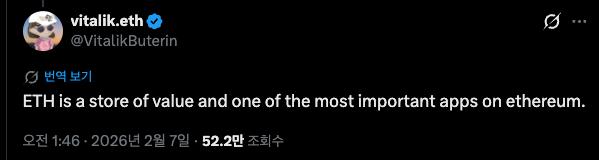

Vitalik: Now, is it okay for the price to rise? “$ETH is a store of value and one of the most important applications on the Ethereum network.” Vitalik has clearly separated the Ethereum network from the Ethereum coin, $ETH, since its inception. He has repeatedly stated in the past that, “$ETH price increases could be problematic as they increase the cost of using the Ethereum network.” This time, Vitalik has described $ETH as both a “store of value” and an “application with utility.” Currently, $ETH’s primary utilities are as follows: - Collateral asset for securing the PoS Ethereum network - Fees (Gas) for network usage - A central asset for the on-chain economy of Ethereum and the entire Ethereum ecosystem (L2, EVM chains, etc.) Notably, this is the first time Vitalik has explicitly referred to $ETH as a "Store of Value." This implies that even if the price of $ETH rises sufficiently, it will no longer lead to structural problems for the Ethereum network. The following structural changes likely underlie this shift in perception: 1. A dramatic decrease in verification costs after the ZK transition The cost of network verification is expected to decrease dramatically after the introduction of ZK technology, and the minimum entry requirement for validators is also likely to be significantly lowered (32 ETH → 1 ETH) in the long-term roadmap. This means $ETH This means that rising prices no longer directly hinder the decentralization of the Ethereum network. 2. Continuously Expanding L1 Block Space Ethereum's L1 block size is rapidly expanding, which suggests that network usage costs have fallen sufficiently to support the $ETH price increase, and are likely to fall further in the future. 3. Purpose-Specific and Performance-Specific Scaling through L2 Specific purposes that are difficult to achieve on L1 (such as censorship, privacy, and ultra-high-speed transactions in milliseconds) can be sufficiently scaled through L2. In other words, the structure where rising ETH prices directly led to decreased network usability has already been resolved. 4. The Misconception of an "Infinite Issuance Asset" Many people still perceive $ETH as an asset with an infinite issuance. However, Ethereum's structure actually allows for more ETH to be burned than issued as network usage increases. While the transition to an L2-centric architecture led to a decrease in L1 usage and burn for a while, L2s are also currently paying significant fees to Ethereum. Additionally, trends such as - rapidly increasing L1 scalability - adoption as a global payment layer through stablecoins and RWA are increasing the likelihood that Ethereum will become a deflationary asset with a gradually decreasing net issuance. Conclusion $ETH is no longer simply a coin consumed as gas fees. It is the asset that ultimately captures the value of all economic activity occurring throughout the Ethereum ecosystem. In other words, $ETH itself is an application with significant utility and a store of value.

This article is machine translated

Show original

Telegram

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content