This article is machine translated

Show original

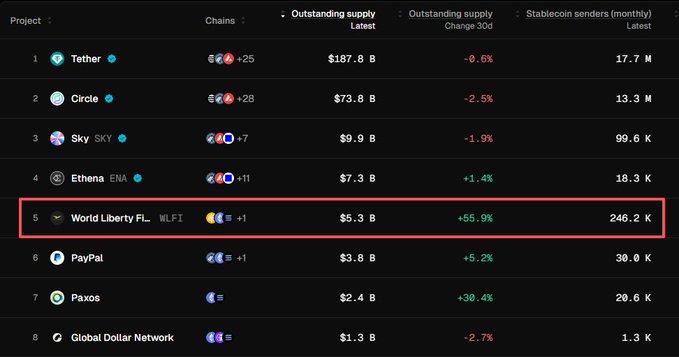

⚡️With Binance's deep integration, $USD1 has grown by 55% in one month, and its current market capitalization has exceeded $5 billion, firmly establishing it in the top tier of stablecoins!

Now it's a time for passive income; besides the dual-token win, you can basically just sit back and enjoy the returns from USD1.

There are two investment methods:

1⃣Main Channel: Binance platform + WLFI subsidies.

1) Placing it in a contract/leveraged account: In actual testing, holding 50,000 USD1 would yield approximately 1,500 $WLFI, worth 150 USDT, with an annualized return of around 16%.

This relies almost entirely on WLFI subsidies and can continue to generate returns for over a week.

After the subsidies end on February 20th, the protocol's internal returns (borrowing interest + fee sharing) should support an annualized return of approximately 2-3%.

2) Placing it in a wealth management product, yielding a 4.2% flexible deposit return.

2⃣ On-Chain Protocol Yields (World Liberty Markets)

Based on the Dolomite protocol's yield structure, plus WLFI subsidies, the combined APY can reach 9.6%.

Family members, is it possible that we can expect another USD1 investment activity to continue? 👀

BITWU.ETH

@Bitwux

01-24

⚡关于 USD1 活动的几个要点——

1)usd1需要划转到杠杆账户或合约账户,设置好之后不用开仓交易,放过来就可以。

设置方法:在合约-右上角三个点,设置成「联合保证金」或者「统一账户」,就可以享受1.2x奖励加成。

2)usd1增发了10亿,后面应该还会持续增发,收益率肯定是会从22%逐渐变低的。 x.com/Bitwux/status/…

Looking forward to a refill

Sector:

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share