In early 2024, a simple game called “Notcoin” quietly went viral on Telegram. It featured no complex visuals and no deep storyline—users simply had to keep tapping a virtual coin on the screen to earn in-game tokens. Within just a few months, this near-primitive “tap-to-earn” game attracted over 30 million users, becoming one of the fastest-growing applications in the history of cryptocurrencies.

Notcoin’s success was no accident. It signaled the rise of a brand-new user acquisition paradigm in the Web3 world. While traditional crypto applications were still struggling to educate users about private key management and gas fees, Telegram and the TON ecosystem jointly built a growth engine with zero cognitive barriers, viral distribution, and social-native design. This article takes a deep dive into this phenomenon, revealing how the “simple tap-to-earn” model plays the role of a Web3 “Trojan Horse.” Through minimalist interaction design and a finely tuned economic model, it has successfully converted tens of millions of traditional internet users into participants in the blockchain ecosystem—and explores the profound implications of this traffic blitz for the industry’s future landscape.

The Perfect Infiltration of “Zero Cognitive Barrier” — Why “Tap-to-Earn”?

The key to understanding the Telegram–TON ecosystem’s explosive growth lies in recognizing how it completely bypassed every traditional obstacle to mass Web3 adoption. In a typical DApp experience, users must go through a daunting series of steps: downloading a dedicated wallet, securely backing up seed phrases, purchasing cryptocurrency, understanding gas fees, and approving smart contract transactions. Each step is accompanied by technical fear, security anxiety, and the risk of financial loss.

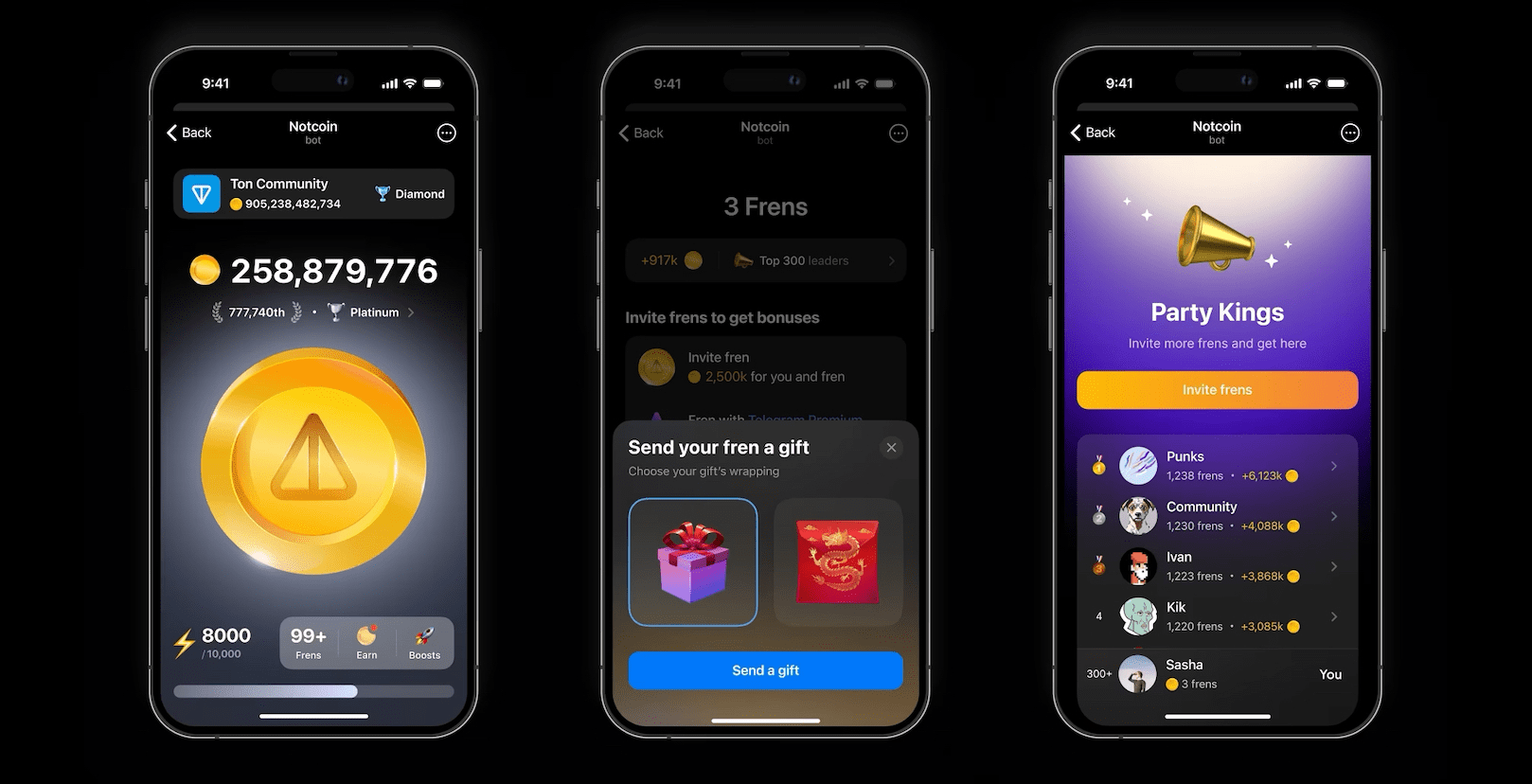

The design philosophy of tap-to-earn games completely overturns this logic. The user journey is astonishingly simple: users open Telegram—the messaging app they already know; click a bot link—no different from interacting with any customer service bot; and start tapping the screen to earn rewards—the most instinctive human interaction imaginable. Private keys, wallets, gas fees, smart contracts—all the core concepts of Web3 are carefully hidden behind the user experience.

This design works because it precisely triggers fundamental drivers of human behavior. Instant feedback, variable rewards, and visualized progress—these gamification elements, combined with the ultimate motivation of “earning money,” create extremely strong user stickiness. More importantly, the model spreads virally through social relationships. When users see friends sharing their earnings rankings in chat groups, curiosity and herd psychology drive them to join quickly. In Notcoin’s case, users could earn additional rewards by inviting friends, further accelerating the spread.

At its core, this “zero cognitive barrier” strategy is a form of cognitive offloading. All the complexity of blockchain technology is encapsulated in the backend, while users are presented with the simplest and most intuitive value proposition: every tap you make has value. The brilliance of this approach lies in establishing the core belief—“my actions can generate digital assets”—before postponing education about what those assets are, how they are stored, and how they are used until after users have already been successfully captured.

Telegram as the “Perfect Petri Dish” — How Infrastructure Catalyzes Viral Growth

The success of the tap-to-earn model is highly dependent on Telegram’s unique platform ecosystem. With over 900 million monthly active users, Telegram is not just a messaging app—it has evolved into a super-ecosystem integrating communication, communities, media distribution, and lightweight applications. The deep integration between the TON blockchain and Telegram provides tap-to-earn games with innate advantages unmatched by any other platform.

The most critical integration lies in the seamless wallet experience. Telegram’s built-in “TON Wallet” allows users to receive, store, and send cryptocurrencies without ever leaving the app. When Notcoin users need to redeem tokens earned through tapping, the system can automatically create a wallet address within their Telegram wallet and deposit the tokens. This entire process happens in-app, and users may never even become aware of the concept of a “wallet address.” This “invisible wallet” experience removes the biggest psychological barrier for new Web3 users—the fear and confusion surrounding private key management.

Another key advantage is Telegram’s channel-based viral distribution mechanism. Telegram channels and groups are naturally suited for rapid information dissemination. Successful tap-to-earn games typically create official channels to publish tasks, update rules, and display leaderboards. Users, seeking greater rewards, voluntarily share game links across their various groups. This is not simple advertising—it is trust-based social recommendation. When users see friends actively participating, their trust threshold drops significantly.

In addition, the flexibility of Telegram bots enables limitless possibilities for game interaction. Developers can implement complex game logic, task systems, and reward distribution through bot APIs, while all interactions occur within the familiar chat interface. This creates a unique “conversational gaming” experience—users feel like they are interacting with a smart assistant rather than using a complex blockchain application. The TON blockchain provides a cheap and fast settlement layer for these interactions, ensuring that millions of micro-transactions can be processed efficiently and at low cost.

From “Airdrop Farmers” to “Ecosystem Citizens” — The Path of User Value Accumulation

The true test for a successful tap-to-earn game is not how it attracts massive numbers of users, but how it converts short-term speculators into long-term ecosystem participants. Most projects design sophisticated “user upgrade paths” to gradually guide profit-seeking “airdrop farmers” toward becoming deeper “citizens” of the ecosystem.

The first stage of conversion usually occurs within the game itself. After users accumulate base tokens, games introduce staking mechanisms—users can lock tokens for a period of time in exchange for higher returns. This cleverly achieves two goals: it reduces immediate sell pressure and stabilizes the in-game economy, while also introducing users to the core DeFi concept of staking, even if they do not fully understand the underlying technology. Games may then introduce NFT systems, allowing users to purchase special virtual items or identity markers with tokens. These NFTs often carry social display value or provide functional advantages within the game.

More significant conversion happens at the interface between the game and the broader TON ecosystem. Mature tap-to-earn projects partner with TON-based DeFi protocols, NFT marketplaces, or other DApps. Users can exchange in-game tokens for TON mainnet tokens and provide liquidity on decentralized exchanges, or use game tokens to purchase NFTs from partner projects. Through these carefully designed “exits,” users are naturally guided into the wider TON ecosystem.

The most successful projects position themselves as entry points and educational tools for the TON ecosystem. In its later stages, Notcoin allowed users to convert in-game tokens directly into real TON tokens and provided simple tutorials on using them for payments, transfers, or participation in other TON applications. This design enables users to complete the identity shift from “gamer” to “blockchain user” almost unconsciously. They may still not understand blockchain technology in detail, but they have personally experienced how blockchain-based digital assets are created, transferred, and used to generate value.

The Sustainability Question — The Ecosystem Legacy After the Bubble Burst

With the explosive growth of tap-to-earn games, an unavoidable question has emerged: how sustainable is this model? On the surface, many projects resemble classic Ponzi economics—early users profit from later users’ participation, and when token demand cannot keep up with issuance, the system collapses. However, dismissing the TON tap-to-earn boom as mere hype may overlook deeper evolutionary dynamics.

The first key to sustainability lies in the evolution of value creation. Early tap-to-earn games may indeed have offered purely speculative value, but as the ecosystem matures, newer projects are attempting to link tapping behavior to real value creation. Some convert taps into micro-tasks such as data labeling, content moderation, or AI training; others integrate game mechanics with brand marketing, where user taps directly generate exposure value for advertisers. This shift from “pure inflation” to “value backing” is an important sign of ecosystem maturation.

The second key is the refinement of economic model design. Early simplistic issuance models are being replaced by more sophisticated tokenomics. Projects are introducing burn mechanisms, multi-token systems (separating game points from governance tokens), and dynamically adjusted issuance curves. These designs aim to balance short-term incentives with long-term value, allowing token economies to self-regulate rather than relying entirely on an endless influx of new users. TON’s low transaction costs make frequent micro-adjustments to such complex models feasible.

From a broader ecosystem perspective, even if individual tap-to-earn projects eventually decline, the infrastructure and user base they leave behind may continue to generate value. Tens of millions of users have encountered crypto wallets for the first time through simple games, learned about private key backups (even in simplified form), and experienced asset transfers. This scale of user education is unmatched by any other promotional method. More importantly, the successful design patterns, growth strategies, and retention mechanisms that emerged from these projects will provide valuable lessons for future serious applications in the TON ecosystem.

A Paradigm Shift in Web3 User Acquisition

The explosive growth achieved by the Telegram–TON ecosystem through the tap-to-earn model reveals a potential path toward mass Web3 adoption: instead of educating users to understand blockchain, let blockchain understand users. The core of this paradigm shift is user-experience priority—completely hiding complex technical details and presenting only the most intuitive value interactions.

This traffic blitz rests on three pillars: precise alignment with fundamental human motivations through the fusion of gamification and economic incentives; Telegram’s unique infrastructure enabling deep integration of wallets, social features, and applications; and carefully designed user conversion paths that gradually transform short-term traffic into long-term ecosystem value.

For the broader Web3 industry, the TON ecosystem’s experiment offers important insights. It proves that a seemingly simple tap-to-earn mechanism, when supported by the right platform, can become an effective tool for breaking out of niche circles and reaching massive new audiences. When millions of users first encounter crypto wallets simply to earn by tapping, mass Web3 adoption has already begun—quietly and unintentionally.

The ultimate significance of this experiment may not lie in how much short-term wealth it created, but in what it demonstrated: lowering cognitive barriers, respecting user habits, and leveraging social distribution may be more effective growth strategies than any technical breakthrough. Behind the constant tapping sounds of Notcoin and its peers, a profound transformation in how Web3 moves toward the mainstream is unfolding quietly within Telegram chat windows. And once users grow accustomed to the new paradigm of “messages as transactions, taps as earnings,” the user base and imaginative boundaries of the entire crypto world may be permanently redefined.