The market has entered a downturn, and skepticism about the crypto market is growing. Tiger Research believes this time is different from the past: past crashes were triggered by internal problems (Mt. Gox hack, ICO scams, FTX crash), while this time the ups and downs are driven by external factors (ETF approvals led to a bull market, tariff policies and interest rates caused a decline).

Article by Ryan Yoon

Article source: TechFlow TechFlow

TechFlow Dive: The market has entered a downward cycle, and skepticism towards the crypto market is growing. Tiger Research believes this time is different from the past: past crashes were triggered by internal problems (Mt. Gox hack, ICO scams, FTX crash), while this time the rise and fall are driven by external factors (ETF approvals brought a bull market, tariff policies and interest rates led to a decline).

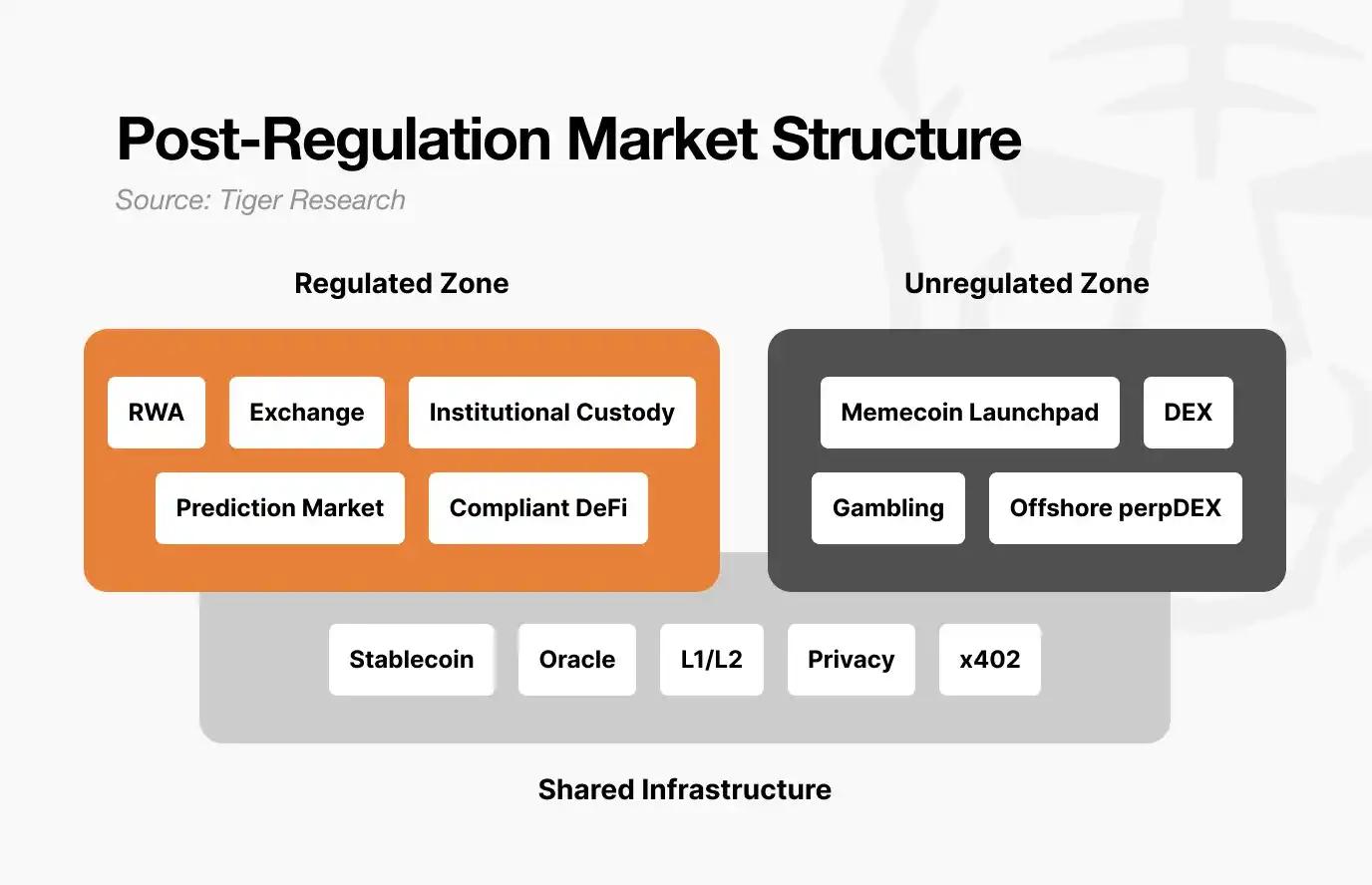

The post-regulation market has split into three tiers: a compliant zone, a non-compliant zone, and shared infrastructure. Funds no longer flow in a "trickle-down" fashion as they did in the past. ETF funds remain in Bitcoin and no longer flow to Altcoin.

The next bull market requires two conditions: the emergence of a killer app in the non-compliant zone and a shift in the macro environment to support it.

The full text is as follows:

As the market enters a downturn, skepticism about the crypto market is growing. The question now is whether we have entered a Crypto Winter.

Key points

- The Crypto Winter follows a sequence: major events → collapse of trust → brain drain.

- The past winter was caused by internal problems; the current rises and falls are driven by external factors; it is neither a winter nor a spring.

- The post-regulatory market is divided into three tiers: the compliant zone, the non-compliant zone, and shared infrastructure; the trickle-down effect disappears.

- ETF funds remain in Bitcoin; do not flow out of the compliant zone.

- The next bull market needs a killer use case plus a supporting macroeconomic environment.

1. How did the previous Crypto Winter unfold?

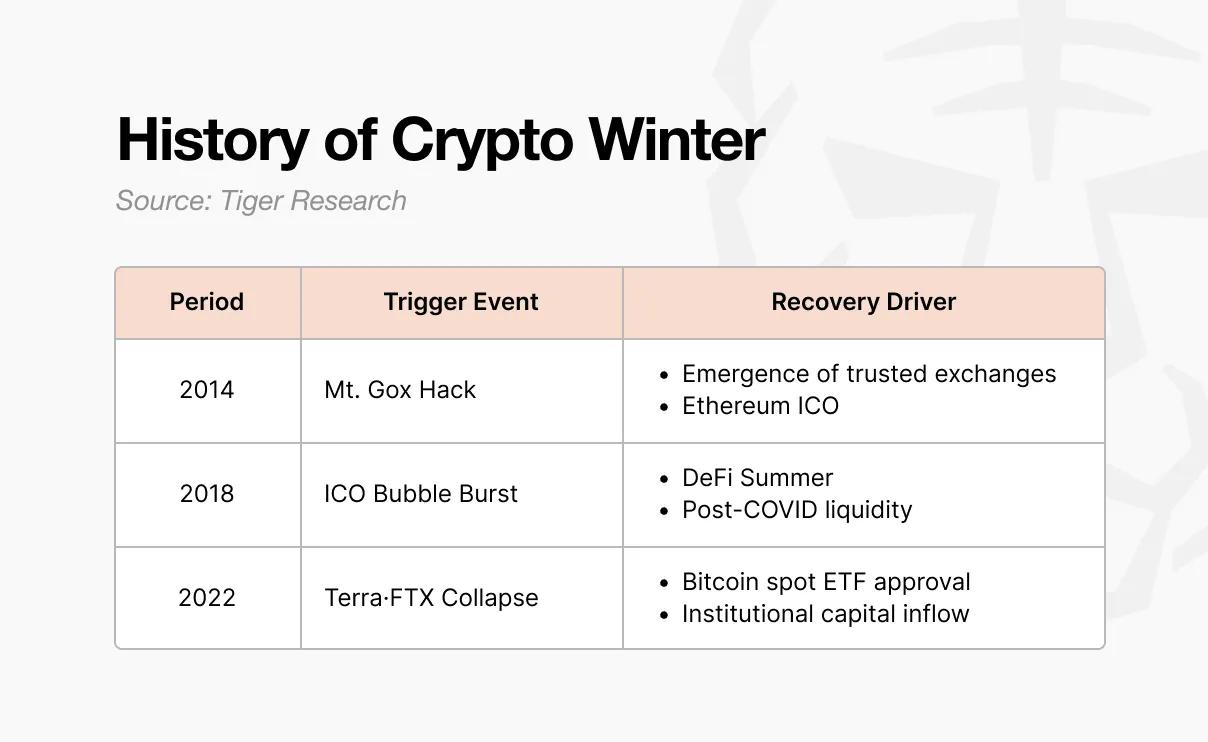

The first Bitcoin winter occurred in 2014. Mt. Gox was the exchange handling 70% of global Bitcoin trading volume at the time. Approximately 850,000 BTC disappeared in a hack, and market trust collapsed. New exchanges with internal controls and auditing capabilities emerged, and trust began to recover. Ethereum also entered the world through ICOs, opening up new possibilities for visions and fundraising methods.

This ICO became the catalyst for the next bull market. The 2017 boom was ignited when anyone could issue tokens and raise funds. Projects raising tens of billions based solely on a white paper flooded the market, but most lacked substance.

In 2018, South Korea, China, and the United States unleashed a wave of regulatory measures, causing the bubble to burst and ushering in a second financial winter. This winter did not end until 2020. Following COVID-19, liquidity surged, and DeFi protocols such as Uniswap, Compound, and Aave gained attention, with funds flowing back into the sector.

The third downturn was the most severe. When Terra-Luna collapsed in 2022, Celsius, Three Arrows Capital, and FTX all went bankrupt. This wasn't just a simple price drop; the industry's structure itself was shaken. In January 2024, the U.S. SEC approved a spot Bitcoin ETF, followed by the Bitcoin halving and Trump's pro-crypto policies, and funds began flowing in again.

2. Crypto Winter Mode: Major Events → Trust Collapse → Talent Loss

All three economic downturns followed the same sequence: a major event occurred, trust collapsed, and talent left.

It always starts with a major event. The Mt. Gox hack, ICO regulation, and FTX's bankruptcy after the Terra-Luna crash. Each event differs in scale and form, but the result is the same: the entire market is thrown into shock.

The shock quickly turned into a collapse of trust. Those who had been discussing what to build next began to question whether cryptocurrency was truly a meaningful technology. The collaborative atmosphere among the builders vanished, and they began blaming each other for responsibility.

Doubt led to a brain drain. Those who had been creating new momentum in blockchain fell into doubt. In 2014, they turned to fintech and Big Tech companies. In 2018, they moved to institutions and AI. They went where things seemed more certain.

3. Is this the current Crypto Winter?

The patterns of the Crypto Winter of the past are still visible today.

- Major events :

- Trump's tariff policies trigger market turmoil

- Federal Reserve interest rate policy shift

- The crypto market declined overall.

- Trust collapses : Suspicion spreads within the industry. The focus shifts from what to build next to mutual blame.

- Talent drain pressure : The AI industry is growing rapidly, promising a faster exit and greater wealth than crypto.

However, it's difficult to call this a Crypto Winter. Past winters erupted from within the industry itself. Mt. Gox was hacked, most ICO projects were exposed as scams, and FTX crashed. The industry itself lost trust.

Things are different now.

ETF approvals triggered a bull market, while tariffs and interest rates drove a decline. External factors both boosted and depressed the market.

The builders did not leave either.

RWA, perpDEX (a decentralized exchange for perpetual contracts), prediction markets, InfoFi, privacy. New narratives are constantly emerging, and they are still being created. They haven't yet driven the entire market like DeFi has, but they haven't disappeared either. The industry hasn't collapsed; the external environment has changed.

We did not create spring, therefore we did not experience winter.

4. Changes in market structure after regulation

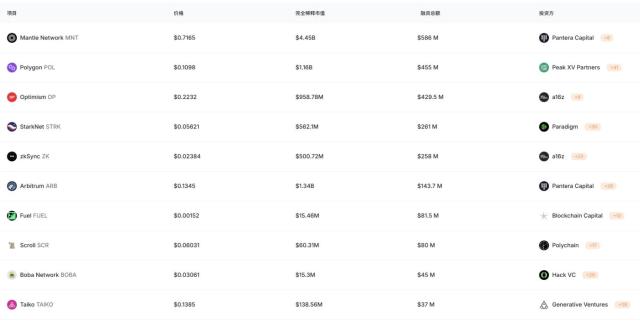

Behind this lies a significant shift in the post-regulatory market structure. The market has split into three tiers: 1) the compliant zone, 2) the non-compliant zone, and 3) shared infrastructure.

The compliant zone includes RWA tokenization, exchanges, institutional custody, prediction markets, and compliant DeFi. These are audited, require disclosure, and are legally protected. Growth is slow, but capital is large and stable.

However, once in the compliant zone, it's difficult to expect the explosive returns of the past. Volatility decreases, limiting upside potential. But downside risks are also limited.

On the other hand, the non-compliant sector will become even more speculative in the future. Entry barriers are low, and the speed is fast. It will be more frequent to see gains of 100 times in one day followed by a -90% drop the next.

However, this space is not meaningless. Industries born in the non-compliant zone are creative, and once validated, they move into the compliant zone. DeFi has done this, and prediction markets are doing it now. It acts as an experimental ground. But the non-compliant zone itself will become increasingly separate from compliant zone businesses.

Shared infrastructure includes stablecoins and oracles. They are used in both compliant and non-compliant markets. The same USDC is used for institutional RWA payments and also for Pump.fun transactions. Oracles provide data for verifying tokenized government bonds and for clearing anonymous DEXs.

In other words, as the market fragments, the flow of funds also changes.

In the past, when Bitcoin rose, Altcoin also rose through a trickle-down effect. Now it's different. Institutional capital entering through ETFs stays in Bitcoin and stops there. Capital in the compliant sector doesn't flow into the non-compliant sector. Liquidity only stays where value has been proven. And even Bitcoin, relative to risk assets, has yet to prove its value as a safe-haven asset.

5. Conditions for the next bull market

The regulatory framework is already in place. The builders are still constructing. So, two things remain.

First, a new killer use case must emerge from the non-compliant sector. Something that creates value that didn't exist before, like the DeFi Summer of 2020. AI agents, InfoFi, and on-chain social networking are candidates, but they haven't yet reached the scale to drive the entire market. The process of validating experiments in the non-compliant sector and moving into the compliant sector must be recreated. DeFi did this, and prediction markets are doing it now.

Second, the macroeconomic environment. Even after regulatory cleanup, with developers building and infrastructure accumulating, upside potential is limited if the macroeconomic environment is unfavorable. The 2020 DeFi Summer erupted amidst the post-COVID liquidity release. The 2024 ETF approval rally also coincided with expectations of interest rate cuts. Regardless of the crypto industry's performance, it cannot control interest rates and liquidity. For the industry's developments to be convincing, the macroeconomic environment must shift.

A repeat of the past "crypto season" where everything rose together is unlikely. The market has become fragmented. The compliant sector is growing steadily, while the non-compliant sector is experiencing wild swings.

The next bull market will come. But it won't come for everyone.