From a partnership to new DeFi feature, the DeFi yield ecosystem is overflowing with opportunities

𝘎𝘳𝘦𝘢𝘵 𝘰𝘱𝘱𝘰𝘳𝘵𝘶𝘯𝘪𝘵𝘪𝘦𝘴, 𝘥𝘰𝘶𝘣𝘭𝘦-𝘥𝘪𝘨𝘪𝘵 𝘈𝘗𝘠𝘴/𝘈𝘗𝘙𝘴, 𝘢𝘯𝘥 𝘧𝘳𝘦𝘴𝘩 𝘷𝘢𝘶𝘭𝘵𝘴 𝘢𝘤𝘳𝘰𝘴𝘴 𝘉𝘢𝘴𝘦, 𝘗𝘭𝘢𝘴𝘮𝘢, 𝘢𝘯𝘥 𝘌𝘵𝘩𝘦𝘳𝘦𝘶𝘮.

Lets have a look 🧵👇

------------------------------

➢ @krakenfx is rolling out a new “DeFi Earn” product in the US, EU, and Canada that lets users earn on‑chain yields up to 8% APY by depositing assets into DeFi strategies via Kraken’s interface.

This product bridges CeFi convenience with DeFi yield mechanics.

------------------------------

➢ @scryptplatform announced a partnership with @gauntlet_xyz to give Swiss‑licensed institutional investors ongoing access to DeFi yield markets.

Institutional flows can stabilize yields and TVL over time.

Professional capital often targets liquidity‑rich, sustainable yield strategies, not short incentive pools.

------------------------------

➢ @superformxyz launched a mobile app for U.S. users that aims to make onchain yield farming and asset growth simpler using familiar mobile UI while keeping users in control of their assets.

This move works to broaden retail access to DeFi yield strategies and could lead to increased user participation in yield products from both DeFi veterans and newcomers.

------------------------------

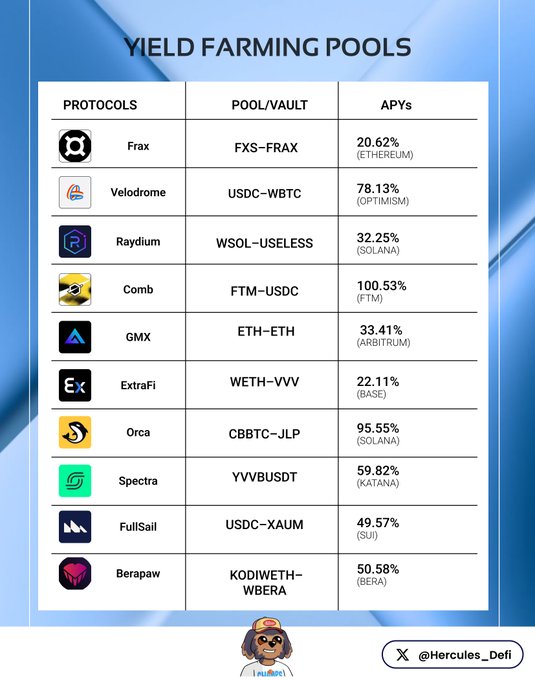

𝐘𝐢𝐞𝐥𝐝 𝐅𝐚𝐫𝐦𝐢𝐧𝐠 𝐏𝐨𝐨𝐥𝐬

➢ FXS–FRAX

DApp: @fraxfinance

Chain: Ethereum

APY: 20.62% (current), 33.35% (30-day avg)

TVL: $2.22M

Pool/Vault type: Algo-Stablecoin LP

➢ USDC–WBTC

DApp: @VelodromeFi V3

Chain: Optimism

APY: 78.13% (current), 35.02% (30-day avg)

TVL: $2.1M

Pool/Vault type: CL Liquidity Pool

➢ WSOL–USELESS

DApp: @Raydium AMM

Chain: Solana

APY: 32.25% (current), 32.55% (30-day avg)

TVL: $1.68M

Pool/Vault type: Standard LP

➢ FTM–USDC

DApp: @combfinancial

Chain: Fantom

APY: 100.53% (current), 100.53% (30-day avg)

TVL: $1.09M

Pool/Vault type: Yield / Incentive LP

➢ ETH–ETH

DApp: @GMX_IO V2 Perps

Chain: Arbitrum

APY: 33.41% (current), 8.84% (30-day avg)

TVL: $13.56M

Pool/Vault type: Perpetual Derivatives Pool

➢ WETH–VVV

DApp: @Extrafi_io

Chain: Base

APY: 22.11% (current), 27.92% (30-day avg)

TVL: $1.41M

Pool/Vault type: Leveraged Farming LP

➢ CBBTC–JLP

DApp: @orca_so DEX

Chain: Solana

APY: 95.55% (current), 34.58% (30-day avg)

TVL: $983K

Pool/Vault type: Standard LP / Perpetuals Exposure

➢ YVVBUSDT

DApp: @spectra_finance V2

Chain: Katana

APY: 59.82% (current), 61.92% (30-day avg)

TVL: $974K

Pool/Vault type: Fixed-Maturity Yield Vault

➢ USDC–XAUM

DApp: @FullSailFi

Chain: Sui

APY: 49.57% (current), 31.90% (30-day avg)

TVL: $923K

Pool/Vault type: Standard LP / Cross-Chain

➢ WETH–SURGE

DApp: @Uniswap V2

Chain: Base

APY: 68.90% (current), 80.61% (30-day avg)

TVL: $772K

Pool/Vault type: Standard LP

➢ KODIWETH–WBERA

DApp: @0xBeraPaw

Chain: Berachain

APY: 50.58% (current), 49.87% (30-day avg)

TVL: $650K

Pool/Vault type: Liquid Staking LP

Which did i miss? lemme know in the comments 👇

what a good list sir

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content