Author: Gu Yu, ChainCatcher

After the price of ETH hit a new low since May of last year, Ethereum founder Vitalik Buterin published a lengthy article today reflecting on Ethereum's long-standing core Layer 2 strategy and planning to increase investment in Layer 1, which is expected to have a significant impact on the entire crypto industry.

The initial Rollup-centric roadmap defined Layer 2 as Ethereum-supported sharding, providing trustless block space. In this article, Vitalik appears to have abandoned his previously advocated "Rollup-centric" scaling model, pointing out that while Ethereum's underlying scaling is progressing, Layer 2's decentralization is "far slower than expected," and many Layer 2 implementations are unable or unwilling to meet the trust guarantees required for true sharding.

"These two facts, for whatever reason, mean that the original vision of Layer 2 and its role in Ethereum are no longer meaningful, and we need a new path," Vitalik said. From an outsider's perspective, these statements imply that Vitalik acknowledges the Layer 2 narrative is almost obsolete, and that future focus will be more on scaling Layer 1 itself.

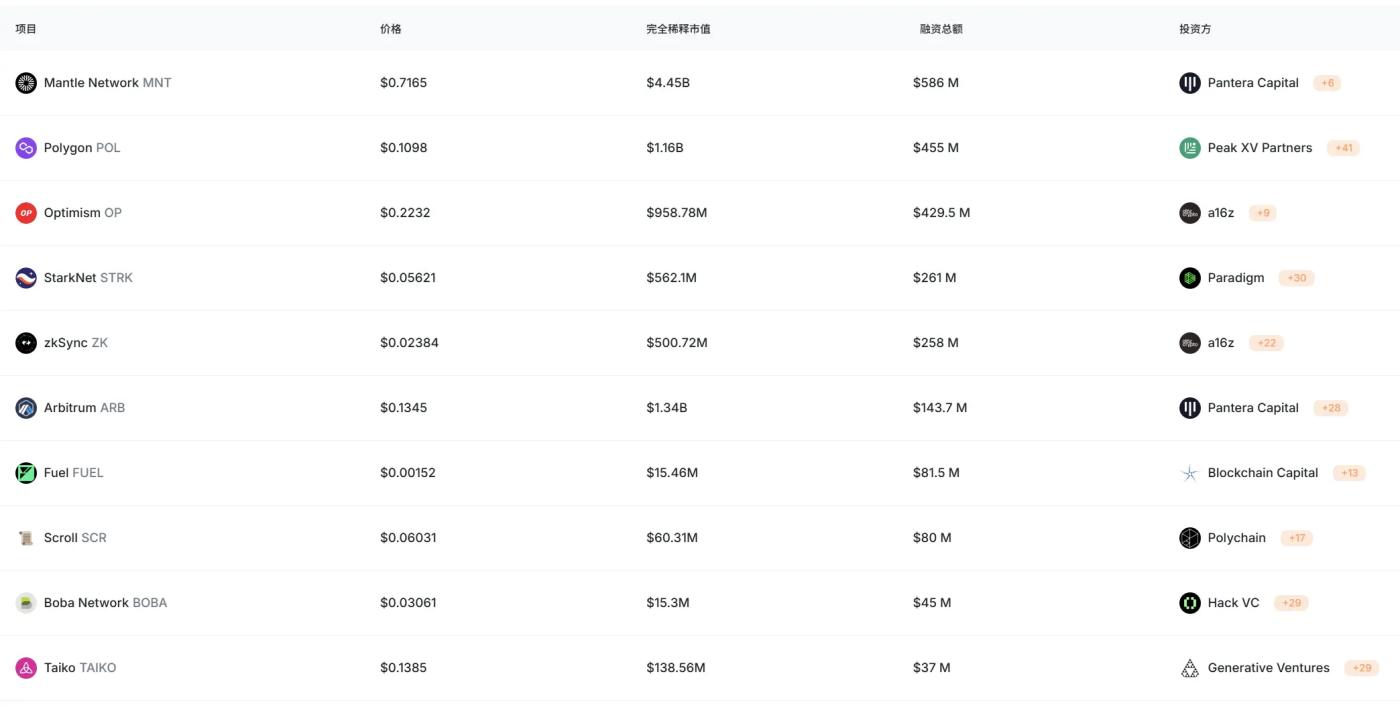

Since its inception, Layer 2 has become one of the most sought-after and market-focused concepts in the crypto industry. Nearly a hundred Layer 2 tokens, such as Polygon, Arbitrum, and Optimism, have emerged, raising a total of over $3 billion. They have played a key role in scaling Ethereum and reducing transaction costs for users, with the FDV of several tokens consistently exceeding $10 billion.

However, under the strong competition from Solana's high-performance blockchain, the performance advantages of Layer 2 have not been fully realized, and the industry influence of its ecosystem projects has been declining. Currently, only the Base ecosystem remains active in the crypto industry, representing Ethereum Layer 2 and carrying the banner.

Main Layer 2 token market capitalization and funding data source: RootData

Furthermore, Layer 2 outages continue to occur frequently. On January 11th of this year, Starknet experienced another outage after many years of operation; subsequent reports indicated that a conflict between the execution and proof layers caused approximately 18 minutes of on-chain activity to be rolled back. Last September, Linea experienced an outage lasting over half an hour. In December 2024, the Taiko mainnet experienced a 30-minute outage due to an ABI issue, indicating that these technologies remain technically unstable.

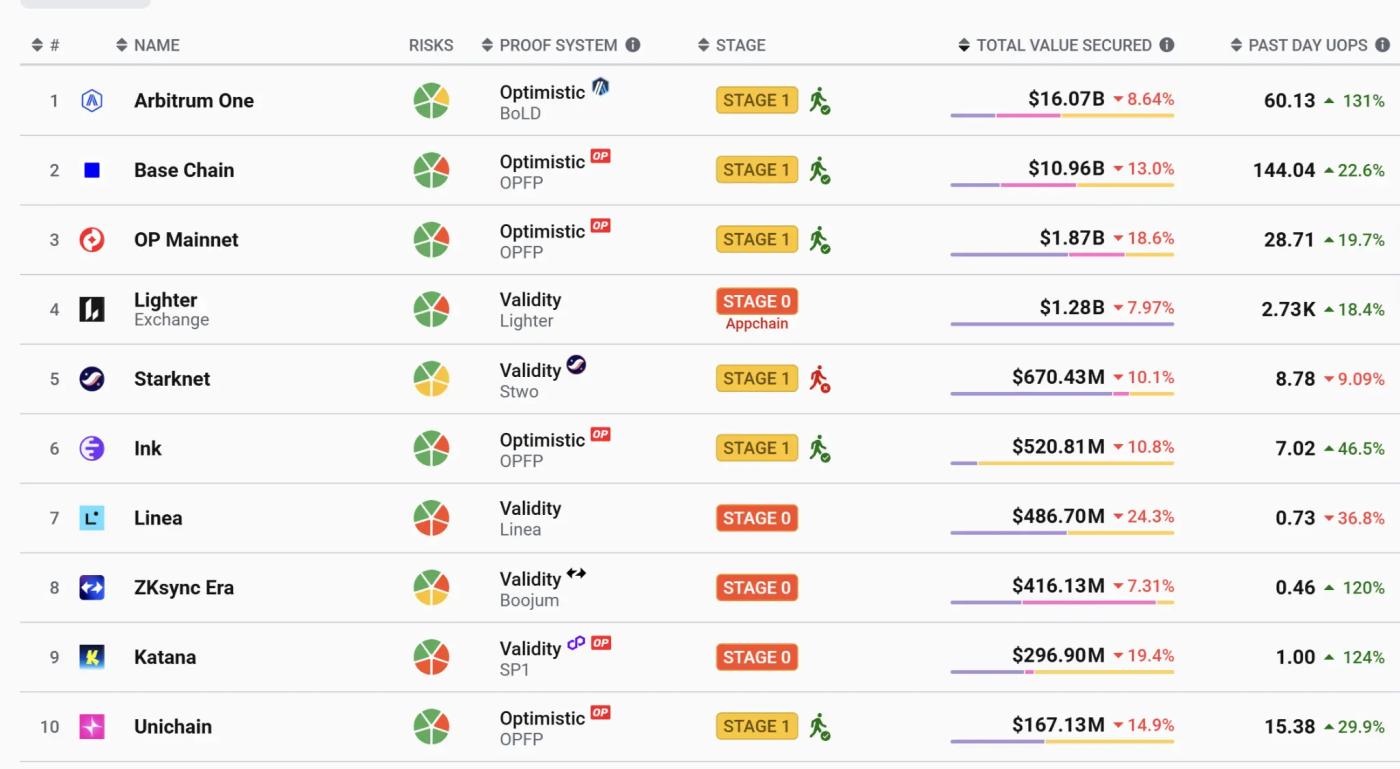

In fact, Vitalik had previously proposed a framework for measuring the decentralization of Rollups, which is divided into phases, from Phase 0 (where a centralized trust committee can veto transactions), Phase 1 (where smart contracts begin to have limited governance rights), to Phase 2 (where trust is completely eliminated).

Despite the emergence of nearly a hundred Ethereum Layer 2 projects, only a very small number have reached Stage 1. Base, a Layer 2 project incubated by Coinbase since 2023, only reached Stage 1 last year. Vitalik Buterin has criticized this point on several occasions. According to L2beat statistics, among the top 20 Rollup projects, only one project has reached Stage 2: zk.money, a product developed by the decentralized privacy protocol Aztec, but development of this product has currently stalled. The other 12 projects are all at Stage 0, heavily reliant on accessibility features and multi-signature functionality.

Vitalik pointed out that Layer 2 projects should at least be upgraded to Phase 1, otherwise these networks should be viewed as more competitive, vampire-like "Layer 1 networks with cross-chain bridges".

Source: L2beat

Besides the corporate interests that could potentially delay the Layer 2 decentralization process, Vitalik pointed out that there are also technical challenges and regulatory concerns. "I've even seen at least one company explicitly state that they may never want to move beyond Phase 1, not only for technical reasons related to ZK-EVM security, but also because their clients' regulatory requirements demand that they retain ultimate control," he said.

However, Vitalik did not completely abandon the concept of Layer 2, but rather further broadened his views on what Layer 2 should achieve.

“We should stop viewing Layer 2 as a ‘branded shard’ of Ethereum, and the social status and responsibilities that come with it,” he said. “Instead, we can think of Layer 2 as a complete spectrum, including chains that are fully trusted and credited by Ethereum and have a variety of unique properties (e.g., not just the EVM), as well as a variety of options with different levels of connectivity to Ethereum, which individuals (or bots) can choose whether to focus on based on their own needs.”

Regarding future development directions, Vitalik further suggested that Layer 2 projects should focus on added value rather than simply scaling in the competition. His suggested directions include: privacy-focused virtual machines, ultra-low latency serialization, non-financial applications (such as social or AI applications), application-specific execution environments, and exceeding the throughput capabilities of next-generation Layer 1.

It is also worth noting that Vitalik again mentioned ZK-EVM proofs, which can be used to extend Layer 1, a pre-compiled layer that is written into the base layer and "automatically upgrades with Ethereum".

Over the past year, the Ethereum Foundation's organizational restructuring and two network upgrades have placed Layer 1 at the forefront of its strategy. One key objective is to progressively increase the gas limit through multiple iterations, enabling L1 to handle more native transactions, asset issuance, governance, and DeFi settlements without over-reliance on L2. This year's Glamsterdam upgrade plan includes several technological improvements aimed at reducing MEV-related manipulation and abuse, stabilizing gas rates, and laying a crucial foundation for future scaling improvements.

In an earlier speech, Vitalik stated that 2026 will be a pivotal year for Ethereum to regain lost ground in terms of self-sovereignty and trustlessness. The plan includes simplifying node operation through ZK-EVM and BAL technologies, launching Helios to verify RPC data, implementing ORAM and PIR technologies to protect user privacy, developing social recovery wallets and time lock functionality to enhance fund security, and improving the on-chain UI and IPFS applications.

Vitalik emphasized that Ethereum will correct the compromises made over the past decade in terms of node operation, application decentralization, and data privacy, and refocus on its core values. Although this will be a long process, it will make the Ethereum ecosystem stronger.

Appendix: Many industry professionals have also shared their opinions on Vitalik's articles and viewpoints. Below are some key excerpts from ChainCatcher's analysis:

Wei Dai (Research Partner at 1kx):

It's good to see Vitalik discuss the hindsight error of the Rollup-centric roadmap. However, asking "If I were at the L2 level, what would I do today?" misses the point.

The key is not what Vitalik will do, but what these L2 layer and application teams will do. The L2 layer and its applications will consistently prioritize their own interests, not Ethereum's. For the L2 layer to reach Phase One or achieve maximum interoperability with Ethereum, it must be worthwhile to do so.

This issue has long been defined as a security concern (L2 layers require L1 layers to support functionality and CR). However, the most crucial question is whether Ethereum's L1 layer can provide more users and liquidity for L2 layers and applications. (I believe there's no simple solution, but efforts towards interoperability are heading in the right direction.)

Blue Fox (renowned crypto researcher):

Vitalik's point is that L2 utilizes L1, but it doesn't provide adequate value feedback or ecosystem feedback. Now, L1 can extend itself without relying on L2 for scalability. L2 either needs to maintain consistency with L1 (native rollup) or become L1.

What does this mean? It's bad news for general L2, but good news for L2 application chains, as we've consistently stated before. L2 application chains can be used in many creative ways, providing value back to the ecosystem.

Jason Chen (renowned crypto researcher):

As Ethereum itself expands, the most significant change is that its gas fees have become almost indistinguishable from those of L2 Ethereum. Gas fees are expected to continue to decrease, and with the gradual rollout of ZooKeeper, its speed will also become comparable to that of L2 Ethereum. Therefore, L2 Ethereum is currently in a very awkward position. Vitalik's tweet essentially declares that L2 Ethereum's initial historical mission of expanding Ethereum has been completed. If new narrative angles are not found for L2 Ethereum, it will become a relic of the past and be phased out.

For project teams, the biggest goal of implementing L2 is to make money from transaction fees. However, L2 has little meaning for users, since its gas and performance are not significantly different from the mainnet.

L2 was born from Ethereum and died from Ethereum, just as the conflict between the Zhou emperor and the feudal lords came to an end.

Haotian (renowned cryptography researcher):

I've mentioned this at least 10 times in previous articles: the general-purpose layer 2 strategy is no longer viable, and each layer 2 should be transformed into a specialized layer 2, which is essentially a layer 1 as well. Unexpectedly, after Vitalik Buterin guided the long-term alignment of stage 2 strategies, many layer 2s still became "discarded pawns."

Layer 2, especially general-purpose Layer 2, carries a heavy development burden. Initially, it faced the technical challenge of aligning with Ethereum's security roadmap. Later, it encountered regulatory issues related to the centralized Sequencer after token issuance. Finally, it suffered from the burden of being "falsified" due to a weak ecosystem. The root cause is that all Layer 2 initially depended on Ethereum Layer 1 for survival. However, when Ethereum found itself struggling and began to dominate the performance evolution of Layer 1, Layer 2 lost any potential to empower Ethereum, becoming nothing more than a burden and a hassle.