This article is machine translated

Show original

Despite many US stocks exceeding expectations, they subsequently plummeted.

From a micro perspective, this is due to investor concerns about future guidance.

From a macro perspective, it's because there's a lack of cash in the market.

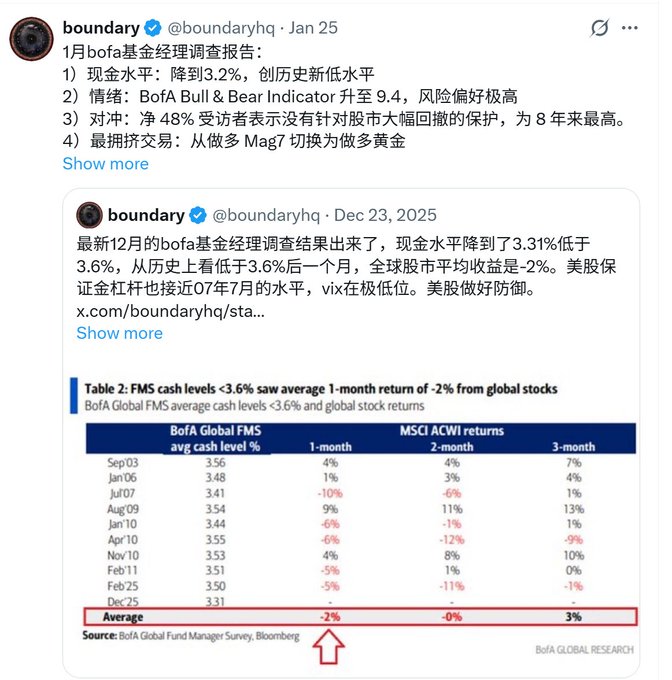

The January BOFA fund manager survey report showed cash levels falling to 3.2%, a record low.

Indicators measuring US stock leverage levels are also approaching their 2007 highs. Fund managers and retail investors who are bullish lack cash, have excessive leverage, and can only rely on verbal manipulation to push up prices.

The slightest disturbance has led to this current predicament.

$TSLA $PLTR

boundary

@boundaryhq

12-17

美股现在整体走到了什么位置:参考美股场内杠杆指标,目前美股已经走到了杠杆泡沫化状态。从2025年6月开始,指标突破1个标准差,进入杠杆泡沫化的状态。目前接近2007年7月的状态,离2000年3月还有距离,

Oh yes yes😍

Make 2022 repeat again

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share