This article is machine translated

Show original

This provides one perspective.

Be extra careful when projects launched by Bybit, especially those launched with an "All In" approach.

Remember this!

For example.

On January 28th, Bybit announced the simultaneous launch of Bybit Spot, Bybit Alpha, and Byreal platforms.

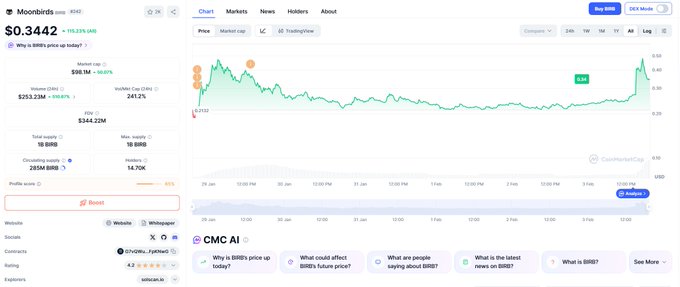

On February 3rd, Upbit announced the launch of $BIRB, which immediately triggered an 80% increase.

Bybit 'All In in approach to launching new tokens is based on betting on project popularity and community, aiming to capture liquidity from the new coin.

As expected, nearly half of the liquidity for the new coin after its launch came from Bybit. This also helped establish a crucial initial liquidity base.

After liquidity stabilized, UPBIT and Bithumb were launched.

South Korean funds are characterized by high concentration and explosive growth; on the same day, they directly pulled up by 80%, and FDV once returned to the 400M+ range.

From a broader perspective, Moonbirds, Seeker, and Fight have all recently followed almost the same pattern:

First, list on Bybit and Byreal to build a liquidity moat. Then, list on major exchanges like Coinbase or Upbit to achieve explosive growth. This listing pace allows projects to ensure stable liquidity in the early stages and achieve explosive growth at the right time.

I boldly predict that more and more Sol projects will favor this route.

The reason is simple: in a market environment of increasingly tight liquidity, stability has greater long-term value.

Bybit's recent listing pace, including memes, has been quite praised.

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share