The cryptocurrency market is experiencing one of its worst trading days in history, with double-digit drops for Bitcoin and even top altcoins.

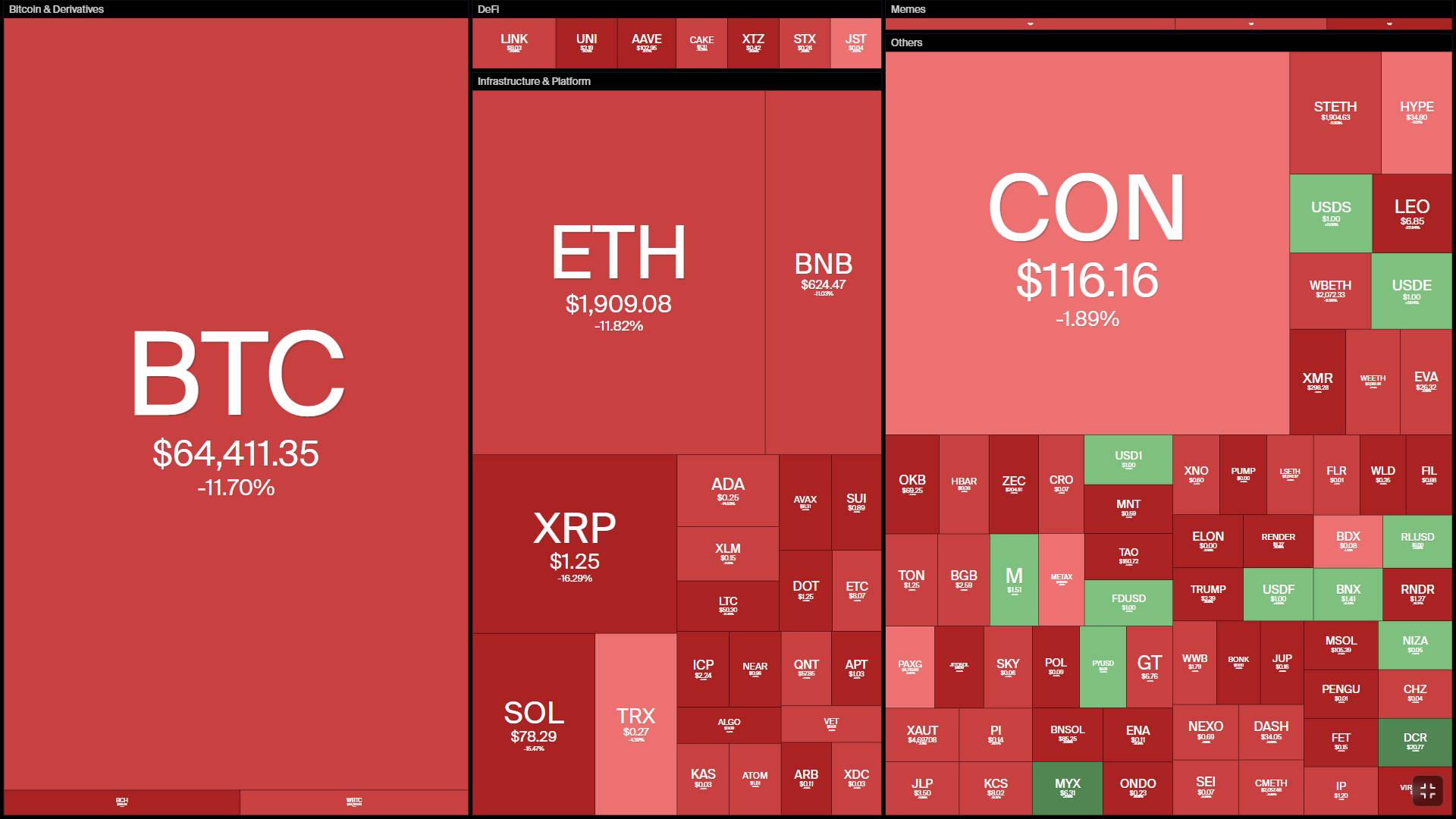

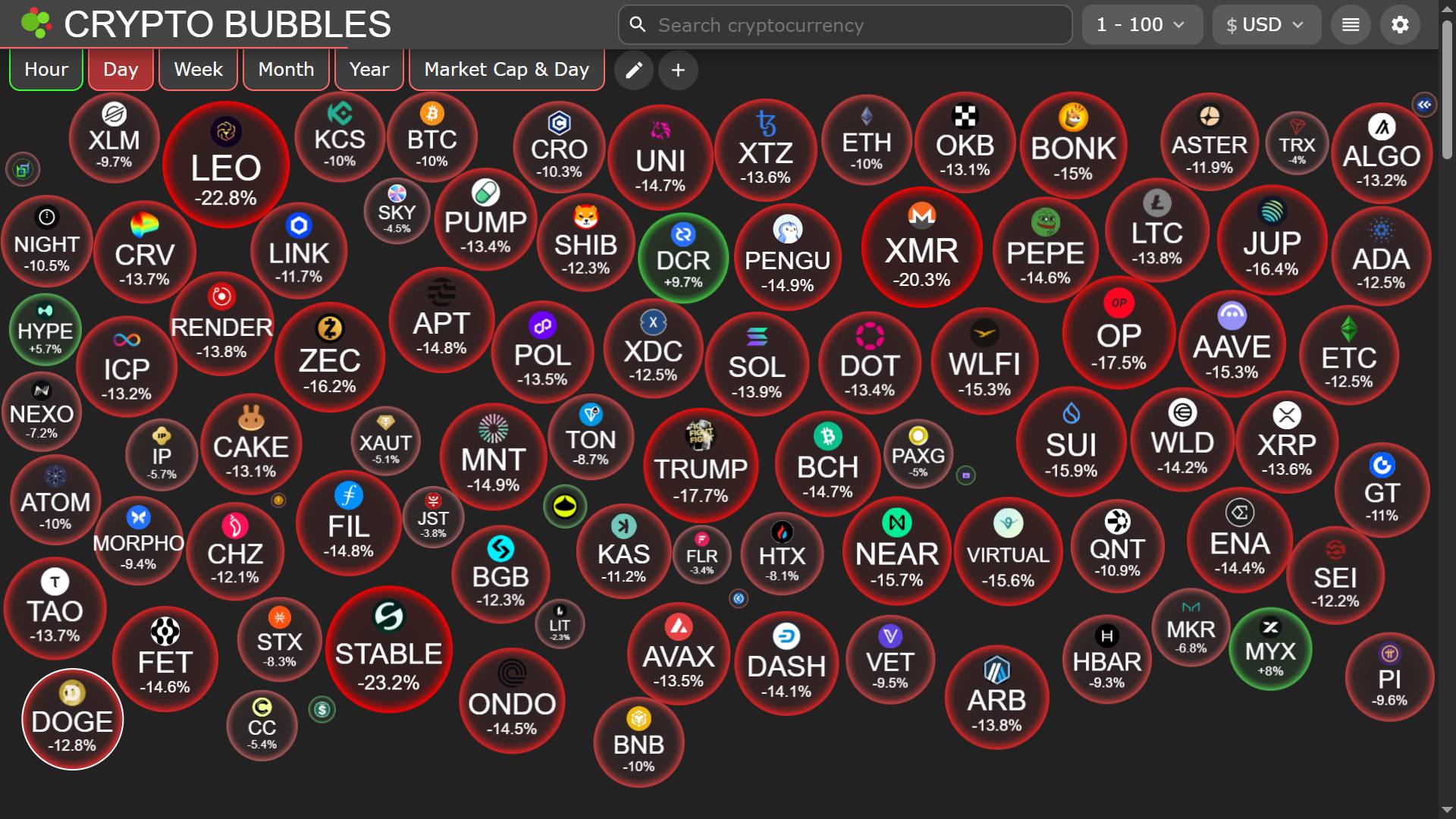

Fluctuations of top cryptocurrencies at 8:40 AM on February 6, 2026

Fluctuations of top cryptocurrencies at 8:40 AM on February 6, 2026

As of the morning of February 6, 2026, the crypto market was still awash in red as the 12-hour sell-off showed no signs of stopping.

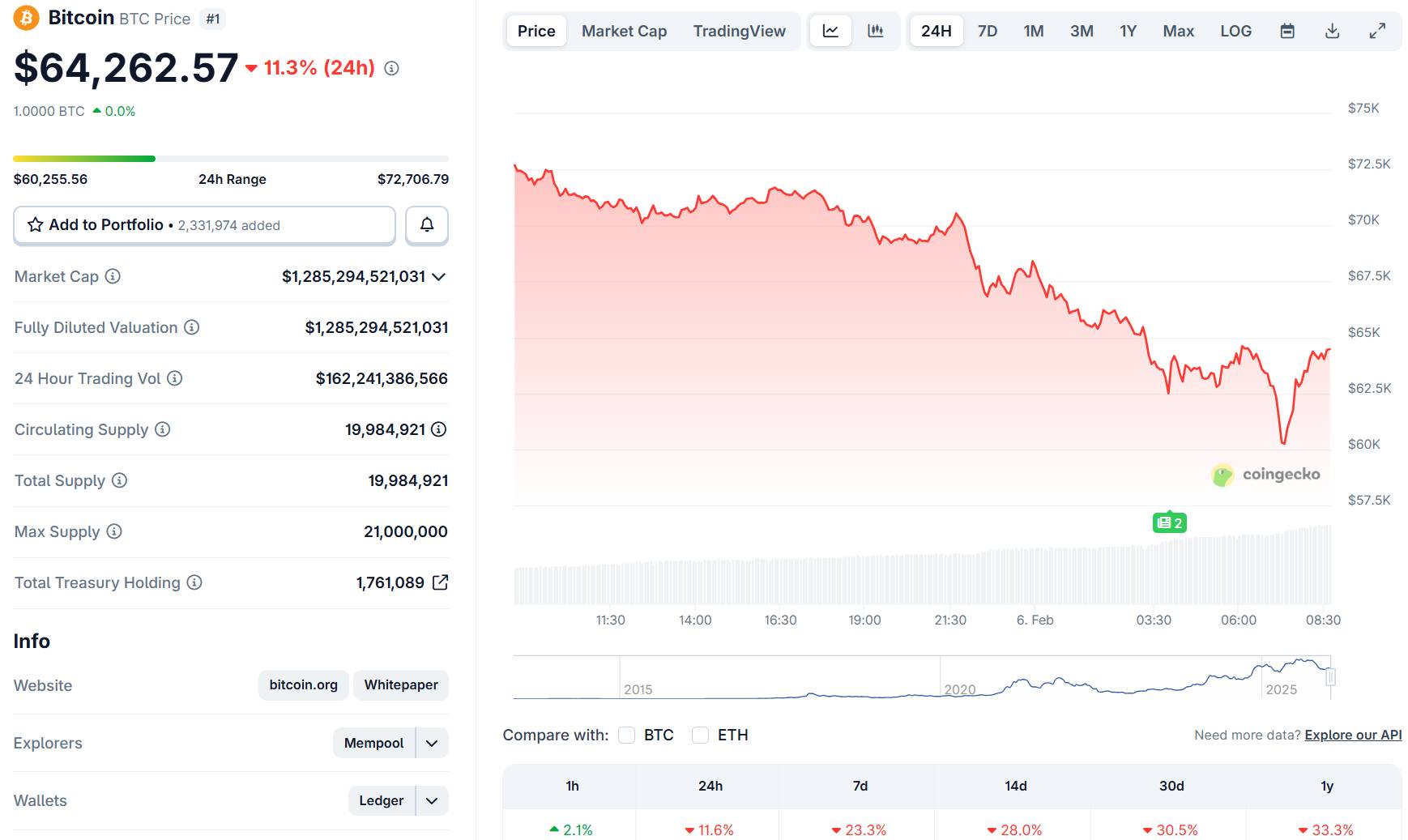

On many exchanges, the price of Bitcoin (BTC) at one point plummeted to as low as $60,000 or even lower, marking a 24-hour drop of over 16%. This was one of the worst trading days in the history of the world's largest cryptocurrency, second only to the dark days of the FTX crash in 2022 .

Bitcoin price fluctuations over the past 24 hours, screenshot from CoinGecko at 08:40 AM on February 6, 2026.

Bitcoin price fluctuations over the past 24 hours, screenshot from CoinGecko at 08:40 AM on February 6, 2026.

This also marks a new Dip for Bitcoin in 2026 and the lowest price since September 2024 – wiping out the gains made before Donald Trump's election as US President, with his promise to boost the crypto industry in the United States. From its all-time high of over $124,000 in October 2025, Bitcoin has fallen by more than 50% in less than five months.

At the time of writing, BTC is temporarily recovering to the $64,500 region, but there is still no guarantee that the upward trend will continue from here.

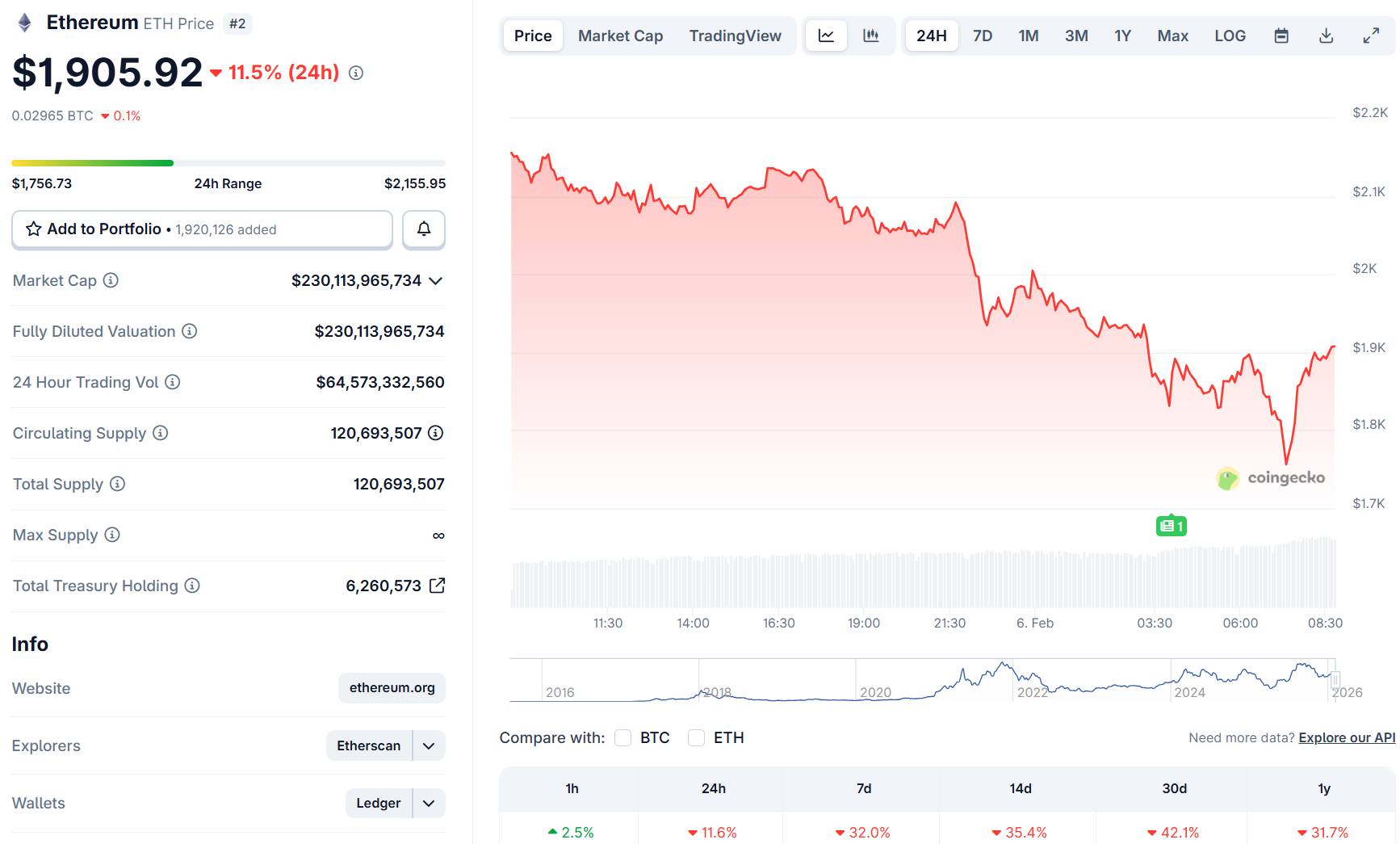

Meanwhile, many altcoins are also experiencing sharp sell-offs. Ethereum (ETH) has also fallen by more than 14% in the past day, dropping below $1,800.

Ethereum price fluctuations over the past 24 hours, screenshot from CoinGecko at 08:40 AM on February 6, 2026.

Ethereum price fluctuations over the past 24 hours, screenshot from CoinGecko at 08:40 AM on February 6, 2026.

ETH is facing significant pressure from whale Dump , and this is causing resentment within the community after co-founder Vitalik Buterin recently unexpectedly changed his stance on scaling through layer-2, arguing that Ethereum's layer-1 has already solved the blockchain triad , while layer-2s have yet to find a purpose.

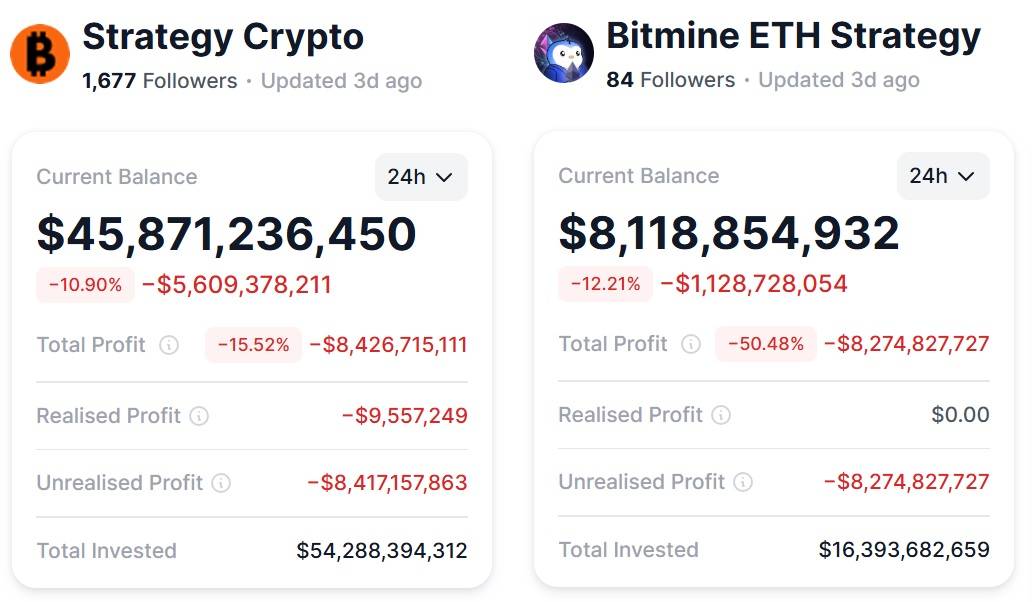

According to DropTabs, Strategy and BitMine's BTC and ETH portfolios – leading digital asset treasury strategies – are currently recording losses of $5.7 billion and $1 billion respectively in just the past day, as the prices of these two cryptocurrencies fell further below DCA prices.

Portfolio performance of Strategy and BitMine. Source: DropTabs (06/02/2026)

Portfolio performance of Strategy and BitMine. Source: DropTabs (06/02/2026)

During the 2020-2023 period, Strategy experienced significant losses due to Bitcoin's sharp decline, with BTC prices falling 22% below the DCA threshold. However, the company decided to maintain its long-term position and not sell. Currently, a 22% drop from the DCA would be approximately $58,000, but with the treasury now many times larger than before, it's uncertain whether Strategy will continue to maintain its investment philosophy given the significant changes in market conditions.

Solana (SOL) dropped by more than 25% to below $70 – a price not seen since December 2023. BNB fell nearly 20% to $570, with similar drops to other major cryptocurrencies like Sui, ZEC, APT, AAVE, NEAR, etc.

Fluctuations of top altcoins on the morning of February 6, 2025. Source: CryptoBubbles

Fluctuations of top altcoins on the morning of February 6, 2025. Source: CryptoBubbles

Crypto market Capital was wiped out by more than $280 billion yesterday, now standing at just $2.2 trillion – also the lowest since September 2024 – before the surge fueled by Trump's election victory.

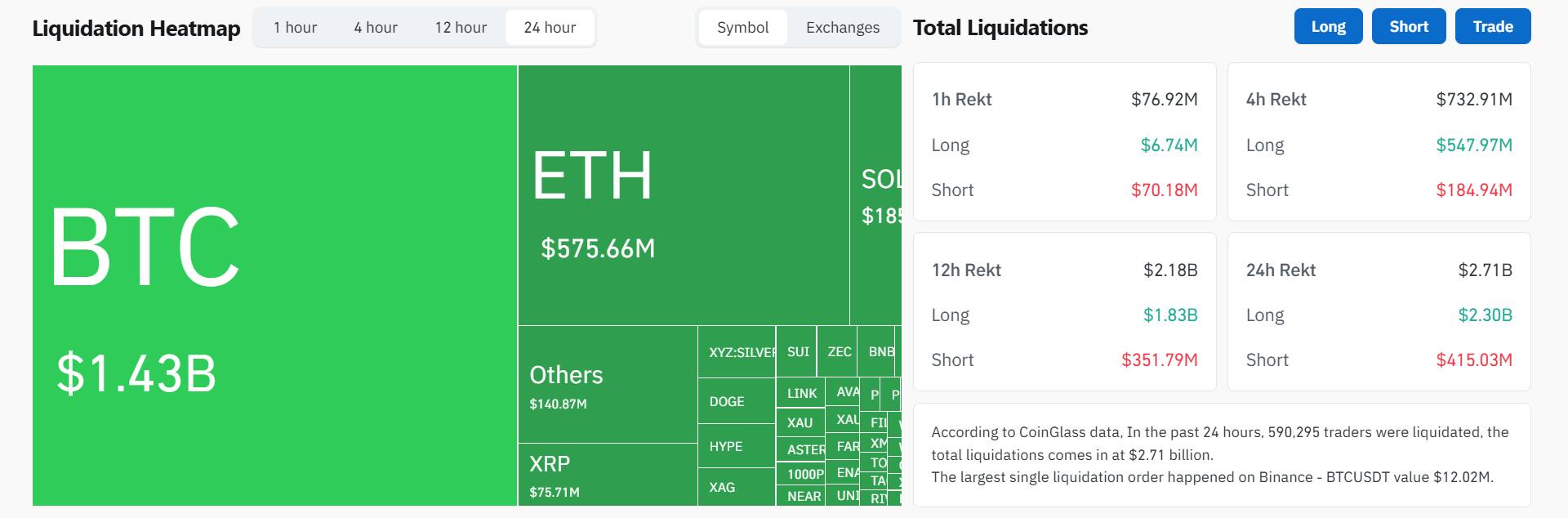

Total Derivative orders in the past 24 hours reached over $2.7 billion, with Longing positions accounting for 85%.

Liquidation data on the crypto Derivative market, screenshot from CoinGlass at 08:50 AM on February 6, 2026.

Liquidation data on the crypto Derivative market, screenshot from CoinGlass at 08:50 AM on February 6, 2026.

The Greed and Fear Index fell to 9 this morning – something that hasn't happened since June 2022, the days following the LUNA-UST crash and the liquidation crisis affecting major players in the industry at that time.

Bitcoin Fear and Greed Index is 9 - Extreme Fear

— Bitcoin Fear and Greed Index (@BitcoinFear) February 6, 2026

Current price: $61,665 pic.twitter.com/u9z4d5JIoE

Coin68 compilation