Original article | Odaily Odaily( @OdailyChina )

Author|Mandy ( @mandywangETH ), Azuma ( @azuma_eth )

This weekend, beset by internal and external troubles, the crypto market suffered another bloodbath. BTC is currently hesitating around the Strategy holding cost of $76,000, while altcoins are so tempted to gouge their eyes out at the price.

Behind the current gloom, and after chatting with projects, funds, and exchanges recently, a question has been repeatedly popping into my head: What will the crypto market be trading a year from now?

The more fundamental question behind this is: if the primary market no longer produces "future secondary markets," what will be traded in the secondary market a year from now? What changes will occur in the exchanges?

Although the death of copycats is a well-worn topic, the market hasn't lacked projects in the past year. Projects are still queuing up for TGE every day, and as media, we're still frequently contacting project teams for marketing and promotion.

(Note that in this context, when we talk about "projects," we are mostly referring to "project teams" in a narrow sense. In the simplest terms, these are projects that benchmark against Ethereum and its ecosystem—underlying infrastructure and various decentralized applications—and are "token-issuing projects." This is the cornerstone of what we call native innovation and entrepreneurship in our industry. Therefore, we will leave aside Meme and other platforms that have emerged from traditional industries venturing into crypto for now.)

If we rewind the timeline a bit, we'll discover a fact we've all been avoiding talking about: these projects that are about to go TGE are all "existing old projects." Most of them raised funds 1-3 years ago, but now they've finally reached the point of token issuance, or even had to take this step due to internal and external pressures.

This seems to be a kind of "industry destocking," or to put it more bluntly, queuing up to complete the life cycle, issuing tokens, giving the team and investors an explanation, and then lying down to wait for death, or spending the money in their accounts hoping for a turnaround from the sky.

Level 1 dead

For us "veterans" who entered the industry in the ICO era or even earlier, experienced several bull and bear market cycles, and witnessed the industry's dividends empowering countless individuals, we subconsciously feel that as long as time is long enough, new cycles, new projects, new narratives, and new TGEs will always emerge.

However, the truth is that we have already strayed far from our comfort zone.

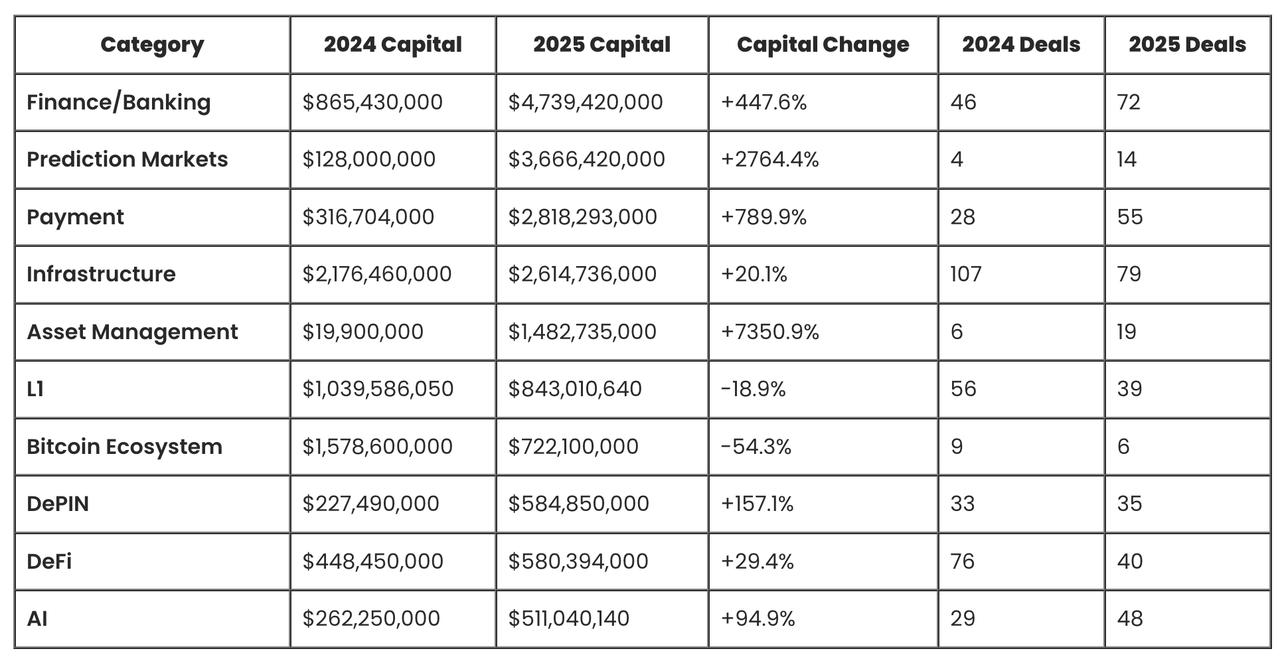

Looking at the data directly, in the most recent four-year period (2022-2025), excluding special primary market activities such as mergers and acquisitions, IPOs, and public fundraising, the number of financing deals in the crypto industry showed a significant downward trend (1639 ➡️ 1071 ➡️ 1050 ➡️ 829).

The reality is even worse than the data suggests: the changes in the primary market are not only a reduction in overall amount, but also a structural collapse.

Over the past four years, the number of early-stage funding rounds (including angel rounds, pre-seed rounds, and seed rounds), which represent fresh blood in the industry, has decreased by 63.9% (from 825 to 298). This represents a larger decline than the overall market (a decrease of 49.4%), indicating that the primary market's ability to provide funding to the industry has been shrinking.

The few sectors with an increasing number of financing deals are financial services, exchanges, asset management, payments, AI, and other applications of crypto technology, but these have limited practical relevance to us. To put it bluntly, the vast majority of them will not "issue tokens." On the other hand, native "projects" such as L1, L2, DeFi, and social networking are experiencing a more significant decline in financing.

Odaily Note: Chart sourced from Crypto Fundraising

One easily misinterpreted piece of data is that while the number of financing deals has decreased significantly, the amount of each deal has increased. This is mainly because, as mentioned earlier, "large projects" have captured a large amount of funds from the traditional financial sector, greatly raising the average. In addition, mainstream VCs tend to increase their bets on a small number of "super projects," such as Polymarket's multiple rounds of financing in the hundreds of millions of dollars.

From the perspective of crypto capital, this top-heavy vicious cycle is even more pronounced.

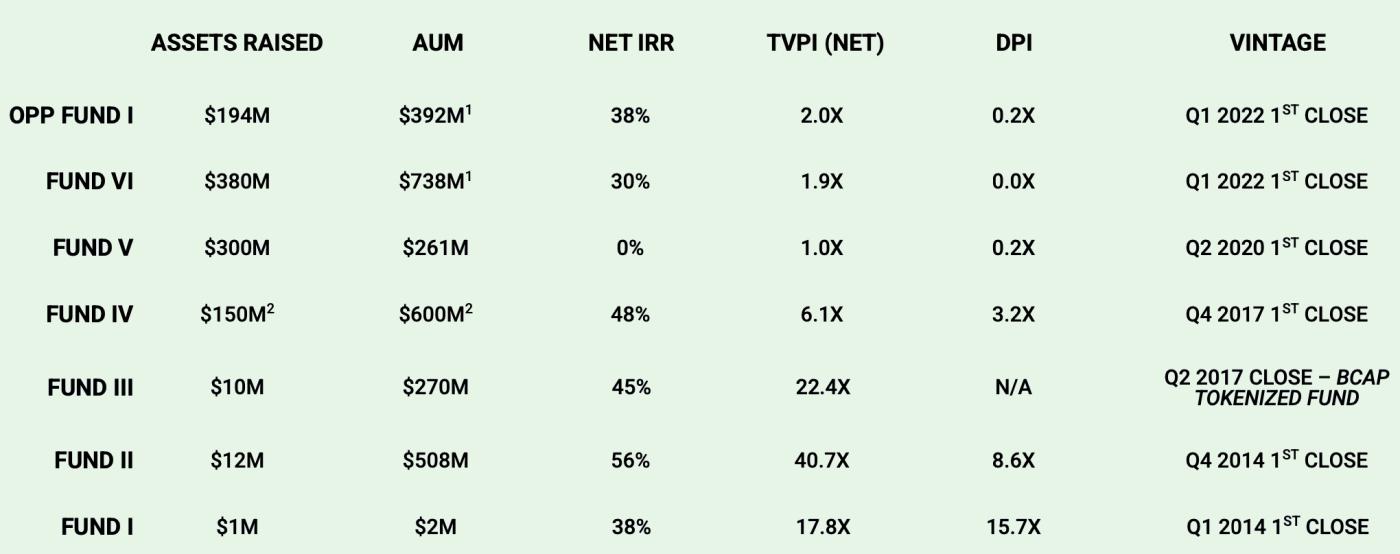

Not long ago, a friend outside the crypto circle asked me why a well-known, long-established crypto fund was raising funds, but after looking at Deck, he was puzzled and asked why their returns were "so bad." The table below shows the actual data from Deck. I won't mention the fund's name, but only extract its fund performance data from 2014 to 2022.

It is clear that between 2017 and 2022, the fund’s IRR and DPI underwent significant changes —the former represents the fund’s annualized return level, reflecting more the “book-based earning power,” while the latter represents the cash return multiple that has actually been returned to LPs.

Looking at different years (vintage), the returns of this group of funds show a very clear "cyclical gap": the funds established between 2014 and 2017 (Fund I, Fund II, Fund III, Fund IV) have significantly outperformed in overall returns, with TVPI generally in the range of 6x-40x and Net IRR maintained at 38%-56%. They also have high DPI, indicating that these funds not only have high paper returns, but have also completed large-scale cash-out, reaping the early benefits of the era of crypto infrastructure and leading protocols from 0 to 1.

Funds established after 2020 (Fund V, Fund VI, and the Opportunity Fund in 2022) have shown a significant downgrade, with TVPI generally concentrated in the 1.0x–2.0x range and DPI close to zero or extremely low. This means that most returns remain on paper and cannot be converted into actual exit profits. This reflects that against the backdrop of rising valuations, intensified competition, and declining project supply quality, the primary market cannot replicate the excess return structure driven by "new narratives + new asset supply" of the past.

The real story behind the data is that after the DeFi Summer boom in 2019, the primary market valuation of crypto native protocols was inflated. When these projects actually issued tokens two years later, they faced a lack of compelling narratives, industry tightening, and exchanges controlling the market and temporarily changing terms. Their performance was generally unsatisfactory, and some even had market capitalization inversions. Investors became a vulnerable group, and funds faced difficulties in exiting.

However, these mismatched funds can still create a false impression of prosperity in certain parts of the industry. It wasn't until the last two years, when some large star funds raised capital, that the true extent of the disaster became apparent.

The fund I cited as an example currently manages nearly $3 billion, which further illustrates that it serves as a mirror for observing industry cycles—whether it performs well or not is no longer a matter of selecting individual projects; the overall trend has shifted.

While established funds are struggling to raise capital these days, they can still survive, lie low, collect management fees, or shift towards investing in AI, while many other funds have already closed down or moved to the secondary market.

For example, Yi Lihua, the current "Ethereum King" in the Chinese market, is someone who remembers that not long ago he was a leading figure at the first level, with an average of over a hundred investment projects per year.

The substitute for knockoffs is never a meme.

When we say that crypto-native projects are running out of steam, a counterexample is the explosion of memes.

Over the past two years, there has been a recurring saying in the industry: the alternative to knockoffs is Meme.

But looking back now, this conclusion has actually been proven to be wrong.

In the early days of the meme wave, we played with memes in the same way we played with mainstream altcoins—screening a large number of meme projects based on so-called fundamentals, community quality, and narrative rationality, trying to find the project that could survive in the long term, constantly renew itself, and eventually grow into Doge, or even "the next Bitcoin".

But today, if someone still tells you to "hold onto the Meme," you'd think they've lost their mind.

The current meme landscape is a mechanism for instantly monetizing popularity : a game of attention and liquidity, and a product of mass production by Dev and AI tools.

It is an asset form with an extremely short lifespan but a continuous supply.

Its goal is no longer to "survive," but to be seen, traded, and exploited .

Our team also has several meme traders who have consistently made profits over the long term. Clearly, they are not focused on the future of a project, but rather on its pace, spread speed, sentiment structure, and liquidity path.

Some say that memes are no longer viable, but in my opinion, Trump's "final crackdown" has actually allowed memes to truly mature as a new asset class.

Meme was never meant to be a substitute for "long-term assets," but rather a return to the game of attention finance and liquidity itself. It has become purer, more brutal, and less suitable for most ordinary traders.

Seeking solutions from outside

Asset tokenization

So, as Memes become more professional, Bitcoin becomes more institutionalized, altcoins decline, and new projects are about to disappear, what can ordinary people like us, who enjoy value research, comparative analysis and judgment, and have speculative attributes but are not purely high-frequency betting on probabilities, do for sustainable development?

This problem doesn't just apply to individual investors.

This also presents a challenge for exchanges, market makers, and platforms—after all, the market cannot rely on higher leverage and more aggressive contract products to maintain activity indefinitely.

In fact, when the entire established logic began to collapse, the industry had already begun to seek solutions from external sources.

The direction we've been discussing is to repackage traditional financial assets into on-chain tradable assets.

Stock tokenization and precious metal assets are becoming top priorities for exchanges. From centralized exchanges to decentralized platforms like Hyperliquid, all see this path as a key to breaking through the current market barriers, and the market has responded positively. During the most frenzied days of precious metals last week, the daily trading volume of silver on Hyperliquid once exceeded $1 billion. Cryptocurrencies, indices, and precious metals once accounted for half of the top ten trading volumes, helping HYPE surge by 50% in the short term under the narrative of "all-asset trading".

Admittedly, some of the current slogans, such as "providing new choices and lower barriers to entry for traditional investors," are actually premature and unrealistic.

However, from a crypto-native perspective, it may solve internal problems: with the supply and narrative of native assets slowing down, old coins declining and new coins being cut off, what new trading reasons can crypto exchage offer to the market?

Tokenized assets are easy for us to grasp. In the past, we've studied public blockchain ecosystems, protocol revenue, token models, unlocking pacing, and narrative space.

Now, the research focus has shifted to: macroeconomic data, financial reports, interest rate expectations, industry cycles, and policy variables. Of course, we have already been researching many of these areas for some time.

Essentially, this is a shift in speculative logic, rather than a simple expansion of product categories.

The listing of gold and silver tokens is not just about adding a few more currencies; what they are really trying to introduce is a new trading narrative—bringing the volatility and rhythm that originally belonged to the traditional financial market into the crypto trading system.

Prediction Market

Besides bringing "external assets" onto the blockchain, another direction is to bring "external uncertainty" onto the blockchain—prediction markets.

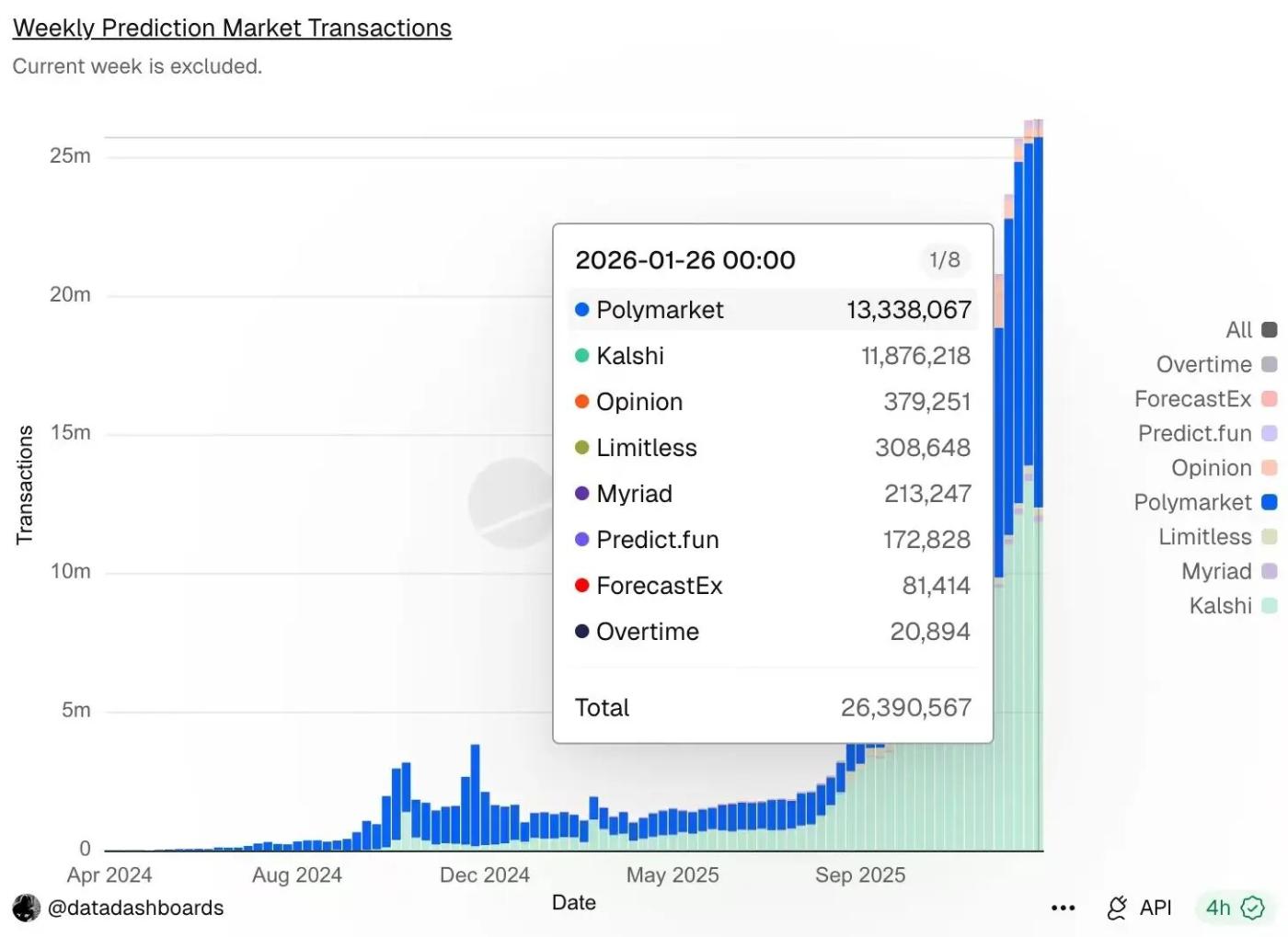

According to Dune data, despite the sharp drop in crypto prices last weekend, trading activity in the prediction market remained high, with weekly trading volume reaching a new record high of 26.39 million. Polymarket ranked first with 13.34 million transactions, followed by Kalshi with 11.88 million transactions.

We won't go into the details of the development prospects and expected size of the prediction market here. Odaily has been writing more than two articles analyzing the prediction market every day recently... You can search for them yourself.

I'd like to talk about this from the perspective of crypto users: why do we play in prediction markets? Is it because we're all gamblers?

Of course.

In fact, for a long time in the past, altcoin traders were not betting on technology, but on events: whether a token would be listed, whether there would be an official announcement of a partnership, whether a token would be issued, whether new features would be launched, whether there would be compliance benefits, and whether they could ride the next wave of narratives.

Price is merely the result; the event is the starting point.

For the first time, market prediction has broken down this issue from a "hidden variable in the price curve" into an object that can be directly traded.

You no longer need to indirectly bet on whether a certain outcome will occur by buying a token; instead, you can directly bet on whether "it will happen" itself.

More importantly, it is predicted that the market is adapted to the current environment of "new projects being cut off and narratives being scarce".

As the number of new tradable assets decreases, market attention becomes more focused on macroeconomics, regulation, politics, the behavior of industry leaders, and major industry events.

In other words, the number of tradable "objects" is decreasing, but the number of tradable "events" has not decreased, and may even be increasing.

This is why the liquidity that has actually emerged in the prediction market in the past two years has almost entirely come from non-crypto native events.

Essentially, it introduces the uncertainties of the external world into the crypto trading system. From a trading experience perspective, it is also more user-friendly for existing crypto traders.

The core questions have been drastically simplified to one: Will this outcome occur? And, is the current probability too high?

Unlike memes, the barrier to market prediction lies not in execution speed, but in information judgment and structural understanding.

Now that you mention it, doesn't it make you feel like I could try this too?

Conclusion

Perhaps the so-called crypto will eventually disappear in the near future, but before it disappears, we are still trying to make things happen. After the "new coin-driven trading" gradually fades away, the market will always need a new speculative vehicle that has low barriers to entry, a narrative that can spread, and sustainable development.

In other words, markets don't disappear; they simply migrate. When the primary level ceases to produce the future, what the secondary level can truly trade are two things: the uncertainty of the external world and the trading narrative that can be repeatedly reconstructed.

Perhaps all we can do is prepare for yet another shift in speculative paradigms.