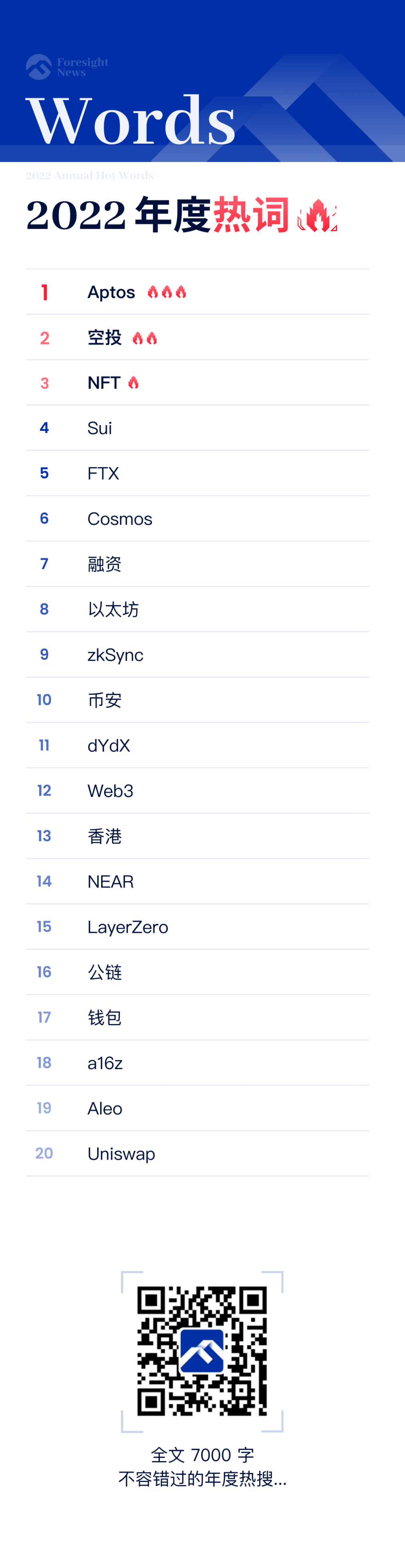

Annual hot search list on the site

Aptos: The top new public chain of the year

It is not surprising that "Aptos" can rank first on the site's annual hot search list this year. Although it only started the airdrop of the token APT in October, as a new public chain leader born with a silver spoon in its mouth, Aptos has successfully taken over the baton from EOS, Polkadot, Solana, and Avalanche in history in terms of community attention and ecological popularity this year, becoming the new top public chain.

If we look back at the major project progress nodes of Aptos this year, we will find that they almost run through 2022:

- On March 15, Aptos completed a strategic financing of US$200 million, led by a16z, with participation from Tiger Global, Katie Haun, Multicoin Capital, Three Arrows Capital, FTX Ventures and Coinbase Ventures;

- On May 13, Aptos opened registration for the Incentive Testnet 1, which officially started on May 16 and lasted until May 27;

- On July 1, Aptos opened registration for the Incentivized Testnet 2, which was officially launched on July 12 and will last until July 22.

- On August 19, Aptos opened registration for the Incentivized Testnet 3, which will last until September 9;

- On July 25, Aptos completed a $150 million financing, led by FTX Ventures and Jump Crypto;

- On October 18, Aptos launched the mainnet and immediately released a token economics overview. The initial total supply of APT is 1 billion, of which 51.02% is allocated to the community, 19.00% to core contributors, 16.50% to the foundation, and 13.48% to investors.

- On October 19, Aptos distributed approximately 20 million APT tokens to users who completed the Aptos Incentivized Testnet application or minted the APTOS:ZERO Testnet NFT;

It is still unknown whether Aptos, which started in 2022, will gradually usher in an ecological prosperity in 2023, or replicate the development trajectory of EOS and Polkadot.

Airdrop: A core topic throughout the year

"Airdrop" is the hot word second only to Aptos this year. From APE in March to OP in June, and then to APT and Blur multiple packages in October, the large-scale airdrops that have been realized this year have almost run through the whole year:

- On March 17, BAYC's parent company Yuga Labs launched the APE token with a total of 1 billion tokens, of which 62% will be allocated to the community, 15% to airdrops, 47% to the ecological fund, 8% to BAYC founders, 16% to the Yuga Labs team, and 14% to partners and investors;

- On June 1, Optimism officially opened the OP governance token airdrop, with an initial issuance of 4294967296 tokens, which will be inflated at a fixed rate of 2% per year. The first round of airdrops will account for 5% of the total tokens.

- On October 18, Aptos released a token economics overview. The initial total supply of APT is 1 billion, and about 20 million APT tokens will be airdropped to users who complete the Aptos incentive test network application or mint APTOS:ZERO test network NFT;

- On October 20, Blur was officially launched and will airdrop Packages to all users who have traded NFTs in the past 6 months. The second round of airdrops will be open for application on December 6, which will be ten times the size of the first round. The third round of airdrops will end in January next year, when the BLUR token will also be launched.

At the same time, potential airdrops such as Sui, zkSync, StarkNet, Scroll, Aleo, Sei, etc. may also make everyone have high hopes, so this year everyone’s participation in the test network and airdrops have become basic operations, and it is destined to continue the popularity of the airdrop topic (see the timeline "Summary of Selected Potential Airdrops").

Sui: A new public chain protagonist who came late but got ahead

The trend of Sui's popularity this year has perfectly verified the logic that good things never come late in the crypto world. As two related projects that also came out of the Diem core team, compared to the powerful Aptos, Sui is more like Cosmos back then, and Aptos is more like the popular Polkadot back then:

Sui’s initial attention and discussion were far less than Aptos, especially after Aptos released its token in October this year, its popularity was once far behind.

But in the past month, unlike the gradually decreasing voice of the Aptos ecosystem, Sui's popularity has remained high as the details of the token distribution and other details that everyone is looking forward to have been disclosed. With the arrival of 2023, Sui is likely to become one of the protagonists of much attention, just like Aptos this year (recommended reading " A look at the PoS blockchain network Sui released by several former members of Meta ").

FTX: The biggest industry black swan in 2022

The collapse of "FTX" should be the black swan event that has the most profound impact on the industry this year. It is also regarded as the Lehman crisis in the crypto world. The size of its funding hole and the number of outrageous operations have led to no one knowing who will be the next target of the collapse.

Therefore, its impact on the entire market is not only in the dimensions of assets and prices, but more importantly, it has a profound impact on industry confidence and regulatory expectations: one of the top three exchanges in the world, a leading company in the limelight, misappropriated user assets and even caused billions of dollars in losses, causing it to collapse rapidly overnight.

You have to know that just a few months ago, FTX seemed to be unaffected by Terra and Three Arrows Capital. The market felt that it had money in its pockets and was attacking from all sides, expanding its M&A front - it won the bankruptcy auction of Voyager for approximately US$1.422 billion, defeating previously rumored competitors such as Binance, and at the same time expressed its intention to consider bidding for the assets of the bankrupt crypto lending platform Celsius Network, etc.

Therefore, few people could have imagined that the beginning of all this would be so dramatic, and no one thought that the collapse of a $32 billion giant would be so rapid. The series of chain reactions it triggered, whether it is FTX and its related entities themselves, or centralized institutions such as Genesis and DCG that serve as counterparties, the crisis is still fermenting in depth (recommended reading timeline " Crypto Lehman Moment, the Dominoes Overturned by FTX ", " Reflections on the Collapse of FTX ").

The arrest of SBF by the Bahamian police on December 13th opened a new chapter for the entire FTX incident (see the timeline " SBF was arrested, is FTX entering the final chapter of the story? "). The aftermath of the incident is expected to continue in 2023, and the battle is destined to be long.

Cosmos: Implicitly the Second Largest Public Chain Ecosystem

"Cosmos" took advantage of the popularity of LUNA and Terra ecosystems in the first half of this year, and its development momentum was significantly better than the Polkadot parallel chain project, which is now in decline.

Even though the subsequent collapse of Terra had a serious impact on the Cosmos ecosystem, which was deeply involved, unlike the Polkadot parachain auction and the lack of attention to the project, Cosmos is still a hot project, especially with the release of the 2.0 version of the white paper at the Cosmoverse conference, which greatly expanded the narrative space in terms of inter-chain security, liquidity staking, new token models, and fee mechanisms.

Although the release of ATOM tokens may bring selling pressure to the secondary market in the short and medium term, it is undoubtedly an expected boost to the longer-term narrative. After all, having a story to tell is the driving force behind the continued growth of public chain and other crypto projects.

Delphi Digital, which previously focused on the research and development of the Terra ecosystem, also stated that it will focus on the Cosmos ecosystem in the future (further reading " Delphi Labs: Why we focus our R&D efforts on the Cosmos ecosystem "). Although its performance in terms of security and technical issues is not satisfactory, at least for now, Cosmos has a tendency to become the second largest public chain ecosystem after Ethereum in 2023.

Financing: More than 20 financings of over 100 million US dollars throughout the year

"Financing" as a major topic continues to attract attention. Here we simply list some "well-known projects + more than 100 million US dollars" financing events worth paying attention to this year (excluding some projects with low relevance and special tracks, but according to incomplete statistics, there are still more than 20 events, and they are relatively balanced before and after, which shows that although there have been constant turmoil this year, the financing boom is still strong):

- Solana ecosystem wallet Phantom completed a new round of financing of US$109 million led by Paradigm, with a valuation of US$1.2 billion;

- Blockchain development platform Alchemy completed a $200 million financing round at a valuation of $10.2 billion, led by Lightspeed and Silver Lake;

- Amber Group completed a $200 million financing at a valuation of $3 billion, with participation from Temasek, Sequoia China, Pantera Capital and Tiger Global Management;

- Immutable, the developer of NFT second-layer scaling solution Immutable X, completed a $200 million financing at a valuation of $2.5 billion, led by Temasek;

- ConsenSys completed a $450 million Series D round at a $7 billion valuation, led by ParaFi Capital;

- Optimism completed a $150 million Series B financing round, led by a16z and Paradigm;

- BAYC's parent company Yuga Labs completed a new round of financing of US$450 million at a valuation of US$4 billion, led by a16z;

- Helium completes $200 million Series D round at $1.2 billion valuation, led by Tiger Global;

- LayerZero Labs, the development team of LayerZero, announced the completion of a $135 million Series A+ round of financing, led by FTX Ventures, Sequoia Capital and a16z;

- NEAR Protocol completed a $350 million financing, led by Tiger Global;

- Indian crypto exchage CoinDCX completed a $135 million Series D round of financing at a valuation of $2.15 billion, led by Pantera Capital and Steadview Capital;

- KuCoin completed a $150 million financing with a valuation of $10 billion, led by Jump Crypto, with participation from Circle Ventures, IDG Capital and Matrix Partners;

- Chainalysis completes $170 million Series F funding round at $8.6 billion valuation, led by the company’s existing investor Singapore sovereign wealth fund GIC;

- Solana ecosystem NFT market Magic Eden completed a $130 million Series B financing with a valuation of $1.6 billion, led by Electric Capital and Greylock;

- Digital asset brokerage company FalconX completed a $150 million Series D financing round at a valuation of $8 billion, led by GIC and B Capital;

- Digital asset management platform Gnosis Safe announced its name change to Safe and completed a $100 million financing led by 1kx;

- Limit Break, the parent company of NFT project DigiDaigaku, has completed two rounds of financing totaling US$200 million, led by Josh Buckley, Paradigm and Standard Crypto;

- Sui development team Mysten Labs completed $300 million in financing, led by FTX Ventures;

- Animoca Brands completes $110 million financing led by Temasek;

- Uniswap Labs completed a $165 million Series B financing round at a valuation of $1.66 billion, led by Polychain Capital;

- Matter Labs, the developer of zkSync, has completed a $200 million Series C round of financing, led by Blockchain Capital and Dragonfly;

- Aztec Network completed $100 million in financing, led by a16z crypto;

- Amber Group completed a $300 million financing round, led by Fenbushi Capital US;

Ethereum: Entering a new era of PoS

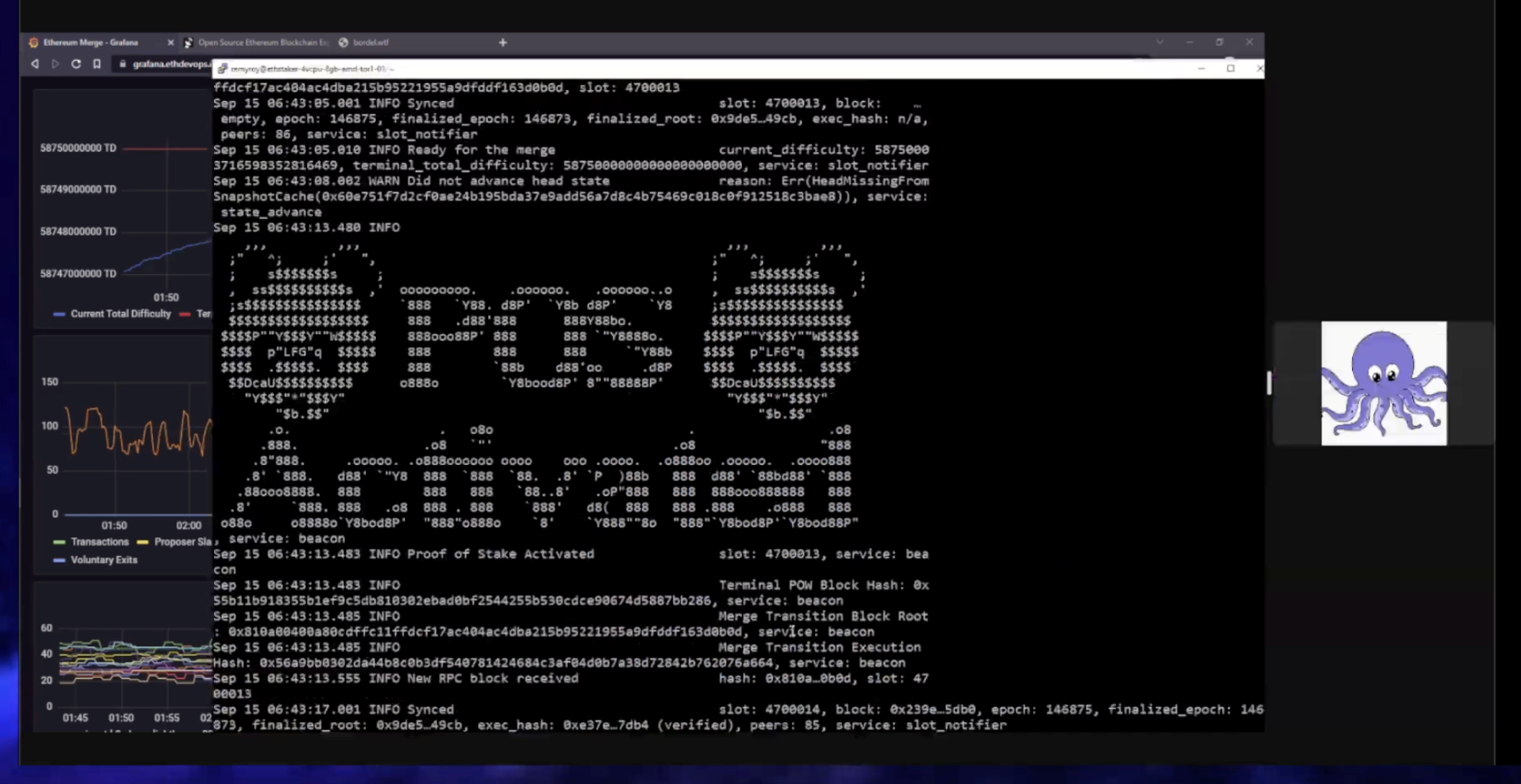

The biggest industry event of "Ethereum" this year is none other than the PoS merger. At 14:42 on September 15, 2022, Ethereum successfully reached the total difficulty of the mainnet merger terminal. The last block in the PoW era was mined by F2Pool with a block height of 15537393.

The Ethereum execution layer (formerly the mainnet) and the proof-of-stake consensus layer (i.e. the beacon chain) triggered a merger mechanism at block height 15537393, and produced the first PoS block (height 15537394).

Hello, PoS; Byebye, PoW. As a billion-dollar behemoth today, Ethereum, which was born nearly ten years ago, has completely become the leading currency representing PoS, thus bringing the crypto competition into a new era (recommended reading " A Brief History of Ethereum: The Hundred-Billion-Dollar Behemoth Born Because Blizzard Weakened Warlock "), 2023 will also be a brand new year after Ethereum fully enters PoS, and will usher in many key milestones such as the Shanghai upgrade, which is worth looking forward to.

zkSync: The zkEVM workhorse with an increasingly important role

"zkSync", as one of the most anticipated future directions of Ethereum, has always been regarded as the main force of the entire Layer2, especially the zkEVM test. The launch of the 2.0 mainnet in October this year also means that as a ZK Rollup compatible with EVM, zkSync is at the forefront of a number of Layer2 competitions.

At this year’s Korea Blockchain Week, Vitalik once again reiterated his optimism for ZK Rollup in the Layer War:

I still believe that some of today’s Optimistic Rollup projects will succeed, but I expect that some of today’s Optimistic Rollup projects dedicated to scaling Ethereum will turn to embrace ZK-Rollups because ZK-Rollups have “fundamental advantages” and even bluntly state that “ ZK Rollup is likely to be Ethereum’s top Layer2 scaling weapon .”

Nowadays, with the depressed sentiment in the crypto market, Layer2, especially zkEVM, plays a particularly important role in the entire Ethereum ecosystem in the future. How zkSync will perform in 2023 (when will the coin be issued) is expected to be one of the most watched topics.

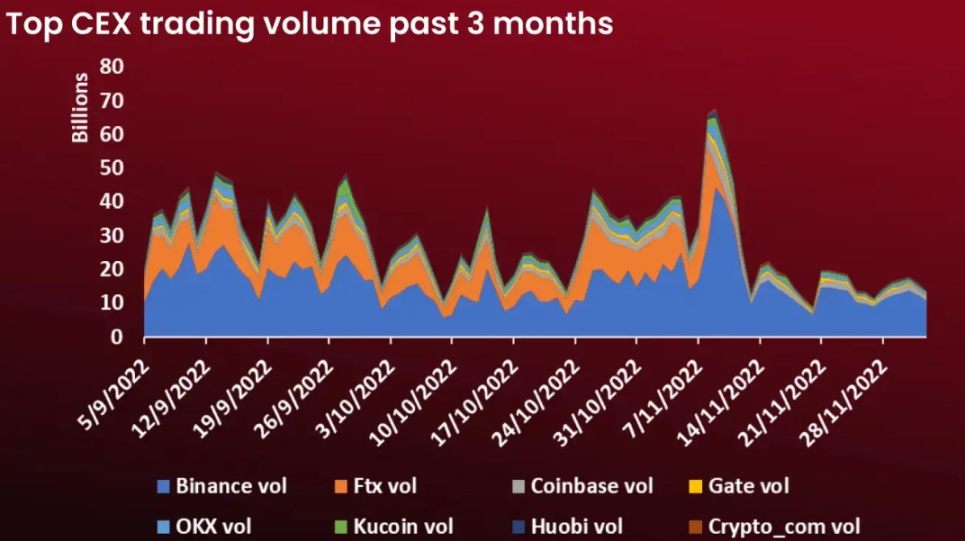

Binance: Sitting on the Diaoyutai amid FUD

"Binance" remains firmly in the lead despite the industry's many setbacks this year.

Especially after the FTX incident, it has been very active, not only participating in the bidding of institutions affected by FTX such as Voyager, but also establishing an industry recovery fund with a scale of up to US$2 billion.

Although it has recently been questioned due to regulatory issues, reserve doubts, and its role in the FTX collapse, and even formed a FUD wave, the market's trust in Binance should still be relatively solid, and the exchange track has temporarily entered the "post-FTX era."

dYdX: Influenced by FTX

The inclusion of "dYdX" on the list should be mainly due to the popularity contributed by the FTX incident. The sudden collapse of FTX this time once again proved that there is no myth of "too big to fail" in the crypto industry, and to a certain extent, it also triggered the trust crisis and liquidity dilemma in the crypto industry.

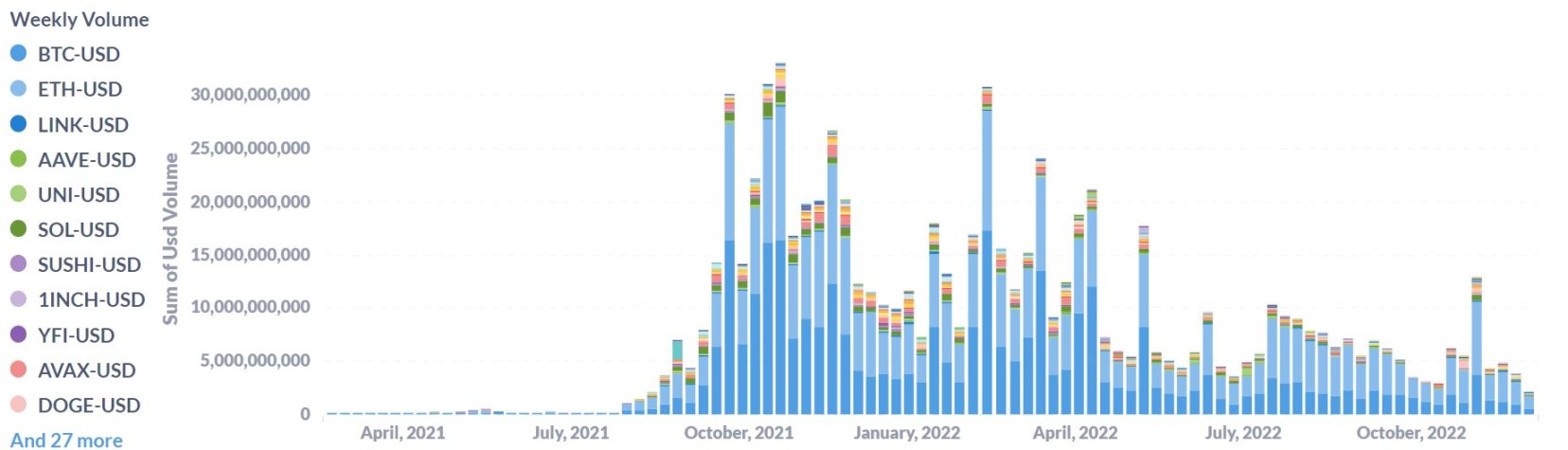

While the crisis continued to spread to centralized exchanges and institutions, decentralized projects like dYdX once again shined, with significant growth in both trading volume and the number of new users, becoming one of the biggest beneficiaries of this industry crisis (recommended reading " The B-Side of CEX's Lehman Moment: An On-Chain Carnival Exclusive to DEX ").

From a data perspective, whether it is on-chain derivatives projects such as dYdX, GMX, and Gains, or traditional DEX protocols such as Uniswap, after the FTX incident began to ferment in early November, the trading volume began to increase several times compared to the previous day, and set historical records around the 9th and 10th.

Among them, dYdX achieved a trading volume of more than 13 billion US dollars in the week from November 6 to November 12, setting a new weekly high since the Terra crisis on May 8 this year.

Although the DEX craze only lasted for a week after that - for example, starting from November 13, dYdX's weekly trading volume fell back to the average level of around US$2 billion, the necessity of decentralization was once again logically verified.

Hong Kong: Striving to Return to Center Stage in Crypto

"Hong Kong" is gradually trying to return to one of the geographical centers of the crypto industry and the Web3 world this year (see the timeline " Embracing Web3, Hong Kong enters a new era of open finance ").

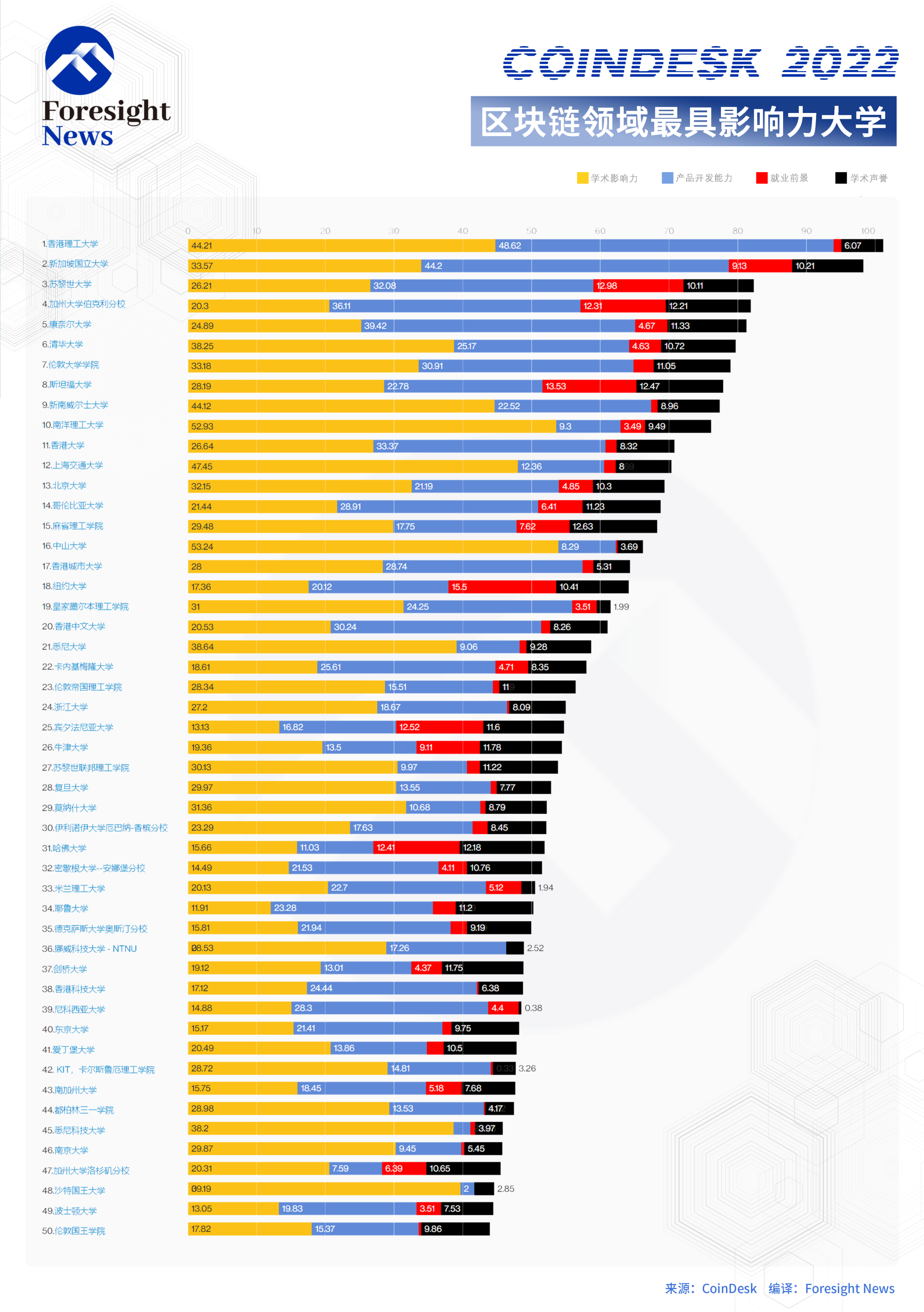

Previously, in the " CoinDesk: The 50 Most Influential Universities in the Blockchain Field in 2022 " compiled by Foresight News , the Hong Kong Polytechnic University ranked first. Others such as the University of Hong Kong, the Chinese University of Hong Kong, and the Hong Kong University of Science and Technology were also on the list. It is one of the regions with the highest density of universities on the list, which shows that Hong Kong already has sufficient competitive strength and foundation.

However, this year, amid the clamor that Web3 is rolling towards Singapore, Hong Kong has gradually fallen behind the front row. It seems that after missing the Internet wave, it will fall further behind the pulse of the Web3 era. Until the current Hong Kong government came to power, Hong Kong has made up its mind to compete with Singapore, London, New York and other cities for the status of global crypto financial center and virtual asset center.

On October 16, Hong Kong Financial Secretary Paul Chan published an article entitled "Hong Kong's Innovation and Technology Development", pointing out that he wanted to promote Hong Kong's development into an international virtual asset center. "The policy declaration will clearly express the government's position and demonstrate to the global industry our vision of promoting Hong Kong's development into an international virtual asset center, as well as our commitment and determination to explore financial innovation with the global asset industry" (further reading " Hong Kong is determined to compete for the global virtual asset center ").

Whether it was the intensive appearances of Web3-related people on the first day of this year's Fintech Week, or the exciting and solemn promises in the virtual asset policy declaration, they all further clearly declared to the world Hong Kong's full sincerity in opening the door to Web3 and crypto assets.

Moreover, dialectically speaking, in October, everyone was still discussing Hong Kong’s strict regulatory system because FTX left Hong Kong for the Bahamas. However, the collapse of FTX just one month later seemed to prove Hong Kong’s sensitivity to risks. Regulation and innovation are two sides of the same coin. Misfortunes often go hand in hand with blessings. The truth can only be revealed when the tide recedes (further reading " A fresh start in 2022, the ebb and flow of Hong Kong’s crypto vision ").

In December, the Hong Kong Securities and Futures Commission also announced that it was drafting regulatory provisions for licensed virtual asset exchanges under the new system, and would launch public consultations and closely monitor the latest developments in the virtual asset field. Subsequently, Southern China Asset Management Co., Ltd. launched Asia’s first batch of virtual asset ETFs on the Hong Kong Stock Exchange: Southern China Asset Management Bitcoin Futures ETF (3066.HK) and Southern China Asset Management Ethereum Futures ETF (3068.HK), which once again demonstrated that the current Hong Kong government has an open-minded attitude towards encrypted assets and Web3, and is accelerating its embrace of the encryption wave.

NEAR: A star public chain that is still making progress

As one of the most popular public chains favored by capital, the development of NEAR this year can only be described as unsatisfactory. It lags behind other mainstream public chains in terms of actual ecological development (even the algorithmic stablecoin USN, which was highly anticipated, ended in failure). However, as a special public chain that has always had unlimited expansion as one of its visions, after NEAR opens staking, the next new shard will be the key narrative to start the next stage, and it still needs to be paid attention to.

LayerZero: The heat remains, but the volume decreases

As an omnichain interoperability protocol, "LayerZero" theoretically supports cross-chain communication between all Layer 1 and Layer 2, so it has always been quite popular in narratives (further reading " With the support of SushiSwap founder 0xMaki, what is the imagination space for LayerZero and Stargate? "). This year, with the launch of Coinbase and Binance and the rapid access of Aptos mainnet at the beginning of its launch, it also brought several short-lived peaks of popularity.

However, its development team LayerZero Labs previously completed a $135 million Series A+ round of financing led by FTX Ventures. Therefore, after the FTX bankruptcy, LayerZero and its subsidiary Stargate (STG) have obviously become much weaker in terms of voice and performance, casting a shadow on their future development.

Public blockchain: New kings fall one after another, and passion fades

"Public chain" is undoubtedly one of the tracks that has caused people to reflect the most this year. Among them, the collapse of the Terra ecosystem and the fall of Solana are representative events, which almost verify that the new king has fallen and the new king is unknown.

The collapse of Terra in the middle of the year and its secondary disasters have, to a certain extent, exposed the duality of the new public chains (SolanaAvalanche, Fantom) to the public, both in terms of size and weakness. The Solana crisis caused by FTX at the end of the year completely tore apart the so-called ecological halo:

A new generation public chain that was once very popular has completely changed in just a few days. At the same time, the Solana Lisbon Conference was in full swing, but the agenda had not yet ended, but its fate had already taken a turn, which is really regrettable.

This makes people re-examine the myth of the new public chain, especially the "Ethereum killers" like Solana that once held high the banner, but now have fallen from the altar one by one, and those seemingly huge ecosystems at the time are also on the verge of collapse in the face of an avalanche-like collapse in confidence and a market value that evaporates like morning dew.

However, the voices of Aptos and Sui have not given people enough hope, so after the enthusiasm for the new public chains has subsided, it seems that only Bitcoin and Ethereum are more resilient and more worthy of attention and expectations.

Wallet: Only by controlling the private key can you control the future

"Wallets" have once again attracted attention as users' distrust of more centralized exchanges has intensified. With the trend of market funds flowing out to the chain, the importance of personal control over the assets behind the wallet has been further highlighted.

The collapse of FTX further proves that there is no centralized exchange that is too big to fail. “Not your keys, not your crypto”. Only by controlling your own private keys can you control your own future (recommended reading: “ CeFi continues to collapse. How to use a hardware wallet to protect your assets? ”).

a16z: The leader of crypto venture capital

"a16z"'s inclusion on the list should be due to its continued efforts in the field of investment and financing. According to previous statistics from Foresight News based on public information, the number of companies or projects in the Web3 field invested by a16z exceeds 90, including public chains, Layer 2, DeFi, NFT, games, metaverse and almost all Web3 tracks (recommended reading "An overview of a16z's Web3 investment map in one article").

Aleo: Airdrop Focus

"Aleo" is positioned as a programmable privacy network. The biggest project progress milestone this year should be the $200 million Series B financing completed in February. Since then, it has become one of the main objects for everyone to study (and swipe for airdrops).

Uniswap: NFT layout and fee switch

Although "Uniswap" ranked last on this year's hot search list, its progress in NFT market layout, fee switches, etc. has attracted much attention (see the timeline " Uniswap Governance ").

In terms of entering the NFT track, Uniswap first acquired the NFT aggregation market Genie, and then realized NFT transactions by integrating sudoswap, and aggregated NFT orders on OpenSea, X2Y2, LooksRare, sudoswap, Larva Labs, Foundation and NFT20, gradually entering the NFT trading track in a substantial way, and the subsequent results are also worthy of attention.

In terms of the fee switch, it has always been the key to UNI empowerment that has attracted much attention. Previously, on August 10, Uniswap's "fee switch" proposal passed the consensus check vote, and then the temperature check vote was successfully passed. The final step of the on-chain vote has been temporarily postponed due to community feedback, and it is expected to give an answer in early 2023 (extension reading " About the popular sudoswap, here is everything you need to know ", " How will the fee switch affect the value of UNI tokens? ").

Mirror Annual Hot Search List

There is some overlap between Mirror’s annual hot search list and the site, which is exactly half, including “ Aptos”, “zkSync”, “Sui”, “Cosmos”, and “LayerZero” , which shows the universality of the attention paid to hot words and their sufficient representative significance.

Among the remaining five, "airdrop", "tutorial" and "test" are always the top searches on Mirror's weekly hot search list, which is consistent with Mirror's historical data. This proves that in the minds of many users, Mirror is an article library full of wealth codes or treasure tutorials. Therefore, many users' search preferences are also concentrated on technical or tutorial articles such as airdrops and tutorials.

The other two, "Sei" and "Optimism", are also representatives of the new public chain forces this year. They have accumulated enough popularity with the help of airdrop expectations and large-scale financing.

summary

In general, specific project-related hot words account for more than half of this year's annual (on-site) hot search list, exactly 11. Major topics such as "financing", "NFT", "Web3", "airdrop", "wallet", and "public chain" account for 6, and the rest are basically event-related hot words.

In addition, the popularity of many hot words on this year's annual hot search list is inseparable from the catalysis of the FTX incident. In addition to directly related hot words such as "FTX" and "Binance", "dYdX", "wallet", "LayerZero", "public chain" and so on are more or less affected by it.

The hidden dangers of the cryptocurrency market this year have caused enough turmoil and suspicion, but at least they will gradually enhance the robustness of the system. Here we can revisit a sentence that Authur Hayes wrote in his blog after "3.12":

"Long live volatility, and stay healthy"

This may be the biggest gain we have gained in 2022 in the current volatile market, and the best survival guide for 2023.