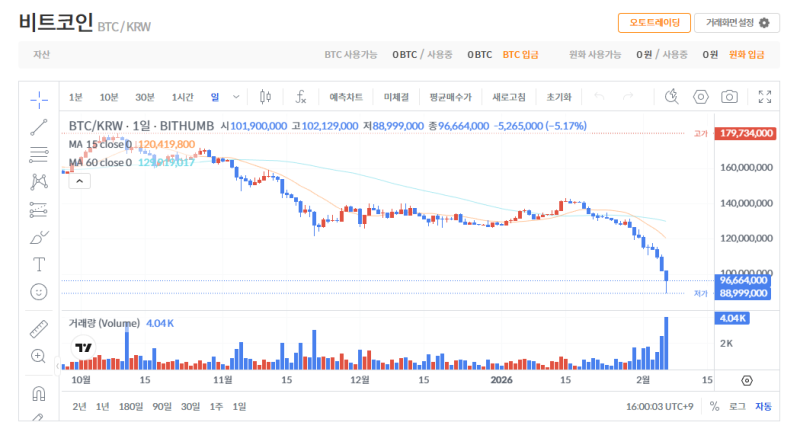

Bitcoin plunges 17.8% on shocking jobs data, breaking below $65,000.

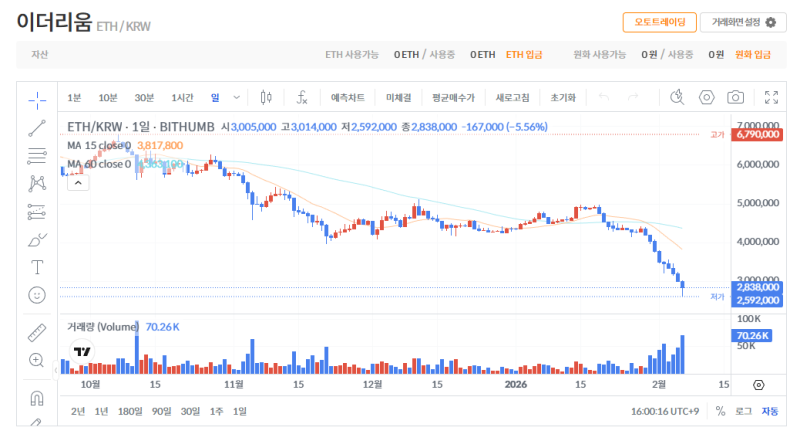

ETH falls to the low $1,900s amid increased volatility.

XRP plunges 25% in one day as investor sentiment plummets.

Bitcoin (BTC) plunged 17.8% from its previous high following the release of the employment report, fueled by a sharp increase in risk aversion. As of 4:00 PM today, the 6th, Bitcoin was trading at $65,100, with volatility significantly increasing as key support levels collapsed in a short period of time. Tether dominance rose to 8.38% at the same time, suggesting a shift in funds toward safe-haven stablecoins.

Ethereum (ETH) also failed to avoid the impact of Bitcoin's weakness. Ethereum fell approximately 19% over the day, trading at $1,915 as of 4 p.m. The rapid breach of what was perceived as a mid- to long-term support level opens the door to further volatility in the short term.

XRP suffered the largest decline among the three. Amidst risk-aversion, selling pressure concentrated, causing it to plummet by approximately 25% in one day and was trading at around $1.30 as of 4 p.m. Investor sentiment is rapidly weakening, and the cryptocurrency is continuing to test its technical support level.

This paper analyzes the recent plunge in the virtual asset market as a result of the accelerated global risk aversion following the shock of the US employment data. Given that Tether dominance has settled in the 8% range, even if a short-term rebound occurs, a reversal in the trend will likely require at least a dominance drop below 8%, leading to a recovery in risk-on sentiment.

The current market has entered a volatile phase following a sharp price adjustment. In the short term, it is more likely that the volatile market will continue with the sale of items by price range rather than a further plunge.

Reporter Jeong Ha-yeon yomwork8824@blockstreet.co.kr