Bitcoin entered the first full week of February under considerable macroeconomic pressure, trading in volatile territory below $80,000 as risk appetite decreased and the market awaited key US employment data.

With fears of a renewed recession, ETF Capital becoming more cautious, and speculation surrounding the Federal Reserve's next move, this week's economic calendar could be a key factor in short-term Bitcoin sentiment.

5 US economic events that could impact Bitcoin and crypto market sentiment this week.

From job vacancy figures to payroll data, each indicator influences expectations regarding interest rate cuts—still one of the strongest macroeconomic factors affecting Bitcoin. Here's what you should watch.

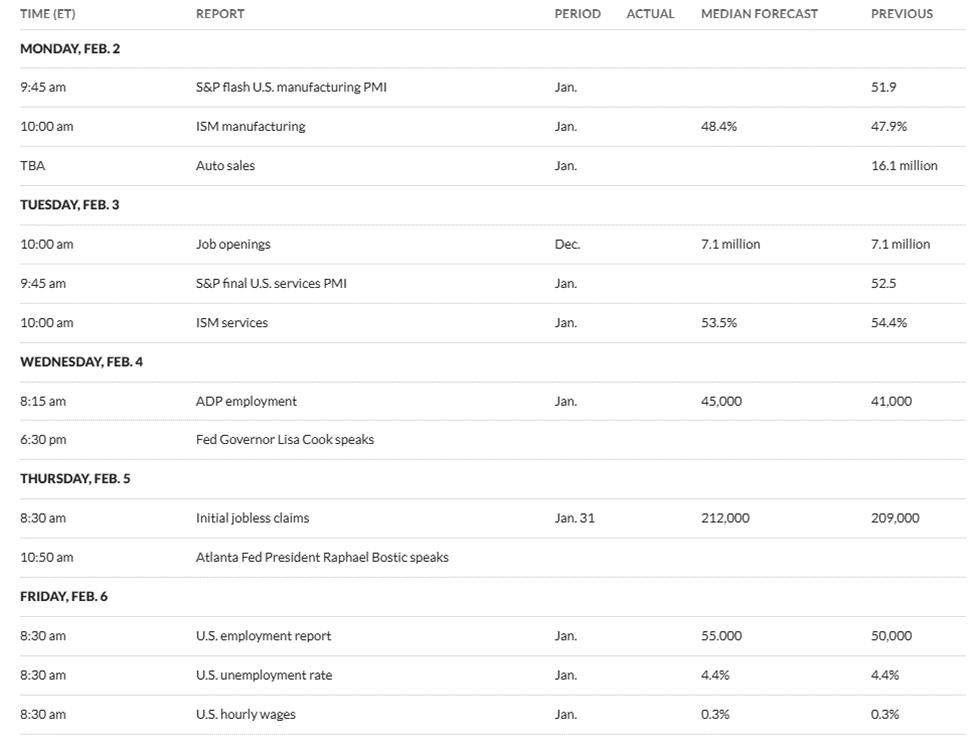

US economic calendar for this week. Source: MarketWatch

US economic calendar for this week. Source: MarketWatchJOLTS job report with vacant positions

The Job Vacancies Report (JOLTS) for December 2025, scheduled for release at 10:00 AM ET, will provide insight into labor demand through the number of unfilled job positions in the U.S.

Economists surveyed by MarketWatch predict there are approximately 7.1 million vacant positions, almost unchanged from November (adjusted to 7.146 million), lower than previous expectations and suggesting the recovery is slowing down.

If the results are lower than expected, this would reinforce the trend of a cooling labor market , increasing expectations that the Fed will cut interest rates by the end of 2026.

History shows that this situation is usually favorable for Bitcoin because loose monetary policy helps boost the value of risky assets. Conversely, if the data is more positive than expected, expectations of interest rate cuts will be delayed and put pressure on BTC.

Market reaction in recent months has been quite erratic. Despite disappointing November figures, Bitcoin's price briefly dropped below $91,000 before stabilizing again.

At the time of writing, the price of BTC is at $75,908, amidst cautious market sentiment and concerns about the risk of a US government shutdown .

Bitcoin (BTC) price fluctuations. Source: BeInCrypto

Bitcoin (BTC) price fluctuations. Source: BeInCryptoIf weak JOLTS data aligns with predictions of an unemployment rate rising to 4.5% by 2026, this could be a positive boost for the market.

ADP Employment Report

The ADP Employment Report on Wednesday, released around 8:15 AM ET, will estimate private sector job growth and typically serves as a prelude to the official payroll report on Friday.

The forecast for January is for an additional 45,000 jobs, slightly higher than the 41,000 in December, but the general consensus still leans towards 47,000 new jobs.

With Bitcoin, the trend of the new data is important , not the absolute numbers. If the data is lower than forecast, recession concerns could resurface, fueling expectations that the Fed will cut interest rates sooner or more aggressively—something history has shown to benefit BTC during bull runs driven by strong capital inflows.

Conversely, more positive data suggesting a healthy labor market and that the Fed may not yet need to ease monetary policy—which would negatively impact the prices of risky assets like crypto.

Previous reports with mixed employment data hadn't immediately triggered a strong reaction in BTC , but later, when payrolls were weaker, the price surged to nearly $92,000.

Currently, with Bitcoin trading on the defensive due to ETF outflows and various macroeconomic uncertainties, a weak ADP report could help stabilize market sentiment ahead of Friday's session.

Number of initial unemployment benefit applications

Initial Unemployment Claims data for the week ending January 31 will be released at 8:30 AM ET, providing the most up-to-date insight into labor market pressures. This report shows how many U.S. citizens filed for unemployment benefits for the first time each week.

The number of orders is expected to reach 212,000, slightly higher than last week's 209,000—which was Capital higher than forecast.

If the number of unemployment benefit claims increases, this would strengthen the argument that the labor market is losing its appeal, reinforcing expectations that the Fed will ease policy and potentially supporting Bitcoin. However, if the number of claims unexpectedly drops sharply, hawkish stances are likely to return and will limit the upside potential of risk assets.

Recent data on unemployment benefit applications also did not generate much volatility for the price of BTC, which was mainly driven by the broader market sell-off trend.

However, with investor sentiment at an extremely anxious level and unemployment projected to continue rising in 2026, any significant increase in the number of unemployment benefit applications could shift the balance of risk toward Bitcoin.

US Nonfarm Payrolls Report

The Nonfarm Payrolls report on Friday is the most important event this week. Forecasts for January suggest an additional 55,000 jobs, with the unemployment rate remaining at 4.4% and Medium wages increasing 0.3% compared to the previous month. However, forecasts vary considerably, with some analysts predicting only around 32,000 jobs will be created.

Weak employment figures increase the likelihood of the US Federal Reserve (Fed) cutting interest rates amid a cooling economy, and this has previously been a reason for the surge in BTC prices.

In December, weaker-than-expected jobs reports helped Bitcoin surge to nearly $92,000 shortly afterward. However, if the upcoming report yields strong results, the Fed could continue to keep interest rates high, putting pressure on BTC – which has already fallen from its recent peak due to concerns about leverage and macroeconomic factors.

Because revised data often causes significant market volatility, Friday's information could determine Bitcoin's short-term trend. The market is currently anticipating a shift in Fed policy, so even if the data falls short of expectations, BTC could still rebound due to the "relief" sentiment.

Bitcoin is currently extremely sensitive to US employment data as traders continuously reassess the Fed's direction. If the data continues to be positive, BTC is likely to struggle to break out. Conversely, if the reports are unfavorable, the Fed will have more reason to ease policy, thereby improving risk appetite in the crypto market.

Below is a clear, logically sound presentation, offering an objective and easily understandable perspective while maintaining accuracy regarding the impact of new information.

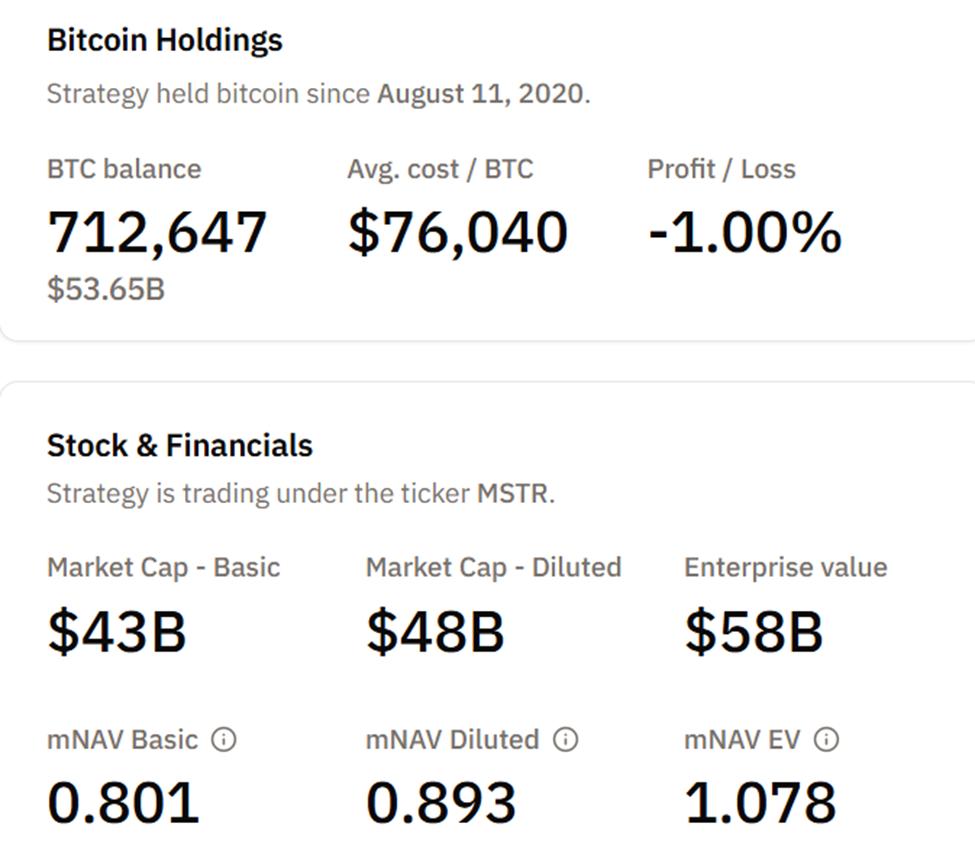

Strategy (MSTR) Q4 2025 Business Results

This important report will be released after the market closes at 5:00 PM (ET) on February 5, 2026, and remains a major psychological driver for Bitcoin, as the company currently holds the world's largest holding of corporate Bitcoin .

Currently, the company owns approximately 712,647 BTC, worth an estimated $53.65 billion at current prices, representing about 3.4% of the total circulating supply of Bitcoin.

Strategy's BTC holdings. Source: Bitcoin Treasureries

Strategy's BTC holdings. Source: Bitcoin TreasureriesThis investment means that MicroStrategy's financial statements are influenced by both accounting perspectives and the overall sentiment of the crypto market.

According to analysts' forecasts, the company's fourth-quarter earnings per share (EPS) could show a loss of approximately $18.06, significantly higher than last year's loss of $3.20. The main reason stems from write-downs on "fair value" assets related to the Bitcoin price correction in the fourth quarter.

Revenue is projected at around $117–119 million, nearly flat or lower than the same period last year. This suggests the company's core software segment now plays a secondary Vai , with the Bitcoin strategy being the main focus.

If actual losses exceed forecasts or cautious statements regarding leverage, stock dilution, or Capital structure emerge, concerns about profit margins will intensify – especially if BTC continues to fall to the price range around MicroStrategy's Medium Capital point of approximately $76,000.

Although the majority of the company's Bitcoin holdings are not yet pledged, negative sentiment alone could put pressure on BTC due to concerns about the risk of the company being forced to sell.

However, there is currently no immediate liquidation risk associated with MicroStrategy's convertible bonds. If the company continues to assert its long-term commitment, buys more Bitcoin, or plans to raise new Capital , the optimistic sentiment about large businesses holding Bitcoin will be further strengthened.