Recently, the cryptocurrency market has once again entered a period of deep adjustment. According to the latest data from HTX, the price of Bitcoin (BTC) has plummeted to the $60,000 mark, a new low since November 2024, with the entire market entering a downward cycle and industry sentiment remaining low. However, amidst this overall market pressure, key data from the TRON ecosystem demonstrates significant resilience and growth: on-chain USDT issuance has surpassed $83.4 billion, continuously breaking historical records; and TRON network revenue has maintained a growth trend, reaching $216 million in January 2026, a month-on-month increase of approximately 4%, showcasing the ecosystem's unique resilience and vitality.

The core projects within the TRON ecosystem continue to see positive developments. Among them, the second round of large-scale buyback and burn operations completed by JustLend DAO, the core DeFi platform of the ecosystem, on January 15th is particularly noteworthy. This round burned a total of 525 million JST, accounting for 5.3% of the total token supply, with an actual investment of over $21 million.

Amidst a challenging backdrop of gloomy market sentiment, sluggish trading, and persistently low trading activity, JustLend DAO resolutely invested tens of millions of dollars to advance the burning and deflation of JST. This move stands in stark contrast to the overall weakness of the market, becoming an important value anchor in the face of adversity.

Of particular note is that, amidst the current overall market downturn, the market price of JST tokens has remained relatively stable, and its price movement has not completely followed the market's large fluctuations. This independence directly reflects the market's recognition of its intrinsic value.

With over 1.08 billion tokens burned and approximately $38.7 million invested, JustLend DAO uses real money to anchor the deflationary certainty of JST.

Since the JustLend DAO community officially approved the JST buyback and burn mechanism proposal in October 2025, the project has progressed efficiently. In just three months, it completed two large-scale on-chain buyback and burn operations, burning a total of over 1.08 billion JST (specifically 1,084,890,753), representing 10.96% of the total token supply, corresponding to a cumulative investment of over $38.72 million. This substantial financial investment and efficient implementation have solidified the deflationary certainty of JST, demonstrating the project's firm commitment to a long-term deflationary mechanism.

The successful implementation of two rounds of large-scale buybacks and burns has resulted in a rigid contraction of the JST circulating supply, significantly reducing the total token supply from 9.9 billion to approximately 8.815 billion. Such a massive scale of deflation and the substantial investment of real money are rare in the history of the crypto industry, directly demonstrating JustLend DAO's strong financial resources and efficient deflationary execution.

According to the previously released buyback and burn announcement, the funds for JST buyback and burn primarily come from two core sources: first, the existing revenue and future net income generated by the JustLend DAO protocol; and second, the excess portion exceeding $10 million in revenue from the USDD multi-chain ecosystem. Currently, because the revenue related to the USDD multi-chain ecosystem has not yet reached the established standard, the funds for JST buyback and burn are currently fully supported by the JustLend DAO protocol.

This funding arrangement fully demonstrates that the JST buyback and burn mechanism is deeply rooted in the real ecosystem benefits of JustLend DAO. Therefore, the JST buyback and burn mechanism is not a short-term marketing stunt, but a normalized, long-term value-enhancing plan anchored to the protocol's continuous benefits and written into the underlying mechanism. It establishes a clear and stable long-term deflationary closed loop for JST: "Real yield → Driving token buybacks → Deflation enhances value → Feeding back into ecosystem development," providing solid support for the long-term stable development of JST from a mechanism perspective.

As KOL OxPink stated, JST's core logic of buyback and burn is highly consistent with the "profit buyback of shares" in the traditional financial market. It directly empowers the token value through secondary market buybacks and permanent burns, allowing the benefits of ecosystem development to truly benefit token holders.

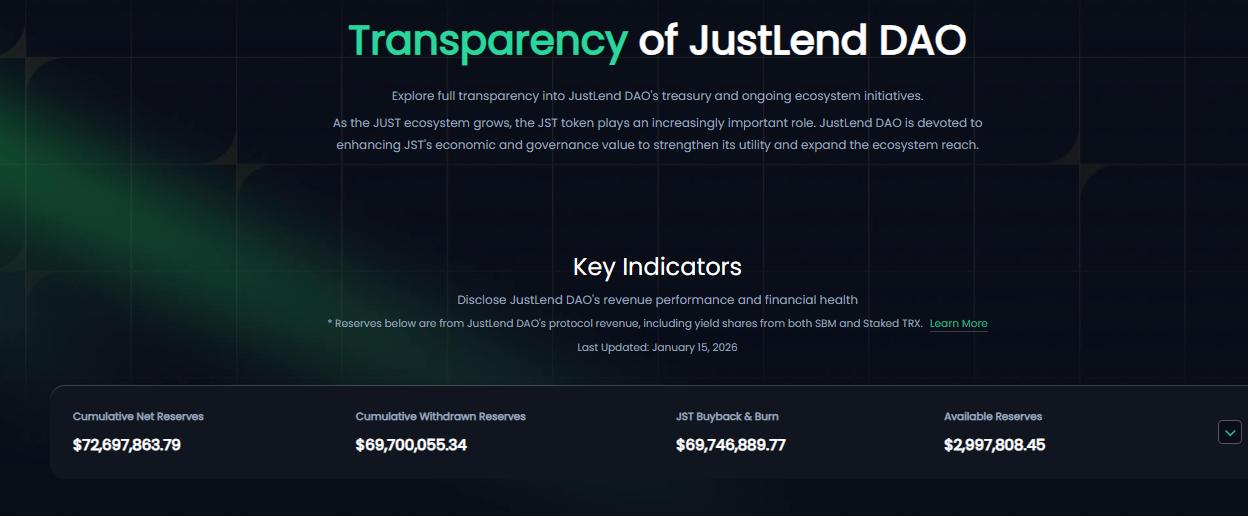

It is particularly worth mentioning that all JST buyback and burn operations are completed on-chain, and every transaction record can be tracked and publicly queried throughout the entire process. Currently, users can view the progress of the buyback and burn, details of funds to be burned, and other core data in real time through the Grants DAO section of the JustLend DAO official website or the dedicated Transparency page, truly achieving full transparency throughout the entire process.

As of February 4, 2026, JustLend DAO still held approximately $31.02 million in outstanding earnings awaiting burn. These funds will be gradually invested in JST buybacks and burns in subsequent quarters, providing a stable financial impetus for the normalization and sustainable advancement of the deflationary mechanism and ensuring the continued release of JST's deflationary effect.

JustLend DAO's diversified business has forged strong profitability, providing solid support for JST's buyback and burn program.

As the core funding provider for JST buyback and burn, and a core financial infrastructure of the TRON ecosystem, JustLend DAO consistently focuses on real-world market needs, building a comprehensive DeFi solution integrating numerous functions such as lending (SBM), liquidity staking (sTRX), energy rental, and the smart wallet GasFree. This diversified and mature business layout not only generates stable, real, and continuous protocol returns for JustLend DAO, ensuring healthy cash flow growth, but also provides a continuous and sustainable source of funding for the JST buyback and burn mechanism, and fundamentally supports the long-term deflationary value of JST.

JustLend DAO's strong profitability is the foundation for the long-term operation of the JST buyback and burn mechanism. This was directly verified in the second round of burns executed on January 15, 2026: a total of $21 million was invested in this round, of which $10.34 million of existing revenue was executed as planned, and the remaining funds came from the net income newly generated by the agreement in the fourth quarter of 2025. This means that JustLend DAO's net income in the fourth quarter of 2025 exceeded $10 million, fully demonstrating its strong and sustainable profitability.

Solid returns stem from a robust and growing business foundation. JustLend DAO's overall operational scale has steadily increased, with key metrics showing impressive performance: JustLend DAO's total value locked (TVL) has consistently remained above $6 billion, consistently ranking among the top three in the global lending sector. According to its financial operations transparency page, JustLend DAO's cumulative net income has reached $72.69 million. Since the JST buyback and burn mechanism was approved last October, nearly $69.7 million in reserve income has been withdrawn in the past three months, leaving nearly $3 million in net income remaining.

Based on its consistently strong revenue performance, JST, in its Q4 2025 report released on January 28, projected that it will invest approximately $21 million in buybacks and burns in Q1 2026, with the sTRX business expected to contribute $10 million in revenue. The specific burn amount will be dynamically adjusted based on actual operating conditions in each quarter. This provides the market with a clear and verifiable expectation, demonstrating the sustainability and reliability of the deflationary logic of "real business generating revenue—revenue driving buybacks—buybacks enhancing value."

In addition to JustLend DAO as its core support, the decentralized stablecoin USDD ecosystem, as an important source of incremental funds for future JST buybacks and burns, is maintaining a rapid growth trend: the total supply of USDD has now exceeded $1 billion, with cumulative treasury revenue reaching $7.4678 million.

It is evident that by building a solid business ecosystem based on a diversified and high-growth core business matrix and constructing strong profitability through continuous and stable protocol profits, JustLend DAO has deeply internalized the JST buyback and burn mechanism into a long-term token value growth mechanism supported by real yield, guaranteed by clear mechanisms, and with a predictable implementation schedule. This has achieved a deep integration of deflationary operations and ecosystem development, and synchronous growth of token value and protocol profits.

The market performance of the JST token directly demonstrates the effectiveness of its ecosystem development. Amidst the current significant downturn in the crypto market and widespread deep corrections in mainstream cryptocurrencies, JST's price has exhibited relative stability and resilience far exceeding the market average, avoiding sharp fluctuations and instead demonstrating a strong independent trend. According to the latest Coingecko data on February 4th, since the market crash began on January 30th, mainstream cryptocurrencies have suffered severe short-term declines: BTC has fallen by 15% in the past 7 days, while ETH and SOL have fallen by more than 25%. In contrast, JST has only experienced a slight decline of less than 1% during the same period, and even rose against the trend at times. This decoupling from the broader market is particularly striking in a weak market, directly reflecting the uniqueness and resilience of its value support.

Looking back at the execution trajectory of JST's deflationary mechanism, its "value growth logic" has been clearly validated by the market—each large-scale buyback and burn directly drives a steady rise in token prices, forming a significant "deflationary benefit effect."

- First driving force (October-December 2025) : After the JST buyback and burn proposal was officially passed on October 21, 2025, market expectations were quickly realized, and the price of JST began a sustained upward trend from 0.032 USDT, climbing to a high of 0.045 USDT on December 3 of the same year, with a short-term cumulative increase of about 40%.

- Second boost (January 2026) : After the second round of large-scale buyback and burn was implemented on January 15, 2026, the price of JST rose again, from 0.040 USDT to 0.047 USDT on January 27, an increase of about 17% in half a month.

The positive market response is not only an endorsement of the deflationary model itself, but also a firm belief in the long-term development logic of "business growth driving value return".

In fact, JustLend DAO's continuous and transparent buyback and burn operations based on real protocol revenue have built a core value foundation for JST that is different from simply being driven by market sentiment. JST's stable performance during market downturns is the most powerful validation of the deflationary model of "business generates revenue - revenue drives buyback - buyback enhances value" and the long-term development logic of the ecosystem behind it.

The TRON ecosystem continues to grow, and JustLend DAO is building its ecosystem to weather market cycles over the long term.

The deflationary logic built upon JST's buyback and burn mechanism, by deeply binding real yield ecosystem returns to token value, is essentially a model of DeFi protocols returning to their business essence and creating a sustainable value model. As market cycles change, when the tide recedes, projects relying on short-term speculation and lacking a solid ecosystem foundation will ultimately fail in the industry's turbulent waters. Only those who cultivate their ecosystem and commit to long-term development will stand firm and become the leading force guiding the next round of industry growth. JustLend DAO is precisely the core practitioner of this development logic.

Colin Wu, founder of the well-known media outlet Wu Blockchain, previously pointed out that most projects in the crypto industry lack value return mechanisms such as dividends and buybacks similar to those in traditional finance. Typically, projects without real revenue can only rely on selling tokens to maintain operations, while projects with revenue mostly allocate profits to the team, with very few cases of truly returning profits to token holders. Therefore, high-quality crypto projects not only need the ability to generate real revenue but also need to write the rules for empowering tokens with revenue into their code and smart contracts. This is the true token model with long-term value.

JST's buyback and burn mechanism is undoubtedly a vivid example of this philosophy and an industry benchmark. JustLend DAO has invested tens of millions of dollars to steadily and systematically advance the JST buyback program, which is strong evidence of its deep commitment to the ecosystem and the construction of a long-term value capture mechanism. By deeply linking the value of the JST token with the real development and profitability of core protocols such as JustLend DAO and USDD, the ecosystem's development path is highly aligned with the interests of JST holders. More importantly, the entire process is built on complete transparency: from clear funding sources and fully verifiable on-chain operations to sustainable profit reserves, it has become a long-term value practice based on real yield, guaranteed by a transparent mechanism, and centered on continuous execution.

Meanwhile, the TRON ecosystem, the parent company of JustLend DAO, continues to accelerate across the board, growing against the trend during the industry downturn, with its ecosystem momentum continuing to rise: the issuance of USDT on-chain continues to break historical records; in January 2026, the total revenue of the TRON network reached a new high, and the strong growth data fully demonstrates the resilience and vitality of the overall ecosystem development.

In terms of ecosystem building and network interoperability, TRON continues to expand its ecosystem boundaries and introduce new traffic: On January 15, MetaMask wallet, the world's largest wallet in terms of user base, announced its official access to the TRON network, opening up a new core traffic entry point for the on-chain ecosystem; On January 26, the cross-chain protocol WalletConnect completed its support for the TRON network, significantly improving the ecosystem's interconnectivity, introducing more incremental resources to the ecosystem, and bringing long-term development momentum to core protocols such as JustLend DAO.

In addition to the strong support of the TRON ecosystem, JustLend DAO has weathered multiple market cycles, maintaining a record of zero security incidents and demonstrating its robust resilience. During this market downturn, JustLend DAO has invested heavily in JST buyback and burn initiatives, showcasing the protocol's core strength and its unwavering commitment to long-term development.

Leveraging the deep foundation of the TRON ecosystem and its continuous product innovation, JustLend DAO has not only built a value foundation for JST that transcends economic cycles by deeply linking protocol returns with token value, but has also defined a new paradigm of long-termism in the DeFi field through concrete actions. When the tide recedes, such builders will become the key force determining the next chapter of the industry.