In short, @sparkdotfi told a story about a DeFi commercial bank (implementing monetary policy and allocating liquidity), working in tandem with its parent company @SkyEcosystem, a central bank (regulating interest rates and issuing currency), to create a powerful growth strategy. In terms of ecosystem niche, Spark is Aave's most direct competitor. Spark's advantage lies in its ability to borrow at the benchmark interest rate set by Sky, resulting in lower funding costs. Morpho or Maple are not Spark's competitors, but rather pools that handle Spark's SLL funding. Messari also discussed Spark's risk control logic, which I recommend those with savings deposits to review. It mainly involves controlling the types of collateral, multi-oracle collaboration, and institutional-grade custody. As for Spark's growth, I've already mentioned it before, so I won't repeat it here.

This article is machine translated

Show original

Messari

@MessariCrypto

02-04

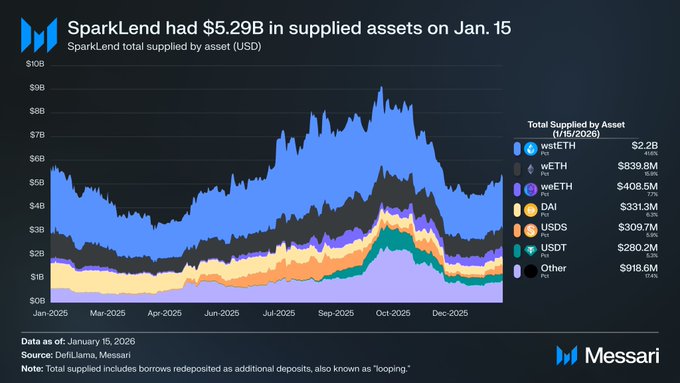

. @sparkdotfi is the leading institutional-grade, blue-chip money-market protocol in DeFi, beating out Aave V3’s Prime Market instance in market size, variety of blue-chip assets offered, and maximum leverage on a risk-adjusted basis.🔥

Our deep dive on Spark breaks down:

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content