Author: Curry, TechFlow TechFlow

Original title: The excitement belongs to the likes of Epstein ; Saylor just wants to hoard coins.

There's a reason why one person can hoard 710,000 Bitcoins .

Last Friday, the U.S. Department of Justice released 3 million pages of documents related to the Epstein case. Politicians, billionaires, and celebrities—a string of names popped up from these documents. Michael Saylor, the founder of MicroStrategy (formerly MicroStrategy), was also among them.

However, Saylor appeared in a rather unusual way; he was at the table that was being looked down upon.

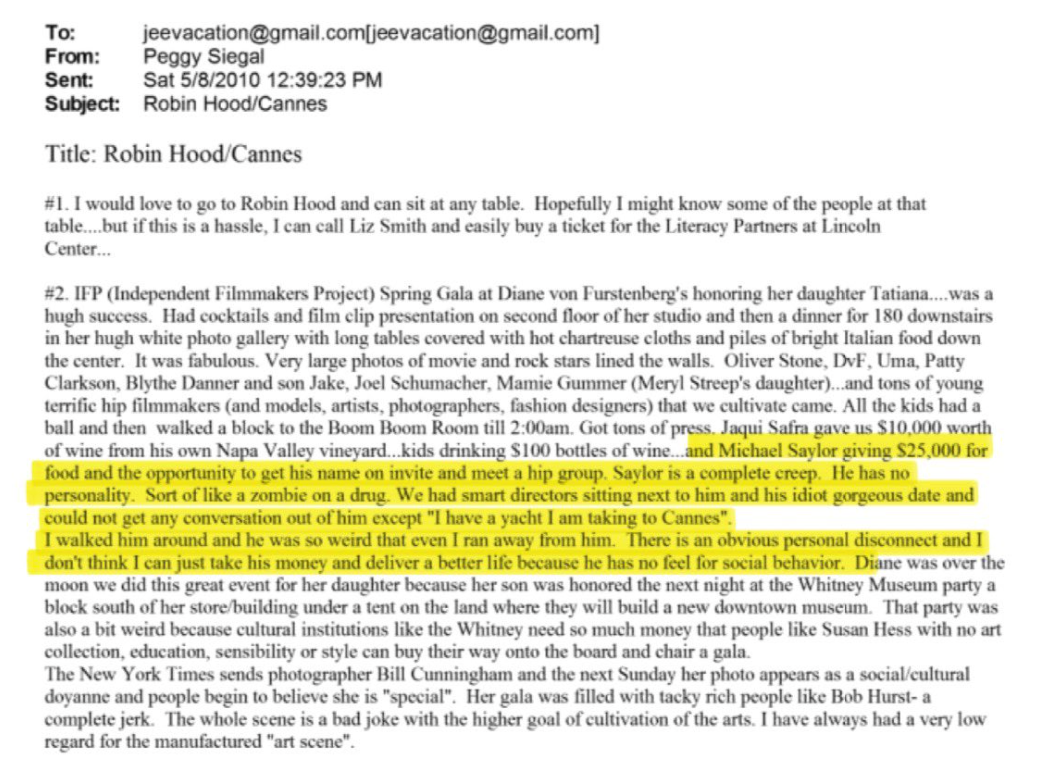

Based on currently available information, in 2010, Epstein's public relations officer, Peggy Siegal, complained in a private email as follows:

"A guy named Saylor spent $25,000 on a dinner ticket, and I was in charge of socializing with him. But he was completely unresponsive, like a drugged zombie. I couldn't stand it and left halfway through."

Peggy's main job was in public relations for Hollywood films, and her side job was arranging dinner parties for Epstein, which basically meant finding wealthy people and bringing them into the circle.

She socialized with wealthy people, helping them meet the right people at parties and dinners, ensuring they had fun and spent their money comfortably. Having been in this business for decades, she should have seen all kinds of rich people.

But Saylor, she couldn't serve her.

The reason isn't that he has a character flaw, it's that he's too boring. He paid to get in, but he couldn't strike up a conversation with anyone and had absolutely no interest in socializing.

Peggy's exact words were, "I didn't even know if I could take his money, and I didn't know where to start if I wanted to control him... He had no personality and no understanding of social etiquette."

Now that the Epstein case has exploded, everyone on the list is scrambling to distance themselves. Saylor, on the other hand, wasn't even on the list back then.

When a person is too bored and withdrawn, it becomes a protective charm.

But when this "boredom" is placed in a different context, it becomes a different story.

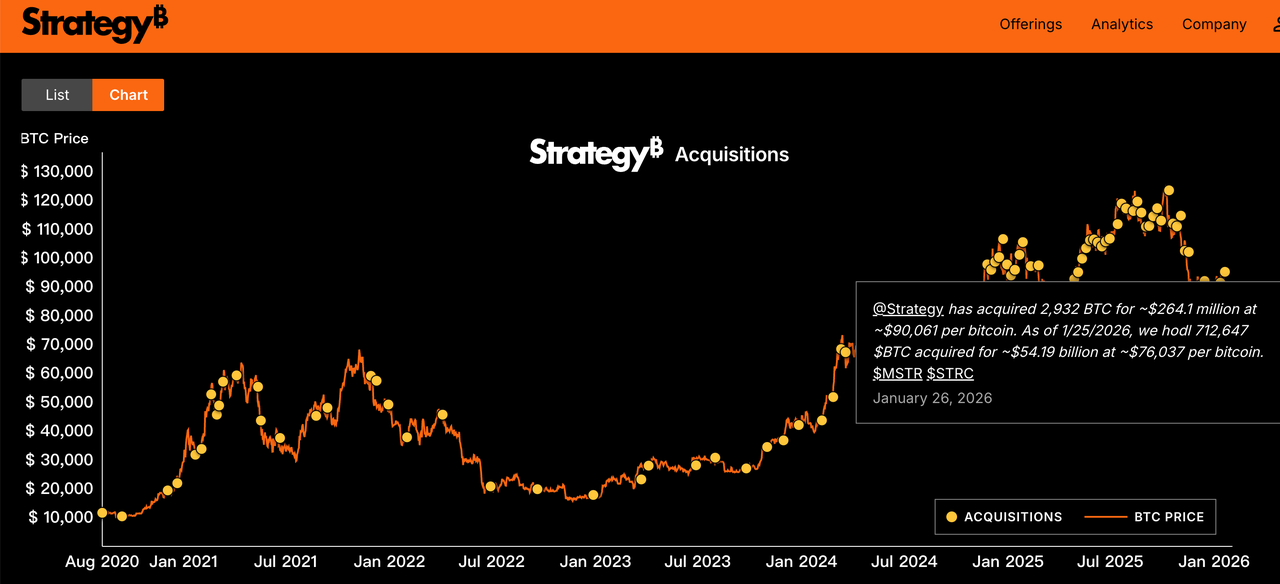

Saylor's company, Strategy (formerly MicroStrategy), is the world's largest publicly traded company holding cryptocurrency. In January of this year, when Bitcoin was still fluctuating around $90,000, they bought more than 37,000 Bitcoins, spending $3.5 billion.

I buy it almost every week, without fail.

As of now, Strategy holds 712,647 Bitcoins at an average cost of $76,037. Bitcoin just fell below $76,000 today, meaning Saylor's position is currently right at the break-even point.

The market's fear index hit a 20-week high, with widespread panic in the crypto. Strategy's stock price has also plummeted 60% from its peak.

But Saylor tweeted "More Orange," implying that she would continue buying next week.

Peggy once said he was like a zombie. Now you see, hoarding cryptocurrency might be something only a zombie could do.

No explanations, no opportune time, no getting off the bus. Completely oblivious to the outside world, and feeling perfectly content with oneself.

While Peggy complained back then about not knowing how to help him spend money, Saylor has clearly found his own way to spend money: buying all Bitcoin.

Judging from that email, Saylor is an outsider in the world of fame and fortune. He can't sit still, he can't have a conversation, and he'd be there all night as if he hadn't even been there. But the same kind of person can sit still when it comes to trading.

No need for socializing, no need to cultivate relationships, no need to guess what others are thinking. Just focus on one thing, buy it every week, and don't resell it.

Being dull, boring, and insensitive to the outside world... these traits might be flaws in social situations, but when it comes to hoarding cryptocurrency, they might be a talent.

After this story spread, a classic meme appeared on Twitter, the gist of which was that Saylor had no interest in underage girls, but was extremely obsessed with underage assets.

In hindsight, this exposure actually helped build a positive image for Saylor to some extent.

After the Epstein case broke in 2019, Peggy, who was in charge of public relations, had all her contracts canceled by clients such as Netflix and FX, which meant that her public relations career was basically over; while Saylor is now one of the world's largest Bitcoin holders.

The person who is disliked is still buying coins, while the person who disliked him has already been eliminated.

However, Saylor's current situation is not so easy either.

The new Federal Reserve Chairman, Warsh, is hawkish, and the market expects him to refrain from aggressive interest rate cuts after taking office. This shift in interest rate expectations has put pressure on various global asset classes.

Gold prices fell, silver prices fell, and Bitcoin prices fell even more sharply.

Coupled with tariff frictions and strained US-EU relations, funds began to flow into traditional safe-haven assets. The narrative of Bitcoin as "digital gold" gradually faded.

If Bitcoin continues to fall, Strategy's ability to raise funds through new share issuance will weaken, and the flywheel of cryptocurrency-equity rotation may become a vicious cycle.

But Saylor seems genuinely unconcerned about these things, which might just be another side of "boredom."

Ordinary investors can't do what Saylor does, not because they lack money, but because they're too "normal." Normal people read the news, analyze stock charts, and follow what others say. When the fear index spikes, their hands start itching to trade, and their hearts start aching.

Every day we make decisions, and every decision drains our willpower.

Saylor's strategy seems to lack a "decision-making" element. Buying is the only action; not selling is the only principle.

In his own words, "Bitcoin is the best asset ever invented by mankind, so why would I sell it?"

You could call it faith, or you could call it fanaticism. But from an implementation perspective, the biggest advantage of this system is:

It doesn't require you to be smart, it just requires you to be bored.

Of course, this isn't a suggestion that you should emulate him. Saylor's confidence stems from being a publicly listed company with the ability to issue stock and borrow money. Ordinary people don't have these advantages, and trying to copy his methods will most likely only result in losses.

But there is one point that we can learn from.

In investing, "fun" is often the source of losing money.

Frequent trading, chasing trends, following news, and using leverage... these behaviors that make investing "interesting" are precisely the enemies of returns.

The truly profitable strategies are often so boring they make you want to fall asleep.

Saylor's case is a bit extreme, but the logic is sound. In a noisy market, "boredom" may be the rarest skill.

Those who were once so adept at socializing at parties are now either distancing themselves from the scene, under investigation, or have completely disappeared.

Perhaps, accumulating cryptocurrency and being a good person are based on the same principle:

Don't linger in crowded places; it's the boring things that are worth doing for a long time.

Twitter: https://twitter.com/BitpushNewsCN

BitPush Telegram Community Group: https://t.me/BitPushCommunity

Subscribe to Bitpush Telegram: https://t.me/bitpush