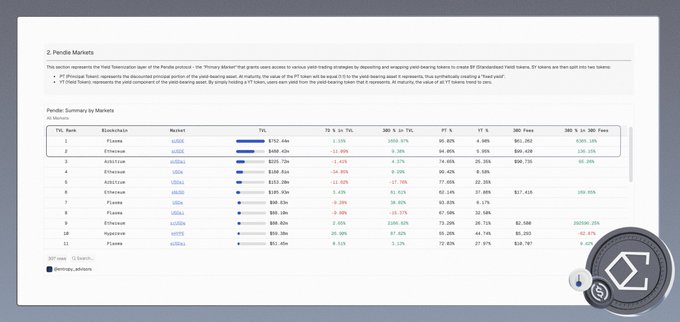

Over $1.6B of Pendle TVL now comes from Ethena assets, with $USDe and $sUSDe accounting for more than 54% of total Pendle TVL. Most capital enters @pendle_fi through PT assets One particularly interesting data point: over 95% of PT-USDe continues to be used as collateral on @aave At the same time, this liquidity is rapidly migrating toward @Plasma Plasma has officially flipped Ethereum to become the largest chain by PT-sUSDe supply, driven primarily by its XPL incentive mechanism.

Ethena

@ethena

02-04

After February's PT expiry, the following Ethena markets on Aave still have capacity:

- sUSDe on mainnet: $880m of capacity

- April PTs (USDe and sUSDe) on @Plasma: $570m capacity | 5.2% APY

- May PTs (USDe and sUSDe) listed shortly on mainnet: $145m initial cap | 4.6% APY

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content