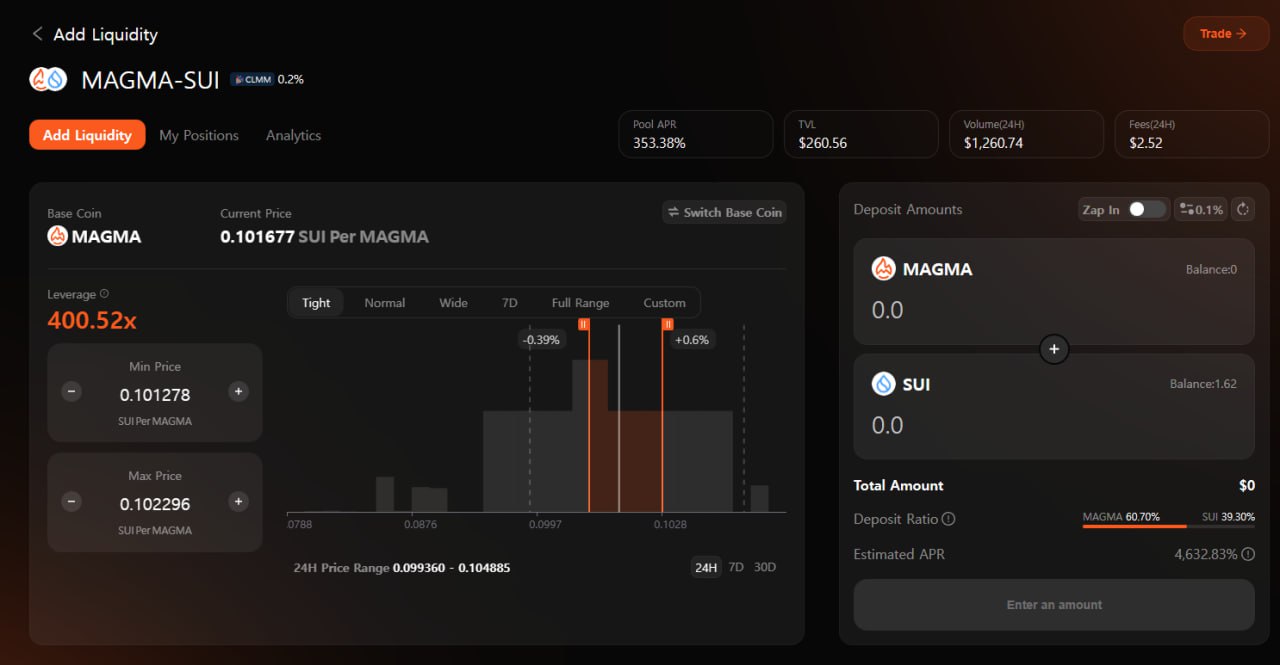

⭐️ Magma Finance, Forbidden Fruit: Why Should You Avoid the Magma-Sui Pool? Those unfamiliar with DeFi platforms might suddenly wonder: "Why is that APR over 300%?..." Some pools display APRs that are incomparable to others. There are many reasons for this, but today, we'll focus solely on the Magma-Sui pool. —— ❓ V3 Pools with 'Almost All Altcoins' as Underlying Assets 🟠Most V3 farmers prefer pools where at least one of their assets is a stablecoin. 🟠Predicting the volatility of a single coin is difficult, so pools that require predicting the volatility of two coins are extremely risky. 🟠For these reasons, not many people are participating, and therefore the APR is typically high... —— 🤣 That's not the problem with the MAGMA - SUI pool... 🟠It's just that the volume and TVL are truly abysmal. 🟠TVL was $260, 24H volume was $1,260, and fees were $2.52. 🟠What this means is... the $2.52 fee was calculated from that $1,260 for the day, resulting in a 353% APR. 🟠Even if we add liquidity, if there's no volume, there won't be any fees... and that inflated APR will drop. —— Some beginners may accidentally invest money in such pools based solely on the APR displayed... The volatility of the two altcoins could be met with volatility, but there could be no fees, which could lead to a disaster. Therefore, I recommend avoiding that pool. Personally, I think stable pools with high reward ratios offer the most potential in Magma.

This article is machine translated

Show original

Sector:

Telegram

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content