the onchain lending market is grossly underrated.

funny thing is that, it recently broke an ATH of $58B TVL, and no one is talking about it.

let's talk about how $SUMR is positioned to capture about 1-5% of onchain lending's growth:

Summer.fi

@summerfinance_

02-04

If you looked at $SUMR and thought, 'oh, look another governance token'

You missed the point entirely.

$SUMR is a bet on the growth of onchain lending infrastructure - with real revenue distribution. Strap in. Here's the breakdown.

With @Morpho and @eulerfinance already leading with remarkable growth, @summerfinance_ is fast-emerging with huge prospects.

Firstly, Lazy Summer charges ~0.66% on vault deposits, which is pretty cool, given its mechanics.

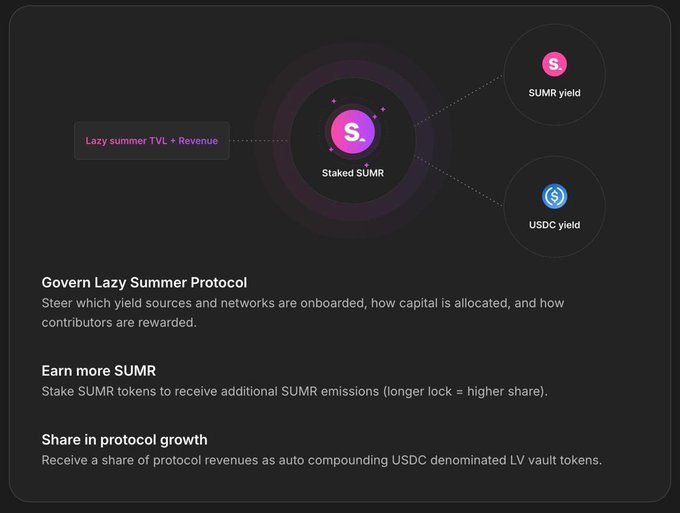

On top of that, 20% of its revenue flows directly to SUMR stakers as $USDC. Stakers eat double; SUMR yield and USDC yield.

Lastly, $SUMR is an indirect play on the performance of the entire curated DeFi lending ecosystem.

As 2026 is set to become a years of vaults and given the uniqueness of Lazy Summer's onchain vaults, which provides automated access to DeFi's highest quality yield, it only gets better from here.

At this pace, SUMR seems currently undervalued.

A bet on onchain, is a bet on SUMR. It's a no-bariner, imo.

It's a wrap!

NB: nothing here is financial advice, I'm holding some SUMR

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content