1/ Borrowers on Euler kept 98%+ of their liquidated collateral value during the last wave of volatility:

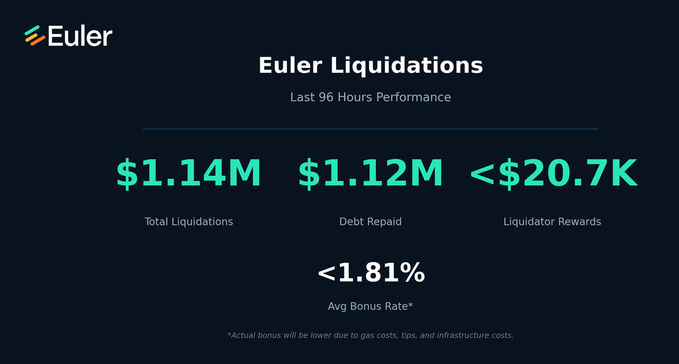

$1.14M in liquidations processed

$1.12M debt repaid

<$20.7K liquidator rewards

<1.81% avg bonus rate

The data shows what efficient DeFi liquidation infrastructure looks like 👇

Why does this matter?

Traditional lending protocols use fixed liquidation bonuses (often 5-15%).

Euler's reverse Dutch auction:

- Starts at 0% discount

- Increases as the health of the position deteriorates until a liquidator steps in

- Result: borrowers keep more collateral

Read more about Liquidations on Euler here:

Sector:

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content