interesting design choice, and the opposite approach we've taken at tplus. when market participants deposit into tplus, funds land in a spot only account. in order to open leverage positions, the user needs to create a subaccount and send collateral eligible assets to it. this was extremely intentional; design decisions should always protect the user from themselves. in tplus, bluechip spot trades are feeless, and margin eligible spot assets generate yield automatically. the default is spot. exposing your positions to liquidation risk is always a conscious choice. this is especially important on tplus because spot and leverage trades occur in the same book. users should feel comfortable depositing large spot balances into the exchange without ever unintentionally risking liquidation; on tplus, that is the default.

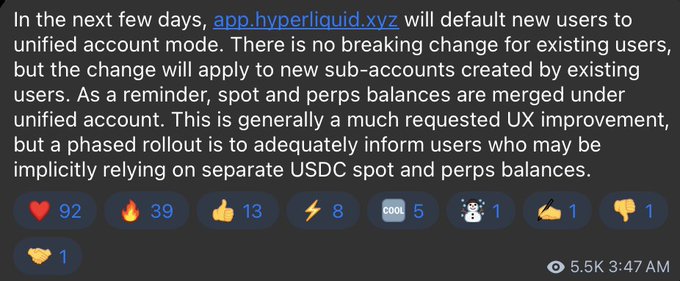

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content