The issuance of these two documents marks the first time that "illegal virtual currencies" and "real-world asset tokenization (RWA)" have been separated at the regulatory level, shifting the policy logic from "complete prohibition" to "a combination of guidance and restriction".

Article by Rosa

Source: Web3Caff Research

On February 6, 2026, Chinese regulators released the most significant industry signal since the "9.24" notice in 2021. Eight departments, including the People's Bank of China, the National Development and Reform Commission, the Ministry of Industry and Information Technology, the Ministry of Public Security, the State Administration for Market Regulation, the State Financial Regulatory Commission, the China Securities Regulatory Commission, and the State Administration of Foreign Exchange, jointly issued the "Notice on Further Preventing and Handling Risks Related to Virtual Currencies" (Yinfa (2026) No. 42, hereinafter referred to as the "Notice"). On the same day, the China Securities Regulatory Commission issued "Announcement No. 1," the "Regulatory Guidelines on the Issuance of Asset-Backed Securities Tokens Overseas by Domestic Assets" (hereinafter referred to as "Announcement No. 1"). This combination of documents marks a new stage in China's regulatory logic for digital assets, shifting from "strict rectification" to "precise risk mitigation and compliant utilization." The core of the policy can be summarized as: strictly prohibiting speculation in native virtual currencies and conditionally opening the door for tokenized assets (RWA) to go overseas under a registration system.

Back in 2021, eight ministries jointly issued the "Notice on Further Preventing and Handling Risks of Virtual Currency Trading and Speculation" (Yinfa (2021) No. 237, commonly known in the industry as the "924 Notice"). This document explicitly stipulated that Bitcoin, Ethereum, and stablecoins including Tether do not have the same legal status as fiat currency, and that conducting virtual currency-related business activities within China constitutes illegal financial activity and is strictly prohibited. On February 6, 2026, the newly issued Yinfa (2026) No. 42 by the eight ministries came into effect, while Yinfa (2021) No. 237 was simultaneously repealed. This signifies that the new "Notice" is a continuation and significant improvement of No. 237, marking a new stage of more precise and coordinated management in my country's regulation of virtual currencies and related derivative businesses.

1. In-depth analysis of Document No. 42 issued by eight ministries: Continuation and revision of regulatory interpretation

Compared to Document No. 237 of 2021, which comprehensively defined virtual currency-related business activities as illegal financial activities, Document No. 42, while maintaining a high-pressure stance, has made a more refined segmentation of the regulatory targets.

The document reiterates the red lines: Bitcoin, Ethereum, and other crypto assets not issued by monetary authorities have no legal tender status, and financial institutions are strictly prohibited from providing related account opening and settlement services. The exchange of fiat currency for such virtual currencies is strictly prohibited, as is providing pricing, information intermediary, or other services for virtual currencies. It also emphasizes that without the approval of relevant departments, no entity or individual, domestic or foreign, may issue stablecoins pegged to the RMB overseas.

Major Amendments (Categorized Regulation): This "Notice" is the first official document to distinguish between "virtual currency" and "real-world tokenization," with one of its biggest highlights being the first clarification of the essential nature of "Real-World Asset Tokenization (RWA)." The policy states that conducting RWA activities and providing intermediary or technical services within China without the consent of the relevant regulatory authorities constitutes illegal activities such as illegally issuing token vouchers or illegally operating securities. This provision effectively blocks some institutions from using "RWA" as a guise for disguised illegal fundraising within China. The document imposes strict regulation, rather than a complete ban, on related businesses of domestic entities issuing real-world asset tokens overseas. The evaluation of real-world asset tokenization businesses follows the principle of "same business, same risk, same rules." Strict regulation will be conducted by relevant departments such as the National Development and Reform Commission, the China Securities Regulatory Commission, and the State Administration of Foreign Exchange according to their respective responsibilities, and a filing system will be adopted. This indicates that regardless of the technical means used for asset issuance, as long as the business substance involves securities business, cross-border circulation, etc., it will be managed in accordance with relevant laws and regulations. Regulation will not tolerate "risk exposure" because of technological innovation. This means that regulatory policies are officially moving towards "categorized regulation" and "coordinated regulation," with a greater emphasis on the substance of the business rather than its form in regulating the tokenization of real-world assets.

2. CSRC Announcement No. 1: Opening a compliant path for domestic assets to raise funds through overseas tokenization.

While the eight ministries issued the "Notice," the China Securities Regulatory Commission (CSRC) officially released Announcement No. 1, the "Regulatory Guidelines on the Issuance of Asset-Backed Securities Tokens Overseas by Domestic Assets" (hereinafter referred to as the "Guidelines"). If the "Notice" from the eight ministries was a "block," then the CSRC's "Guidelines" were a "guideline" for compliant business operations.

The guidelines define RWA as a security token within the scope of ABS (Asset-Backed Securities).

"Announcement No. 1," as the first practical regulation in mainland China specifically addressing RWAs, clarifies the definition of "issuance of asset-backed securities tokens overseas using domestic assets": This refers to activities that use the cash flow generated by domestic assets or related asset rights as repayment support, and utilize cryptographic technology and distributed ledger or similar technologies to issue tokenized equity certificates overseas. This effectively prohibits other chaotic RWA issuances in the market. The China Securities Regulatory Commission (CSRC) explicitly accepts and guides the issuance form of "asset securitization" and its essential "securities attribute." This also means that Chinese regulators have formally recognized the legality of "tokenization" as a fintech tool, stripping away the speculative financial attributes of "virtual currency" and restoring it to a new type of asset-backed security (ABS) vehicle.

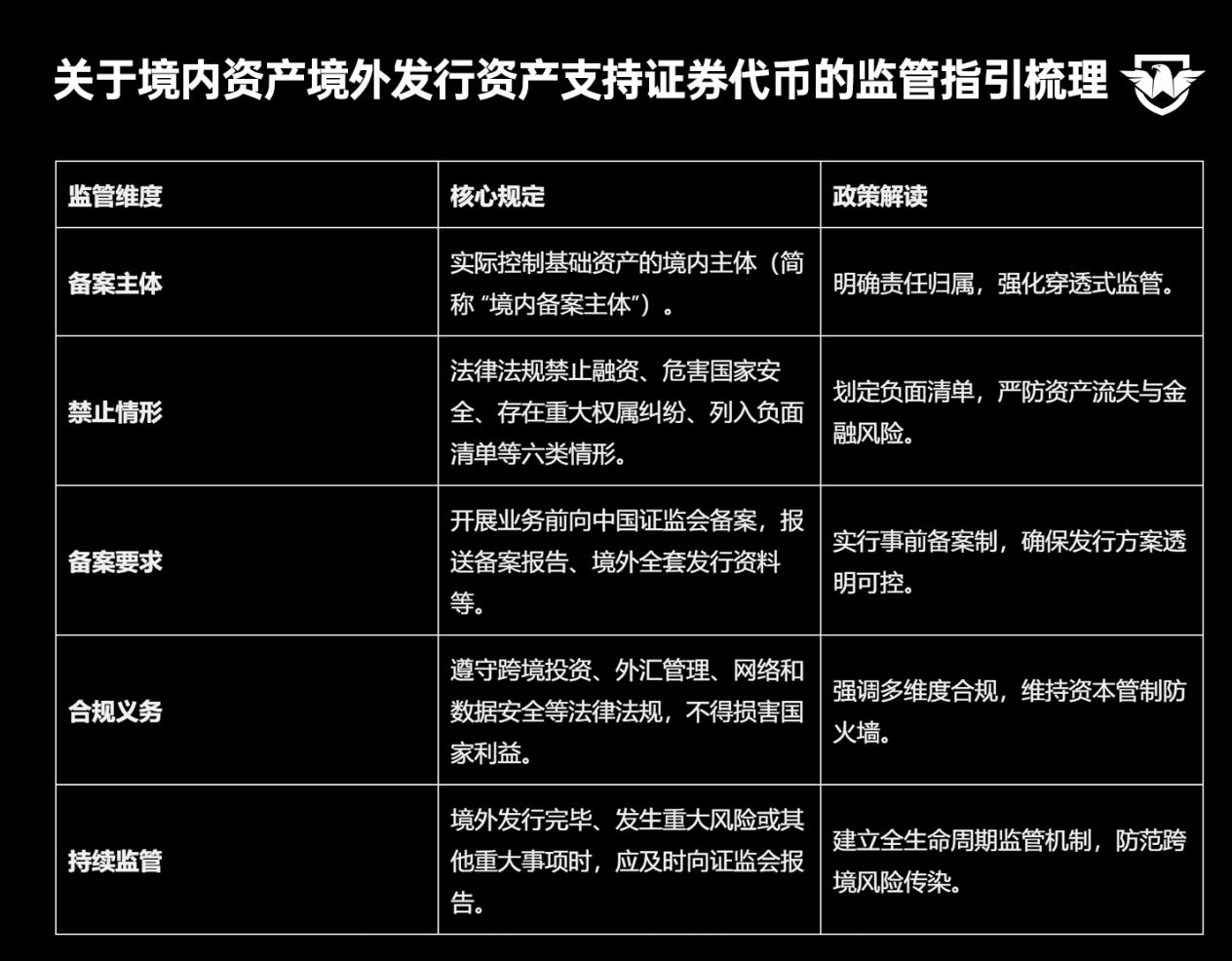

The core principles of the guidelines are: to adopt a filing system and a penetrating supervision, and to establish a "negative list" threshold.

The core provisions of the "Guidelines" are illustrated in the image, compiled by Rosa, a researcher at Web3caff Research, based on the "Regulatory Guidelines on the Issuance of Asset-Backed Securities Tokens by Domestic Assets Overseas."

Overall, the issuance of these two documents marks the first time that "illegal virtual currencies" and "real-world asset tokenization (RWA)" have been clearly distinguished at the regulatory level, shifting the policy logic from "complete prohibition" to a "combination of guidance and restriction." This is not only a positive response to the development of the Web3 ecosystem over the past two years but also an important part of the mainland's financial supply-side reform. Its significant meaning lies in guiding Web3 technology from virtual to real-world applications.

- Allowing "assets domestically, issuance overseas" means explicitly prohibiting and severely cracking down on purely speculative virtual currency asset projects while guiding high-quality mainland assets to compliantly go global and utilize the liquidity of global markets such as Hong Kong. This opens up channels between mainland assets and global liquidity.

- "Technology neutrality, compliance as the foundation." It acknowledges that blockchain, as a technological tool, fundamentally depends on the quality of the underlying assets and legal compliance.

- "High entry barriers and standardized participation of financial institutions." This is not a game for grassroots startups, nor is it a way for domestic assets with poor track records to survive overseas. The regulators not only establish a negative list system, but also stipulate that overseas subsidiaries and branches of domestic financial institutions must act prudently and legally when providing RWA services overseas. They need to be equipped with professional personnel and systems, implement KYC, suitability management, and anti-money laundering requirements, and incorporate these into the compliance and risk control management system of domestic financial institutions.

For practitioners, compliance is the only way out. Embrace compliance and cultivate the real economy. In the future, we expect to see more compliant RWA projects based on the "Guidelines" launched in overseas markets such as Hong Kong, while domestic regulatory pressure will remain high to thoroughly eliminate the remaining breeding ground for cryptocurrency trading speculation.

References:

[1] People's Bank of China website: Notice on further preventing and dealing with risks related to virtual currencies (Yinfa (2026) No. 42)

[2] China Securities Regulatory Commission (CSRC) website: Regulatory Guidelines on the Issuance of Asset-Backed Securities Tokens by Domestic Assets Overseas (CSRC Announcement No. 1 of 2026)

[3] "Official Stance! The Rules of RWA in China Have Been Set! RWA Will No Longer Be a Gray Area!"