Written by: Shi Xingguo

I. Prologue: The Collapse of Consensus and the Turning of the "Beacon"

Blockchain is never short of news, but even more explosive than the recent Bitcoin crash was Vitalik's brief statement, which resonated at the start of Rollups, adding a tragic footnote to this technological journey that has spanned five years.

In February 2026, Vitalik Buterin published a series of strongly worded reflections on social media platforms and Ethereum research forums, undoubtedly a bombshell dropped into the deep waters of the industry. This triggered a widespread public outcry over a "scaling roadmap earthquake." He pointed out that the current L2 ecosystem is more like a collection of isolated islands pieced together with fragile bridges, rather than an organic component of the Ethereum system. These remarks, in effect, publicly acknowledged and deeply analyzed the serious limitations of the "Rollup-centric" scaling solution established since 2020 at the technical level.

Looking back to 2020, when Vitalik published "An Ethereum Roadmap Centered on Rollups," the consensus across the ecosystem was to position the Ethereum mainnet as a security and settlement layer, while outsourcing all execution functions to Rollups. However, five years later, Vitalik himself has overturned this vision, stating that the original idea of considering L2 as the "orthodox solution" for Ethereum scaling is no longer valid.

He made a highly damaging accusation: "If you create an EVM that processes 10,000 transactions per second, but its connection to L1 is only achieved through a multi-signature bridge, then you are operating nothing more than a centralized database disguised as a blockchain." This argument directly hits the Achilles' heel of current mainstream L2 blockchains: even with high throughput, if its security inheritance mechanism remains at the level of "trusting a committee controlled by a few people," then it cannot uphold Ethereum's promise of decentralization. This directly strips away the glamorous facade of the Rollups approach, revealing that many Rollups are essentially still equivalent to off-chain processing or sidechains in disguise.

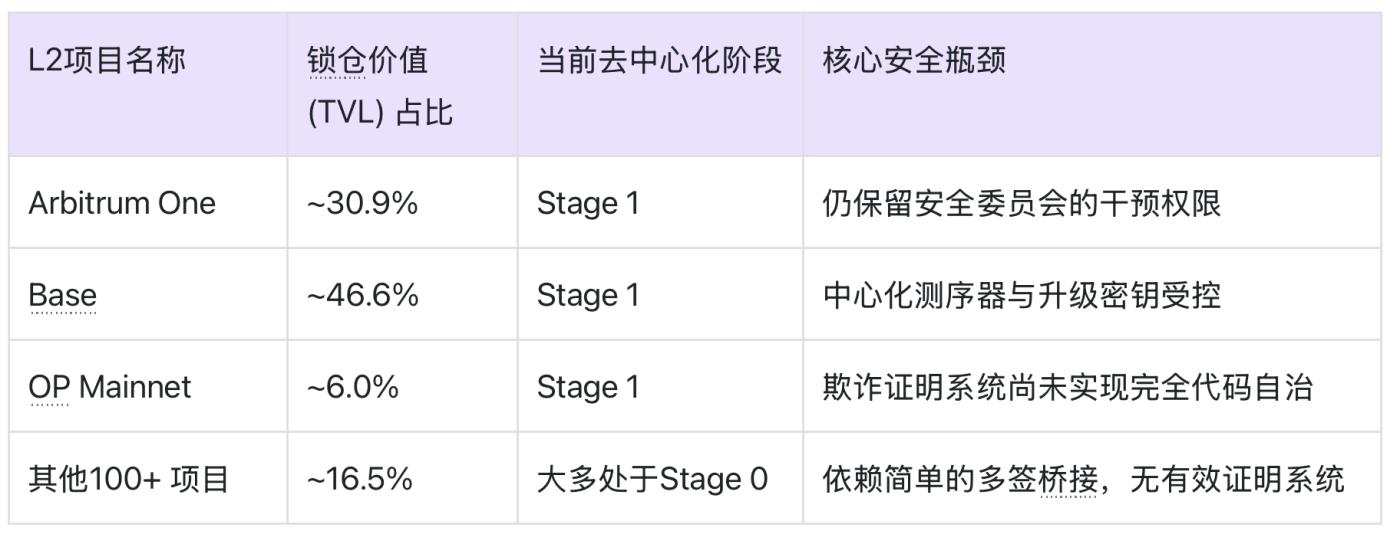

Vitalik Buterin once envisioned a promising, step-by-step evolution for Rollups. In his 2022 maturity framework, he argued that a true Rollup should progress from Stage 0 (fully centralized) to Stage 2 (fully decentralized). However, reality has been harsh. As of early 2026, data from L2 BEAT shows that the vast majority of active L2 platforms remain at Stage 0 or Stage 1, some even sinking deeper into centralized "auxiliary wheels."

II. Looking Back: The "Survival Philosophy" and Limitations of the Patch Era

Rewind to 2020, a time filled with anxiety. Faced with a congested mainnet and exorbitant gas fees, the Ethereum community made a difficult strategic decision: to establish a "Rollup-centric" roadmap.

At the time, this was undoubtedly a rational "survival philosophy." If a complex engineering restructuring were carried out on the underlying L1 architecture, it would have far-reaching consequences. The community opted for a more pragmatic "outsourcing" strategy—moving the complex computations off-chain (Layer 2) and only sending the final results back to the chain for settlement.

This is similar to a bank opening numerous "franchise branches" to alleviate the workload of its head office. While these branches can process transactions quickly, the final reconciliation of accounts and clearing of funds still have to return to the head office, the sole point of contact.

This "patching" approach to survival, while temporarily alleviating performance anxiety, brings limitations that users can personally experience:

First, there's the fragmented experience. Users are forced to "hop between islands" between different L2 blockchains, and their assets are fragmented by cross-chain bridges. Moving from chain A to chain B is as troublesome as going abroad, requiring not only paying exorbitant "visa fees" (cross-chain transaction fees) but also enduring long wait times.

Secondly, there's the issue of eroded trust. In pursuit of efficiency, the ecosystem has had to tolerate a decline in the decentralization of L2. This "get on the train first, pay the ticket later" mentality has resulted in the vast majority of L2 systems still relying on multi-signature wallet governance in their rudimentary stage. Users may think they're using blockchain technology, but in reality, they may only be using a ledger system controlled by a small group of people.

The most fundamental limitation lies in the bottleneck of physical performance. No matter how Rollup is optimized, it is still operating on a one-way street (serial blockchain). When hundreds of L2s simultaneously submit data to L1, congestion simply shifts from on-chain to the interface between off-chain and on-chain. This architecture is destined to be unable to support the real-time high concurrency required for large-scale Web3 applications in the future.

This is a typical example of technological debt. The efficiency of centralized systems and off-chain processing are traded for temporary smoothness, but this debt must eventually be repaid.

III. In-depth analysis: Why can't upper-layer expansion repair the underlying slab compaction?

On the surface, Rollups appear to be a helpless consequence of a "survival philosophy," but the decisive underlying factor is the cold reality of physical laws. Why did L2 fail to achieve its initial scaling goals and instead cause unprecedented fragmentation of the Ethereum ecosystem? Because Rollups attempt to use software-level stacking to mask flaws in the system architecture.

The "one-way street" dilemma of serial execution: Whether it's L1 or L2, the underlying DNA of mainstream blockchains is still "sequential processing." This is like a one-way street; no matter how many overpasses (L2) you build on it, as long as the final exit (state update) is unique, congestion is inevitable.

Rollups are essentially "compressors." They do compress one hundred transactions into one, but this only reduces the data volume at the logical layer; it doesn't change the "queuing" rules at the physical layer. When on-chain activity surges, L2 still has to compete for the limited block space of L1. This architecture is inherently unsuitable for high-frequency finance or AI agents that require millisecond-level response times. More importantly, the future Web3 world involves not only transfers but also massive real-time state synchronization, which L2 simply cannot support.

The biggest side effect of the interoperability "island tax" of L2 is that it has fragmented the originally unified Ethereum liquidity into dozens of isolated islands that are not interconnected. This fragmentation is not only a problem in terms of user experience, but also in terms of economics.

The most typical example is the "seven-day challenge period" of Optimistic Rollups. For security reasons, users have to wait a full seven days to withdraw funds from L2 back to L1. This is unimaginable in traditional finance—it's equivalent to a transfer taking T+7 to arrive. The cross-chain bridges and liquidity aggregators that have emerged from this are essentially levying a "fragmented business tax" on users. In our pursuit of scalability, we have sacrificed the most valuable feature of Web3: atomic composability.

The "involution" of business models: Under modular architecture, profits are fragmented too much, making collaboration extremely difficult. The closure of shared sequencers (such as Astria) is a microcosm: large projects are unwilling to share MEV profits, while small projects cannot afford infrastructure costs. As a result, everyone is reinventing the wheel, building closed "local area networks" instead of jointly constructing an open "wide area network."

The conclusion is harsh: running numerous virtual machines (L2) on a single-core CPU (serial L1) will never achieve the performance of a supercomputer. What this industry needs is not more patches, but a fundamental overhaul.

IV. New Demands of Web3: Real-Time Internet Civilization Beyond "Single Business Batch Processing"

The richness and complexity of Web3 services far exceed those of cryptocurrencies. Taking a broader perspective, this is actually a "generational leap" that Web3 is undergoing. The cryptocurrency era before Web3 was the "ledger" era represented by Bitcoin, whose core task was to accurately record value transfers. Serial processing mechanisms were not only sufficient for this, but also provided the best guarantee of security.

But the world has changed; we are on the eve of the Web3 era. The core demand of the industry is no longer just low-frequency accounting, but "high-frequency state computing."

This shift stems from a new list of demands placed on Web3 by the real world. These demands are characterized by high concurrency, real-time requirements, and complex interactions, which are difficult for any blockchain based on serial logic (whether L1 or L2) to handle.

Imagine this: hundreds of millions of AI agents are autonomously collaborating on the blockchain, requiring millisecond-level responses like fiber optics, rather than "dial-up" block confirmations; the global circulation of RWA assets seeks real-time certainty 24/7, not lengthy settlement waits; and micropayments from a massive number of devices on the DePIN network, if running on a congested serial blockchain, would instantly destroy its economic model with exorbitant gas fees.

In this new paradigm, we are no longer pursuing simply "peak TPS," but rather "real-time determinism." What we need is an infrastructure that can handle massive concurrency like an internet server while maintaining decentralized characteristics. This is not just about improving performance metrics, but also an evolution of the underlying logic from "batch processing civilization" to "real-time civilization."

V. Paradigm Shift: The Upgrading of Parallel Blockchain

Faced with the physical limitations of single-core computing, the industry has gradually reached a consensus: application-level patching alone cannot break through the performance ceiling of the underlying layers. True scaling requires a deep-level architectural restructuring. Parallel blockchains, represented by Parallism, offer such an "architectural" solution.

Structural Restructuring: From Linear Constraints to Parallel Paths The crux of traditional blockchains lies in their "single-threaded" nature, forcing all business operations to queue and bid on the same timeline. Paralism introduces a two-layer topology structure of "Hyper Block + Solo Chains." This is not simply adding lanes, but rather constructing a multi-dimensional execution space. Each solo chain can act as an independent sovereign space, carrying specific high-frequency business—whether it's the instantaneous matching in DeFi or the massive interactions in GameFi. They operate in parallel on their respective tracks, without interfering with each other. This architecture allows blockchains to achieve horizontal scaling (scale-out) capabilities similar to cloud computing for the first time, freeing performance from the physical limitations of a single point.

Interactive Evolution: The most ingenious aspect of the intrinsically consistent parallel architecture lies in its resolution of the contradiction between "sharding" and "unification." Paralism, through its Buddy consensus algorithm, allows independently running sub-chains to achieve atomic alignment of the entire network state via superblocks within each short cycle. This means that cross-chain transactions no longer rely on fragile third-party bridges or lengthy confirmation periods. Under the rhythm of superblocks, asset interactions between chain A and chain B are instantaneous and strongly consistent. This "native interoperability" restores the smoothness and security of Web3 fund transfers, similar to internal bank clearing, completely bidding farewell to the era of "cross-chain taxes."

Business Sovereignty: Rejecting "Forced Fit" In the Ethereum paradigm, all applications must compromise to the EVM standard. However, the parallel architecture grants businesses significant adaptability. Applications are no longer dependent tenants, but architects with customization rights. High-frequency trading can pursue millisecond-level consensus, while large-scale asset storage can choose more robust security parameters. They share the mainnet's liquidity and security without sacrificing their own business characteristics.

This is not merely an increase in throughput, but a fundamental leap for blockchain from "ledger logic" to "computation logic." It proves that the future of Web3 does not need more patches, but rather a robust skeleton born to run in parallel.

VI. Conclusion: Shifting from "Patch Stacking" to "Architectural Innovation," Embracing the Era of Parallelism

The tide of history has reached the juncture of Web3, and the demand has never slowed down, but is accelerating its iteration. Rollups are not a wrong path; they are an expensive but necessary stress test. Over five years, they have completed their historical mission—allowing the entire industry to physically test the physical limits of "layered patching," and ultimately awakening from their setbacks: attempting to build skyscrapers on a single-threaded foundation is ultimately an unrealizable engineering dream.

Vitalik's candor in early 2026, coinciding with the eve of Ethereum's "Glamsterdam" upgrade, is no coincidence. The upcoming "Glamsterdam" upgrade is essentially a "single-core overclocking + multi-threading patch" for Ethereum. By squeezing execution time through ePBS and utilizing multi-core computing power through BALs, Ethereum's L1 performance will reach unprecedented heights in 2026. This demonstrates that Ethereum is still making difficult and circuitous attempts towards "parallelization."

If Glamsterdam represents an extreme struggle within the old serial paradigm, then Paraalism represents an evolution of another dimension—a "multi-core operating system" that inherently rejects queuing and is born to run in parallel. It establishes a data structure revolution from "serial" to "parallel" from its very core. For the ultimate goal of Web3, Paraalism represents the most thorough engineering implementation of this parallel logic at the blockchain's underlying layer.

The future of Web3 will inevitably be supported by a parallel underlying architecture capable of handling massive concurrent tasks. "Getting off at the stop" is not just about saying goodbye to the old route, but also about transferring to the parallel express train that leads to large-scale commercial applications.