Amazon & Google: Projected Spending on South Korean Giants (Samsung/SK Hynix) (2026F) 1. Estimated Spending Data Based on the assumption that the value of storage in the cost structure of AI servers will double, the estimated procurement scale of the two giants in 2026 is as follows: Amazon Storage Spending: $30-36 billion Google Storage Spending: $25-30 billion. Key Variable: In early 2026, due to an extreme shortage of HBM capacity, procurement executives from Amazon and Google were reportedly "renting hotels in South Korea" to seek 3-5 year long-term supply agreements (LTAs), which could lead to actual spending exceeding the budget. 2. Segment Breakdown SK Hynix: The Absolute Beneficiary of AI Premium Google's Logic: Google's TPU v7 architecture has extremely high bandwidth requirements for HBM. Hynix, as the primary supplier of HBM3E, accounts for over 60% of the storage demand for Google's AI accelerator. Amazon's logic: Amazon's Trainium 2 chips are ramping up production, and Hynix has customized a dedicated HBM for them. Profit quality: Hynix raised its HBM3E price by 20% in January 2026, and both giants accepted almost the entire increase to "maintain volume." Samsung: All-round complement and NAND dominance NAND/SSD demand: A large portion of Amazon's $200 billion spending is for data center expansion. Samsung's dominance in the enterprise-grade SSD (eSSD) field is irreplaceable, and it is expected to secure over 50% of the flash memory orders from both companies. HBM catching up: Although Samsung is slightly slower than Hynix in HBM3E progress, its huge production capacity reserves have made it a backup supplier for both giants during the "general-purpose DRAM (DDR5)" shortage. 3. Supply Chain Game: The Strategic Shift in 2026 From "Buy-on-Demand" to "Long-Term Leasing for Supplies": In previous years, storage was a cyclical commodity, and giants tended to drive down prices. However, in 2026, due to HBMs crowding out general-purpose DRAM capacity, traditional server memory prices surged (Q1 prices rose 60%-70% in a single quarter). The Strategic Shift: Of Amazon's $200 billion in spending, the funds originally allocated to storage may face an overspending shortfall of over $5 billion. This portion of profits will directly flow from Amazon's financial statements to SK Hynix and Samsung. The Impact of Self-Developed Chips: Google and Amazon are both increasing their investment in self-developed ASICs (TPU/Trainium). This means their requirements for storage are no longer "standardized" but "customized." Through this deep integration, SK Hynix is transforming from a "supplier" into a "co-developer." 4. Summary: The Logical Basis for Bullish/Bearish Views Bullish on Storage (Samsung/SK Hynix): The combined Capex of 380 billion won from these giants provides strong support for the storage industry. As long as the AI arms race continues, storage chips will remain the hardest currency. Bearish on Expenditure (Amazon/Google): Such massive chip spending means that these two giants will face significant pressure on their gross margins in 2026. A surge in depreciation expenses could lead to a sequential decline in their GAAP profits in the second half of the year. Conclusion: In 2026, Amazon and Google will contribute approximately $50-65 billion in revenue to these two South Korean giants. The above is Gemini's conclusion on AI. I personally favor SK Hynix and Samsung, but also Google, and not Amazon. Google's closed-loop business model between its AI and servers, as well as its existing products, creates an AI flywheel.

This article is machine translated

Show original

川沐|Trumoo

@xiaomucrypto

02-06

亚马逊 (AMZN) 2025 Q4 及 2026 战略财报深度分析,26年支出指引远超谷歌达到了2000亿美金,管理层还称无上限.

一、 核心财务快报 (The Numbers)

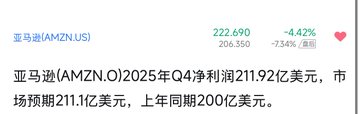

1.营收 (Revenue): $2,114 亿(2025 Q4),同比增 13%。

2.净利润 (Net Income): 季度净利突破 $210 亿,大幅超过去年同期。

3.预期差 (The Beat):

Sector:

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share