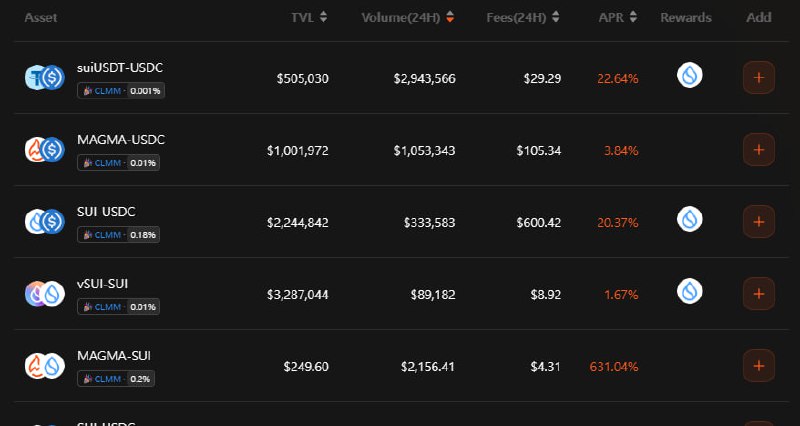

⭐️ Want to experience DeFi in the Sui ecosystem? Magma Finance is one option. There aren't many products that can provide LP in the Sui ecosystem. One is the well-known ㅁㅁㅌ, and Bybit (ranked 2nd) holds a position called Magma. ❓Are there any pools that can profit from Magma? 🟠There are three pools that stand out in the V3 pairs. 🟠The suiUSDT - USDC / SUI - USDC / MAGMA - SUI pools are the ones. 🟠The pools with the highest reward ratios are the Stable Pool (#1) and the Sui - Stable Pool (#2). 🟠The last Magma pool has no rewards, and due to its inherently high risk (because no one is investing), it has a high APR... 🟠Personally, considering the risk-to-return ratio, I think the most attractive option in Magma is the "Stable Pool." —— 😤 The APR of the Stable Pool is 22.64%...? 🟠On Magma Finance, the SuiUSDT - USDC pool currently has an APR of a whopping 22.64%. 🟠No matter how narrow the V3 is, stable pools typically don't offer interest rates exceeding 2-3%... 🟠For some reason, Magma has allocated a large "reward" (20.52%) to this stable pool, resulting in a significantly high APR. 🟠 Perhaps the reason they're concentrating their rewards on stable pools is because retail is the easiest pool to build volume and TVL. —— 🤣 Comparison with the Stable Pool Next Door 🟠 Compared to the APR of ㅁㅁㅌ's suiUSDT-USDC pool (0.001% Tier, High-Frequency, Low-Fees Tier), Magma's is over 15% higher. 🟠 Another thing to note is that ㅁㅁㅌ's stable pool has a higher base APR and a lower "reward ratio." 🟠 Simply put, Magma's APR volatility is lower. (Since most of the rewards come from rewards, if Magma can maintain its balance, it should be fine.) 🟠 While the risk is higher than ㅁㅁㅌ's, choosing Magma Finance among stable pools could be a surprisingly strategic choice. —— Conclusion... Stable Pool LP Supply on SuiChain <<< Magma Finance could be an option, more than you might think. Honestly, it's hard to expect transaction fees on SuiChain these days, but if they offer this much reward... it's a different story. I'll try depositing some actual stablecoins and check the actual APR... If it's around 15-20%, it might be worth a shot. Of course, whether that's actually the case is crucial.

This article is machine translated

Show original

Telegram

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share