I. Foresight

1. Macro-level summary and future forecasts

Last week, the core of the US macroeconomic focus was on the implementation of policy statements and the reaffirmation of inflationary pressures. On January 29, the Federal Reserve maintained the upper limit of interest rates as expected, and its policy statement continued the tone of "wait and see but no further tightening," confirming that the rate hike cycle has ended and the future depends on data.

Looking ahead, the focus of macroeconomic policy will shift from "direction confirmation" to pace and patience. If CPI/PCE continue to decline moderately and employment cools further, the Federal Reserve will gradually have room to shift to a more explicit easing stance this year; however, given the stickiness between inflation and wages, the policy pace is more likely to be gradual. For the market, short-term macroeconomic factors no longer constitute a systemic negative, but they are also unlikely to provide strong stimulus. Asset prices will become more sensitive to single data points, and a genuine trend change will still require sustained resonance between inflation and employment.

2. Market Changes and Early Warnings in the Crypto Industry

Last week, the cryptocurrency market experienced a significant accelerated decline, with sentiment and prices spiraling out of control simultaneously. After being consistently resisted at the $100,000 resistance level, Bitcoin saw a concentrated release of selling pressure, resulting in a sharp and continuous drop throughout the week. Key support levels were quickly breached, and the decline shifted from a gradual decline to a rapid plunge. Trading volume increased significantly during the fall, indicating that it was not a simple correction but rather a simultaneous occurrence of deleveraging and forced liquidations. Major cryptocurrencies generally fell sharply, with Altcoin and the MEME sector experiencing particularly severe declines, with most tokens seeing double-digit drops, reflecting a sharp contraction in market risk appetite.

In terms of warnings, this round of sharp declines signifies that the market has evolved from a period of consolidation below resistance levels to a sentiment-driven downward phase. In the short term, if Bitcoin cannot quickly recover key lost ground and stabilize, panic may persist, and volatility may remain high. Coupled with cautious expectations regarding liquidity at the macro level, the crypto market may further amplify its decline should overall risk assets come under pressure. Overall, the downward momentum should not be underestimated at this stage. Before deleveraging is fully completed, the risk of a second sharp drop or prolonged periods of low-level consolidation should be guarded against.

3. Industry and sector hotspots

Magma Finance, an AMM decentralized exchange (DEX) that has raised $6 million in funding led by Hashkey, is a cutting-edge AMM DEX designed specifically for blockchains based on the MOVE language. Pheasant Network, a DeFAI project that has raised $2 million in funding led by Mint with participation from 90S, is an interoperability protocol that enables AI-driven Intent mechanisms.

II. Hot Market Sectors and Potential Projects of the Week

1. Overview of Potential Projects

1.1. A brief analysis of Magma Finance, an AMM decentralized exchange on the MOVE blockchain that has raised $6 million in total funding, led by Hashkey, and delivers a CEX-level experience.

Introduction

Magma Finance is a cutting-edge AMM decentralized exchange (DEX) designed specifically for blockchains based on the MOVE language .

Magma focuses on building a sustainable liquidity incentive engine , aiming to create a decentralized trading platform that leads in user experience and capital efficiency by aligning the interests of traders, governance participants, and liquidity providers .

Core Mechanisms in Brief

CLMM (Centralized Liquidity Market Maker)

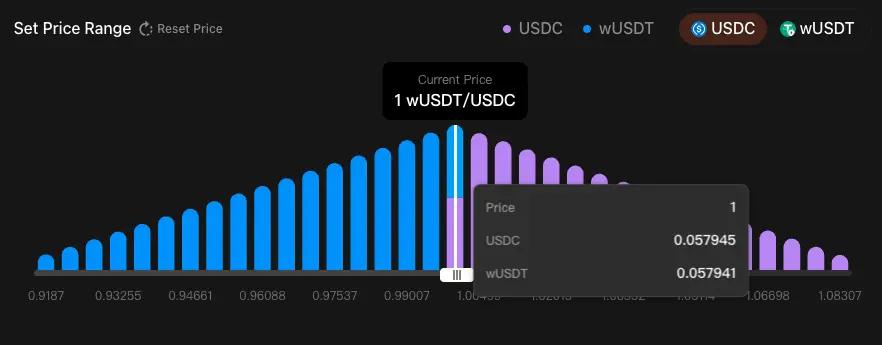

Magma Finance's Centralized Liquidity Market Maker (CLMM) is a capital-efficient automated market-making mechanism that allows liquidity providers (LPs) to concentrate their liquidity within a specific price range. This approach gives LPs greater control over their capital allocation and the potential to earn higher fee revenues for the same liquidity size.

Unlike traditional AMMs that distribute liquidity evenly from zero to infinity, CLMMs allow LPs to invest in price ranges where they perceive the most active trading, thereby improving capital efficiency and providing traders with deeper liquidity at key price points.

Key features include:

Centralized liquidity: Limited partners (LPs) can provide liquidity within a custom price range, improving capital efficiency;

Flexible rate tiers: Multiple rate options to compensate for different risk levels;

Transferable Liquidity Positions: LP positions are represented as NFTs and are tradable and transferable.

1. Core Mechanism

Concentrated Liquidity: LPs can concentrate their funds within a specific price range, significantly improving capital efficiency and avoiding idle funds in price ranges that are unlikely to be reached.

Price Ranges & Ticks: Prices are not continuous but consist of discrete ticks; LPs provide liquidity between two ticks, and liquidity is only active when the market price is within that range.

Liquidity Position NFTification: Each centralized liquidity position is unique and minted in the form of NFTs, recording position parameters and fees, making it tradable and transferable, expanding secondary markets and advanced DeFi use cases.

2. Liquidity Supply Mechanism

Providing liquidity in Magma Finance's CLMM hinges on customizing price ranges :

Setting price ranges: Define the minimum and maximum prices at which liquidity takes effect; narrow ranges improve capital efficiency but are riskier, while wide ranges are more robust but less efficient.

Deposited Assets: If the current price is within the range, two types of assets need to be deposited; if it is below the range, only the pricing asset needs to be deposited; if it is above the range, only the underlying asset needs to be deposited.

Minting Position NFTs: After a transaction is confirmed, an NFT representing that liquidity position is generated and used to manage liquidity and collect transaction fees.

3. Swap mechanism

Magma's Swap mechanism is based on a concentrated liquidity design of ticks and price ranges , which allows LPs to provide active liquidity only at specific price points , thereby obtaining higher fees and reducing Impermanent Loss within the target range.

Ticks and Price Ranges: Prices are divided into discrete ticks, and LPs can concentrate their liquidity within selected tick ranges, which only take effect within the range and earn higher fees.

Price Impact: Large transactions can drive price changes when liquidity is insufficient; the system provides impact estimates to improve transaction transparency.

Slippage: The difference between the expected price and the executed price; users can set a slippage tolerance level, and if it is exceeded, the transaction will be rolled back.

Aggregator: Aggregates liquidity from multiple DEXs and offers optional routing to optimize prices and reduce slippage.

ALMM (Adaptive Liquidity Market Maker)

Magma's ALMM (Adaptive Liquidity Market Maker) is a further evolution of traditional AMMs and CLMMs. Through a liquidity structure based on price levels (Bin) , it concentrates liquidity at fixed price points, forming a stepped curve similar to an order book. Compared to CLMM's range management:

Higher capital efficiency: Discrete Bin eliminates inefficient price ranges and avoids wasted liquidity.

Dynamic fees: Fees are adjusted adaptively to market fluctuations (unlike the fixed rates of CLMM).

Simplify the LP experience: No need for complex price range management.

Zero slippage within a range: Trades within an active Bin are executed at a fixed price.

1. Bin (price tier) architecture

The core of Magma ALMM is the Bin (price tier) architecture :

Bin architecture: Liquidity is divided into multiple discrete bins, each bin corresponding to a fixed price point.

Fixed-price trading: Bin uses a constant and the formula (X+Y=k) to trade with zero slippage within that price point until an asset is exhausted.

Active Bin: Only the active Bin holds two assets simultaneously and generates transactions and fees; the left and right Bins each hold a single asset.

Bin Step: Determines the price difference between adjacent Bins; smaller step sizes allow for more precise and frequent management, while larger step sizes are more suitable for high volatility pairs.

Concentrated Liquidity: LPs can allocate funds to Bins within a selected price range, using capital only in high-frequency trading areas to maximize commission revenue.

2. Transaction Mechanism

Magma's ALMM trading mechanism is based on Bin (price levels) :

Trading process: First, use the liquidity of the active Bin to execute a trade at a fixed price; if the liquidity is exhausted, switch to the next Bin.

Price impact: Only occurs when a trade pushes the price across a Bin.

Slippage: Zero slippage within a single Bin; slippage only occurs when spanning multiple Bins.

Active Bin Mechanism: Only active Bins hold two assets simultaneously and support trading, using a constant and the formula (X+Y=k).

Effect: The tiered transaction simulation limit order book maintains the decentralization and composability of the AMM.

3. Liquidity Supply Mechanism

Magma ALMM allows LPs to distribute their funds across multiple price bins through different liquidity shapes , enabling diversified strategies ranging from passive to highly active.

Liquidity Shapes: These refer to how limited partners (LPs) allocate liquidity within a price bin range to implement different strategies.

Spot (Uniform): Distributes liquidity evenly within a selected range; the strategy is robust and the risk is balanced, making it suitable for beginners or wide-range market making.

Curve: Concentrates more liquidity near the current price and gradually decreases as it moves away from the center; it is highly capital efficient and has great fee collection potential, but is more sensitive to price changes.

Bid-Ask / Inverse Curve: Concentrates liquidity in a bin that is far from the current price, often used for one-sided liquidity; it can enable advanced strategies such as "buy low, sell high" or DCA.

Tron's Review

Magma Finance's core advantage lies in its advanced liquidity system built around the MOVE ecosystem , from CLMM to ALMM . By utilizing the Bin architecture, zero-slippage range trading, dynamic fees, and programmable liquidity shapes , it significantly improves capital efficiency and trading experience while reducing the operational complexity for LPs and ensuring order book-level precision. It has a first-mover advantage on MOVE chains such as Sui and is expected to become the core liquidity layer of the ecosystem.

However, its disadvantages lie in the high complexity of the model, which requires a higher level of understanding of LP strategies and risk management. Bin management and cross-price price fluctuations may still amplify risks in a highly volatile market. Furthermore, the overall size and user base of the MOVE ecosystem are still small, and the liquidity depth and long-term stability still need to be verified by the maturity of the ecosystem.

1.2. Understanding Pheasant Network, a DeFAI protocol that reshapes the cross-chain experience with AI Intents, has raised $2 million in total funding, led by Mint and with participation from 90S.

Introduction

Pheasant Network is a DeFAI project dedicated to building an interoperability protocol for implementing AI-driven Intent mechanisms .

This protocol seamlessly connects fragmented blockchain ecosystems while ensuring security, thereby improving cross-chain interoperability and simplifying cross-chain interaction processes .

Architecture Overview

Pheasant Bridge

Pheasant Bridge is a cross-chain bridge protocol centered on Intents . Through AI-driven AIntent logic , it understands user and application goals, automatically selects the optimal and safest cross-chain path , unifies Layer 2 infrastructure, and connects the Ethereum ecosystem. Its optimistic Bridge-as-a-Service (BaaS) provides developers with native integration capabilities, combining low cost, decentralized design, and real-time network adaptive optimization to deliver a smoother and more predictable cross-chain experience.

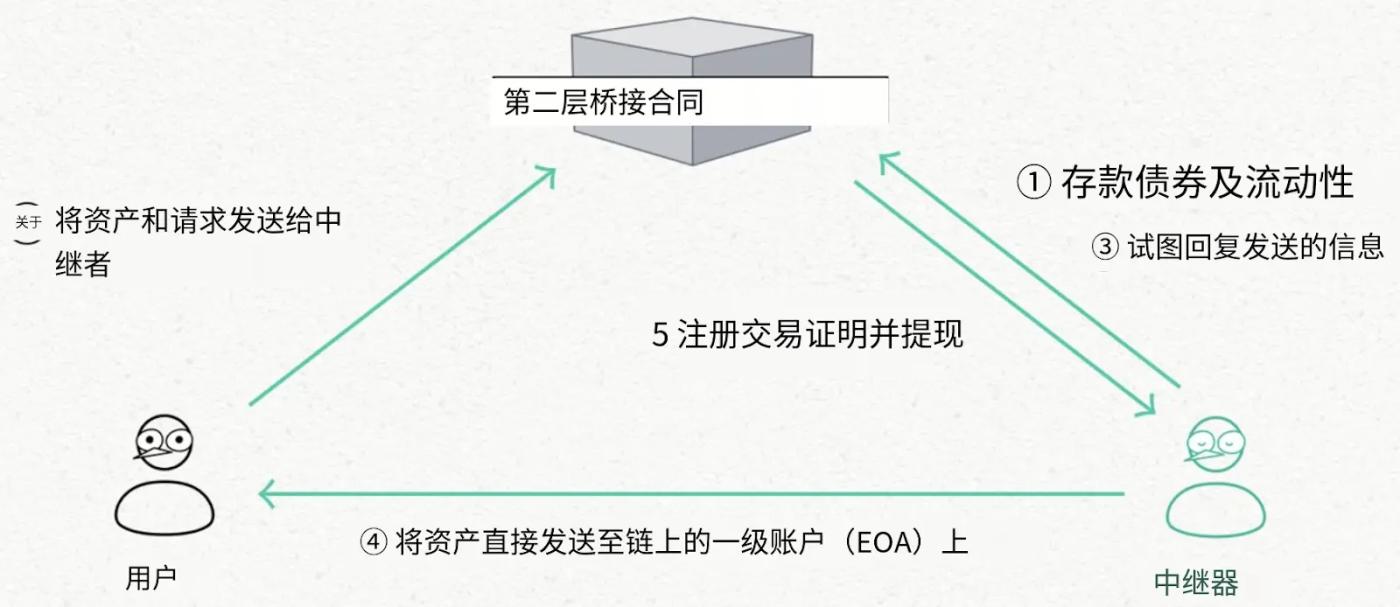

1. L2→L1 / L2→L2 cross-chain operations adopt an optimistic relay model :

Default process: The relayer stakes liquidity to the BondManager (L2 bridge contract); the user submits a transfer request in the source chain contract; the relayer transfers funds directly to the user's address on the target chain; the relayer submits proof generated by the transaction hash to retrieve the user's locked assets.

Fraud handling: The disputer pledges assets to initiate a challenge; the relayer submits evidence to prove their innocence within a specified time; if the relayer is legitimate, the disputer is penalized; otherwise, the disputer can punish the relayer and reclaim their assets.

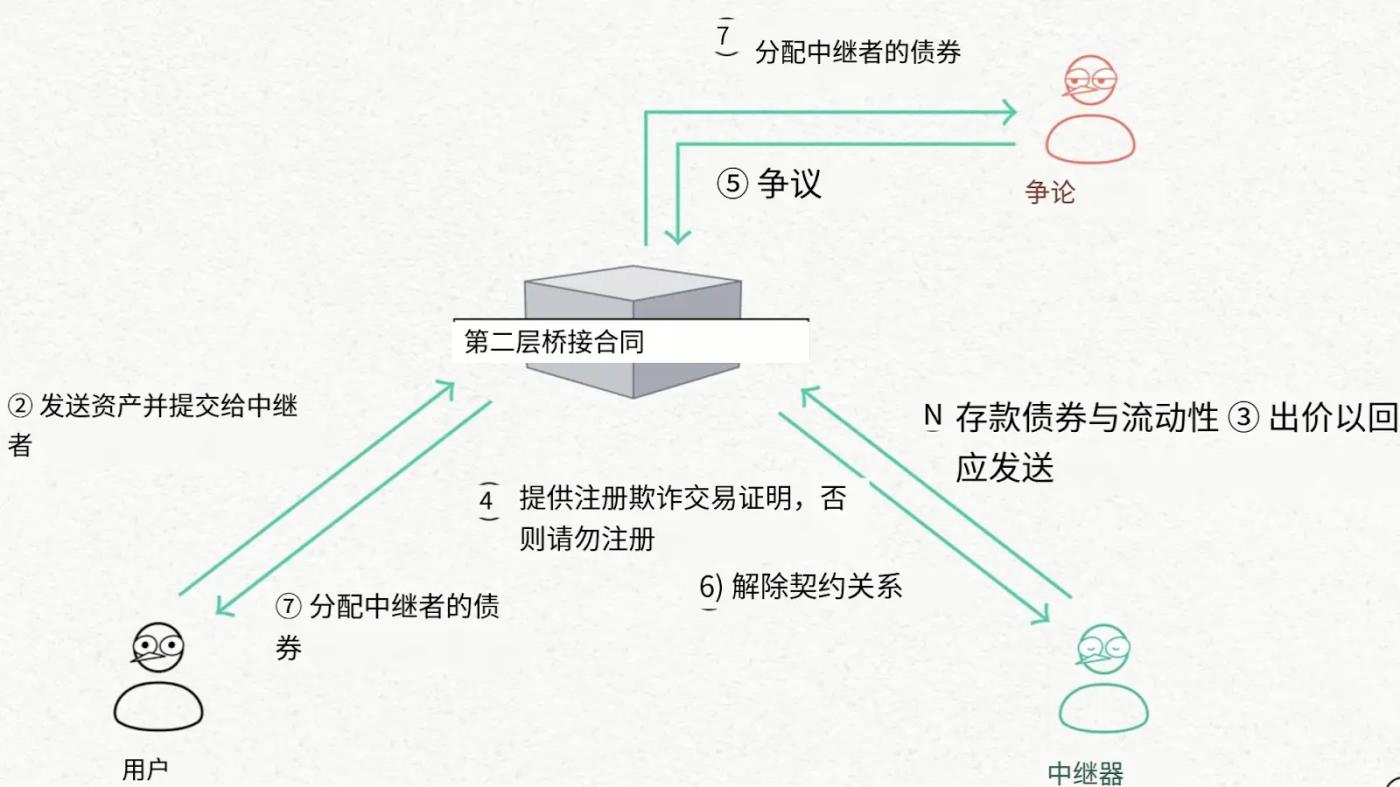

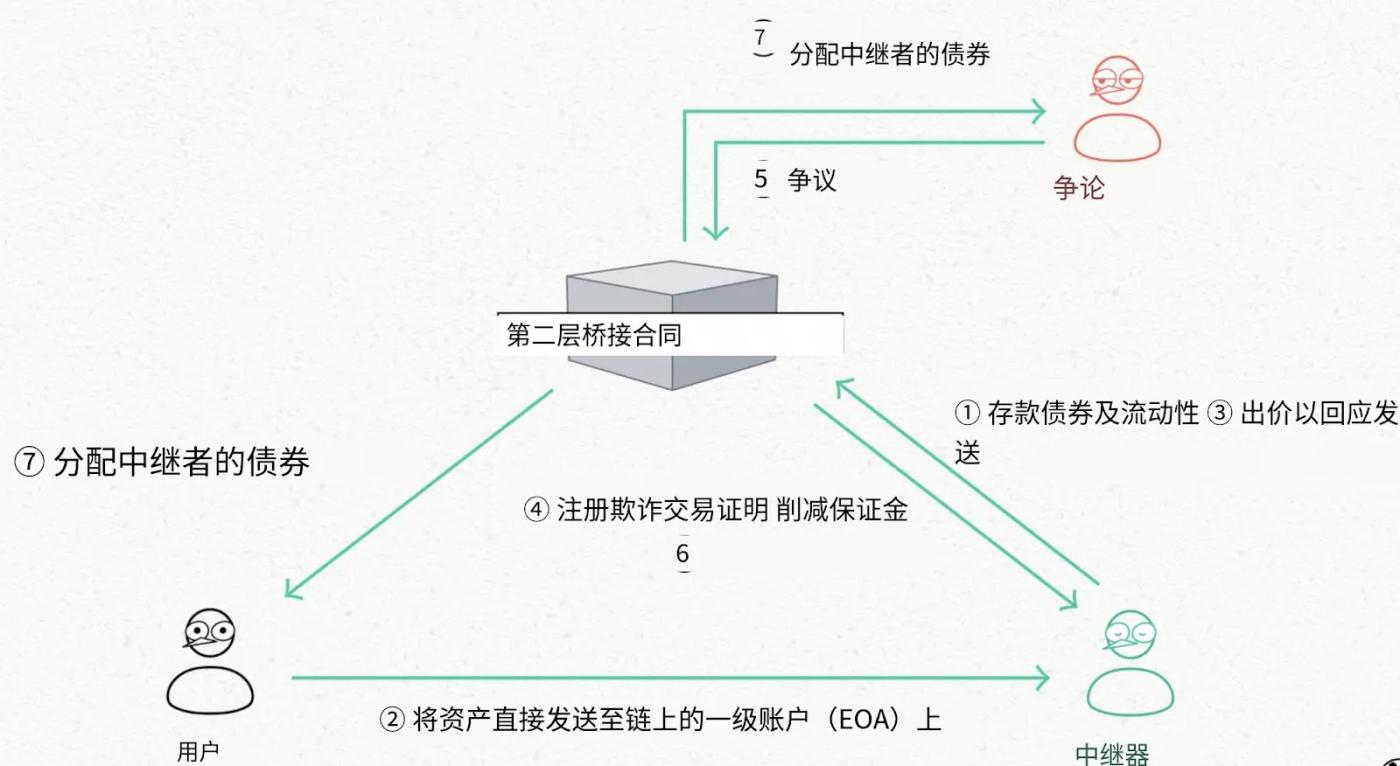

2. L1→L2 cross-chain

Pheasant employs a different mechanism in L1→L2 cross-chain communication than in L2→L1 to avoid the high costs associated with deploying escrow contracts on the L1 side.

Default process: The relayer pledges liquidity to the BondManager (L2 bridge contract); the user directly transfers assets to the relayer's EOA in L1; the relayer generates a proof based on the transaction hash and sends the assets to the user through the L2 bridge contract.

Fraud handling: If the relayer fails to send the assets to L2 within the specified time, the system can slash the relayer to protect the user's rights.

3. Circle's Cross-Chain Transfer Protocol (CCTP)

Pheasant Network employs a dual-track mechanism in USDC cross-chain functionality :

Mechanism selection: Small amounts of USDC use the optimistic protocol; large amounts of USDC automatically use CCTP.

CCTP process:

Users burn USDC via a contract on the source chain ;

The relay requests authorization from the CCTP authentication service ;

Once approved, USDC will be minted on the target blockchain (Mint) .

The newly minted USDC will be credited to the user's target chain account.

Pheasant Swap

Pheasant Swap is a cross-chain exchange protocol that combines cross-chain bridging and asset swapping into a single operation, enabling users to complete cross-network asset exchanges in a single transaction . This integrated design reduces liquidity and process fragmentation in multi-chain ecosystems, significantly improving the efficiency of cross-chain transactions and the overall user experience.

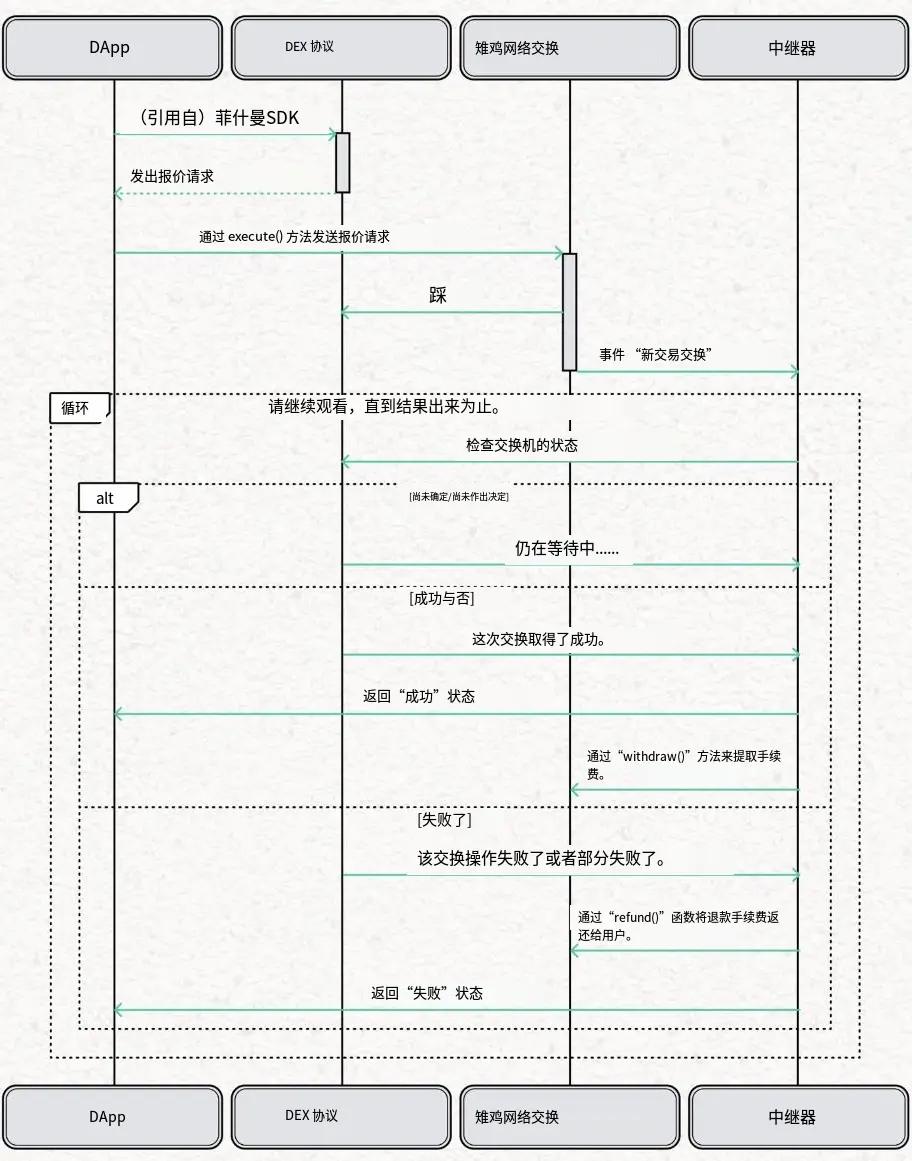

Pheasant Swap's architecture consists of four main components:

DApp: A decentralized application with cross-chain exchange functionality. DApps use the Pheasant SDK to quote exchange requests and submit them to the PheasantNetworkSwap contract for execution.

DEX Protocol: A decentralized exchange protocol integrated with Pheasant Network that receives exchange requests from the PheasantNetworkSwap contract, completes the transaction, and returns the result to the DApp.

PheasantNetworkSwap Contract: A smart contract responsible for coordinating and executing the swap process, routing requests to the appropriate DEX protocol.

Relayer: Tracks the entire process of a redemption from initiation to completion; if the redemption is successful, the relayer collects the corresponding fee; if it fails, the relayer fee is refunded to the user.

Tron's Review

Pheasant Network's core advantage lies in its AI-driven Intent architecture , which integrates cross-chain bridging and cross-chain exchange into one. Through AIntent, it automatically selects the optimal path, achieving a lower cost, higher efficiency, and more user-friendly cross-chain experience in L1↔L2 and L2↔L2 scenarios. Its optimistic relay model, penalty mechanism, and CCTP dual-track USDC solution achieve a dynamic balance between speed and security, while providing developers with modular Bridge/Swap-as-a-service capabilities, significantly reducing the complexity of multi-chain integration.

However, its disadvantage lies in the relatively complex overall system architecture, which is somewhat dependent on the activity of the relay network, the game mechanism, and the effectiveness of AI path selection. In the early stages, the stability in terms of liquidity depth, network coverage, and extreme scenarios still needs to be verified through large-scale operation and time.

2. Detailed Explanation of Key Projects for the Week

2.1. Detailed Explanation of DAWN, a bandwidth market protocol that uses token incentives to break the 100-fold price gap between wholesale and retail internet markets, raising a total of $48.5 million in funding led by Polychain and Dragonfly, with VanEck also participating.

Introduction

DAWN , a token-incentivized protocol, leverages cutting-edge technology to build a new " ultimate internet " with goals including:

This allows users to connect directly to the Internet Exchange Center (IX) without any trusted intermediaries;

Narrowing the price gap between wholesale and retail online by up to 100 times ;

By utilizing home nodes distributed across various locations, the reliance on a single path is eliminated , thus enhancing network resilience.

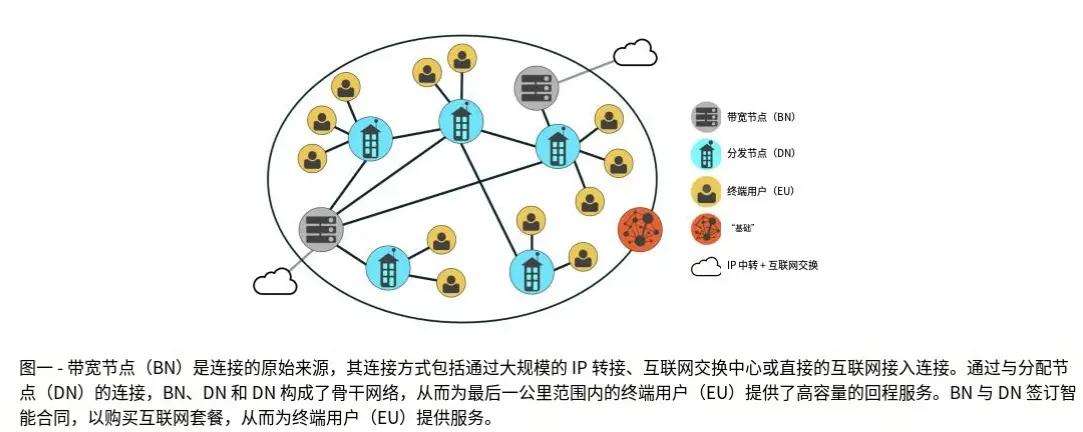

This new last-mile internet consists of three core components:

Incentive mechanism : Rewards are given based on participants' contributions and network performance, covering roles such as data centers, building owners, and network equipment deployers;

Decentralized consensus mechanisms , such as " Proof of Bandwidth " and " Proof of Location, " provide cryptographic and economic safeguards for network performance.

Bandwidth market : Allows node operators to buy and sell network connectivity, enabling home nodes to earn substantial returns by saving on internet access costs and reselling bandwidth, turning network deployment into a profitable investment.

DAWN Architecture Overview

The DAWN protocol aims to build a self-healing, multi-gigabit, autonomous last-mile wireless network by deploying rooftop robotic radios .

Its core objective is to create a decentralized fixed internet connection method , fundamentally liberating users from their dependence on the monopoly of traditional Internet Service Providers (ISPs) .

1. Node Types

Participants in the DAWN network must play at least one of the following roles:

① Bandwidth Node (BN)

You must have resaleable wholesale-grade internet bandwidth (such as IP Transit or Internet Exchange access).

Deploy DAWN-certified >1Gbps point-to-multipoint wireless devices ;

Provides connectivity downstream within a maximum line-of-sight range of 5 miles ;

A single BN can serve 15–100 receiving nodes .

② Distribution Node (DN)

Typically commercial or residential buildings;

Connect to one or more BNs via a rooftop **Robot Antenna System (RAS)**;

It can connect to multiple BNs or other DNs simultaneously in real time;

It forms the core layer of DAWN's programmable, self-healing wireless network .

③End User (EN)

End users who obtain and use bandwidth from DN.

④ Foundation

Controlling DAWN's core smart contracts through multi-signature;

Responsible for key functions of the global network layer, including:

Node Identity and Authentication

Blockchain and inter-node communication

Compliance and supervision

QoS (Quality of Service) monitoring

Payment, settlement and transaction processing, etc.

2. Wireless Devices and Robotic Antenna Systems (RAS)

Vendor-agnostic : DAWN is not tied to any specific hardware vendor;

Initially, the focus will be on supporting multiple gigabit wireless technologies, such as 60GHz millimeter wave and 6GHz band .

BN and DN are used in combination for point-to-multipoint + point-to-point radio and antennas;

The connection is dynamically propagated in the last kilometer via electromechanical beam steering.

This entire hardware and software system is called a Robotic Antenna System (RAS) , and its characteristics are:

It can support any future generation of wireless hardware;

Deployment can be completed without professional human intervention ;

It possesses low-cost, self-healing, and rapid scalability capabilities;

Suitable for trustless decentralized environments .

3. Routing and Network Layer Design

DAWN does not use traditional dedicated routing hardware, but instead adopts:

General-purpose computing devices + cloud-native routing ;

Future home routers will evolve into general-purpose home servers , rather than closed MIPS/ARM devices;

Based on the node performance requirements, software routing solutions such as VPP, Quagga, BIRD, and FRR are adopted.

Network protocol selection

IPv6 is the primary Layer 3 protocol ;

IPv4 is supported in a dual-stack manner and introduces a staking mechanism to reflect the scarcity of IPv4 addresses;

Use eBGP and its security features to manage network traffic;

Each node is logically like an independent autonomous system (AS) , which is naturally compatible with the design of the Internet backbone.

Network trust and verification mechanisms

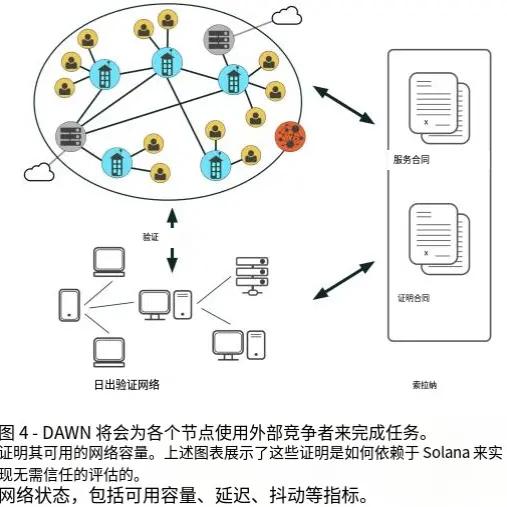

A key feature of DAWN is that it replaces the reputation system and manual ledger in traditional centralized networks with a trustless crypto-economic incentive mechanism .

In wireless network scenarios, this means that we cannot rely on the operator's self-reported performance, but must use "Proofs of Network Resources" to objectively measure node performance, the most crucial of which is Proof of Bandwidth .

DAWN has chosen to connect to the decentralized proof-of-stake network provided by Witness Chain :

Witness Chain has built a mature system for proving bandwidth, data usage, location, etc.

The network is secured by re-staked ETH for cryptoeconomic security (on a scale of billions of dollars).

DAWN directly subscribes to these proofs for network settlement and incentives.

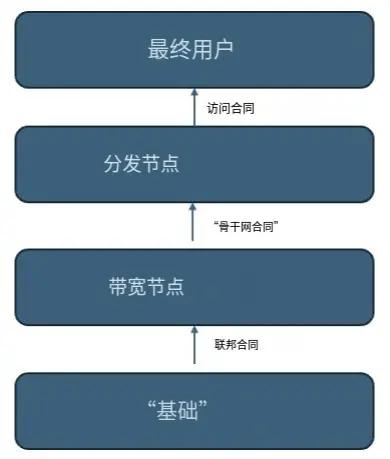

1. DAWN's three types of service contracts

The DAWN protocol defines three core contractual relationships, all settled in DAWN Tokens :

Federal Contracts

From Foundation → Network Node ;

Used for global incentives, subsidies, and guiding network expansion.

Backbone Contracts

Bandwidth Node (BN) ↔ Distribution Node (DN) ;

This represents the protocol between wholesale-level bandwidth and downstream distribution.

Access Contracts

Distribution Node (DN) ↔ End User (EN) ;

This refers to the bandwidth usage agreement for the end user.

2. Proofs of Network Resources

DAWN abstracts "network performance" into cryptographically verifiable resource proofs, which mainly include the following categories:

1. Proof of Backhaul

Essentially, it is a decentralized speed measurement system ;

The challenger node sends data packets to the BN/DN for measurement:

Throughput

Delay

The results are used to make a decision:

Bandwidth reservation

Overselling ratio

Completely decentralized, requiring no self-reporting from operators.

2. Proof of Service

A decentralized data measurement and settlement system ;

A centralized billing system to replace traditional ISPs;

Both parties (supplier and user) submit signed usage data ;

The system will automatically deduct and settle the payment after reconciliation;

This is achieved through a permissionless payment gateway contract .

3. Proof of Location

A two-layer verification mechanism is used to ensure that nodes are actually located in the geographical location they have declared :

First layer (proof of wired location):

Based on network latency and path characteristics;

Using Witness Chain's challenge node network;

By combining the Internet latency-distance curve model, we can verify the approximate location of BN.

Second layer (wireless precision positioning):

Based on decentralized radio triangulation ;

GNSS (such as GPS) as a backup plan;

Suitable for precise positioning of BN and DN.

4. Proof of Frequency

Used to address spectrum coordination issues in unregulated frequency bands such as 60GHz :

Nodes need to stake tokens to obtain exclusive access to a specific frequency band;

Neighboring nodes will scan the spectrum to verify whether there is any illegal interference;

Validators receive rewards through smart contracts;

Foundation provides:

Terrain/obstacle data (Clutter Data)

GIS Challenge

The node verifies based on the encrypted local data:

Signal Strength (RSSI)

Is the propagation model reasonable?

Ultimately, a trustless wireless heatmap is created , which determines the available frequency bands.

Tron's Review

DAWN's core advantage lies in its foundation in cryptoeconomics, combined with decentralized verification mechanisms such as proof of bandwidth, proof of location, and proof of spectrum. This allows it to build a trustless last-mile internet network, enabling homes, buildings, and data centers to directly participate in network construction and revenue sharing. Structurally, it breaks the monopoly of traditional ISPs, significantly reduces internet access costs, and enhances network resilience. Its self-healing wireless architecture, vendor-agnostic design, and high-performance settlement based on Solana give the network excellent scalability and capital efficiency.

However, its disadvantages lie in the high threshold for implementation, strong dependence on hardware deployment, line-of-sight conditions and local supervision, and the potential instability of service quality when network density is insufficient in the early stages. At the same time, the complex proof system and multi-role collaboration mechanism also increase the cost of system design, operation and maintenance and user understanding. Large-scale promotion still requires time and continuous incentives.

III. Industry Data Analysis

1. Overall Market Performance

1.1. Spot BTC vs ETH Price Trends

BTC

ETH

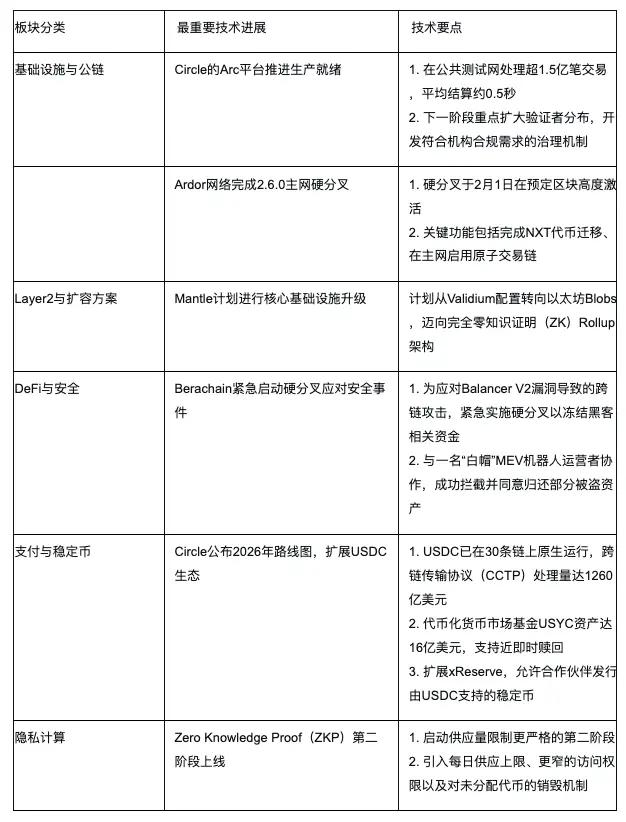

2. Summary of Hot Sectors

IV. Macroeconomic Data Review and Key Data Release Schedule for Next Week

The Federal Reserve's interest rate decision on January 29th, maintaining the upper limit of interest rates as expected, did not bring any policy surprises. The market was more focused on the lack of a more hawkish stance, consistent with the previous backdrop of declining inflation and cooling employment. The decision reinforced the neutral-to-dovish tone that "the rate hike cycle has ended, but rate cuts still require data." US stocks reacted positively but restrainedly, with indices fluctuating at high levels, indicating that funds acknowledge the policy turning point but did not significantly increase their positions, instead maintaining existing long positions.

The December PPI annual rate, released on January 30, continued to weaken, confirming that upstream price pressures are easing and no new inflationary risks are being transmitted to the CPI. This data further reduced concerns about a rebound in inflation and also left room for the Federal Reserve's subsequent policy decisions. US stocks interpreted the data positively, with risk appetite receiving marginal support, but gains remained limited, reflecting that the market is currently more concerned about growth and earnings than about runaway inflation.

Overall, these two events together reinforced the environment of "no further tightening of policies and controllable inflation," which allowed US stocks to maintain their resilience at high levels rather than enter a trend of rising or falling.

Key macroeconomic data releases this week:

February 6: US January Unemployment Rate; US January Seasonally Adjusted Non-Farm Payrolls

V. Regulatory Policies

USA

Legislative Progress: On January 21, the U.S. Senate Agriculture Committee released an updated text of the Digital Commodity Intermediaries Act (the text was discussed within the relevant timeframe). This text establishes a framework for digital commodity intermediaries (such as exchanges and brokers) to register with the Commodity Futures Trading Commission (CFTC) and introduces an expedited registration process. In addition, Congress is also advancing broader cryptocurrency market structure legislation.

Regulatory Update: The U.S. Securities and Exchange Commission (SEC) has approved a rule change submitted by the Nasdaq BX exchange, removing restrictions on certain crypto assets. The change took effect immediately after being submitted on January 26.

EU

New tax regulations have come into effect: Directive DAC8, an EU directive aimed at enhancing tax transparency, officially came into effect on January 1, 2026. This directive requires crypto asset service providers to collect users' tax information and report transactions. If a user fails to provide the required information within 60 days, the service provider must forcibly prevent them from engaging in reportable transactions.

Member State Actions: Germany has adopted the Crypto Asset Tax Transparency Act, which transforms DAC8 into domestic law. Core obligations include customer due diligence, annual transaction reporting, and registration with the Federal Central Tax Office.

Dubai

New regulatory framework in effect: The Dubai International Financial Centre launched its revamped regulatory framework for crypto tokens in mid-January. Key changes include: an explicit ban on privacy coins (such as Monero); a stricter and narrower definition of fiat-backed stablecoins; and the transfer of token approval responsibility to licensed institutions.

Japan

International Tax Compliance: Japan will officially implement the OECD-developed "Crypto Asset Reporting Framework" (CARF) from January 1, 2026, aiming to improve tax transparency by sharing crypto asset transaction information internationally. Domestic exchanges have begun notifying users to submit information such as their tax residence.

China

Regulatory and Risk Warnings: The Central Political and Legal Work Conference proposed to proactively study legislative suggestions to address new issues such as virtual currencies, marking a new stage in the governance of virtual currencies. Simultaneously, regulatory authorities in Heilongjiang, Hebei, Hunan, and other regions issued a series of risk warnings, urging vigilance against illegal financial activities under the guise of virtual currencies and RWA (Real-World Asset Tokenization), and exposing common methods such as investment scams, pyramid schemes, and money laundering.

Welcome to the official ChainCatcher community

Telegram subscription: https://t.me/chaincatcher ;

Official Twitter account: https://x.com/ChainCatcher_