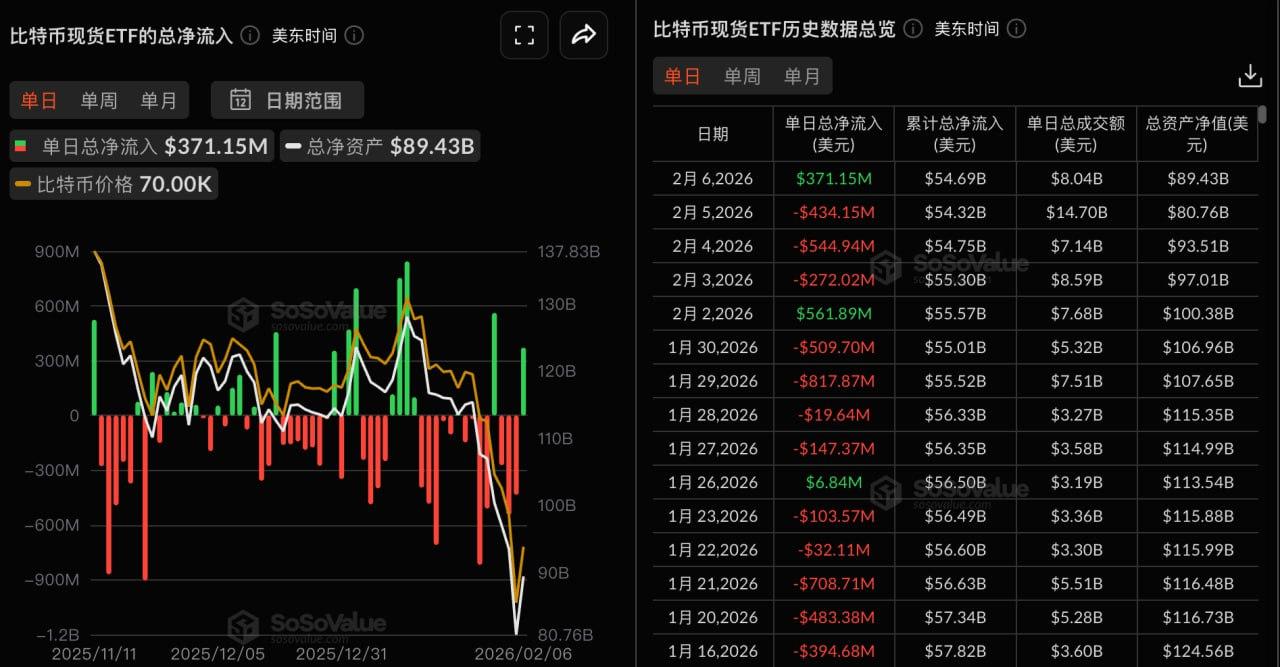

According to ME News, on February 9 (UTC+8), based on SoSoValue data, Bitcoin spot ETFs saw a total net inflow of $371 million on February 6 (Eastern Time).

The Bitcoin spot ETF with the largest net inflow on February 6 was BlackRock ETF IBIT, with a single-day net inflow of $232 million. IBIT's total historical net inflow has now reached $61.841 billion.

The second largest net inflow was into Ark Invest's ARKB ETF, which saw a net inflow of $43.2514 million in a single day. ARKB's total historical net inflow has now reached $1.474 billion.

As of press time, the total net asset value of Bitcoin spot ETFs was $89.433 billion, with an ETF net asset ratio (market capitalization as a percentage of Bitcoin's total market capitalization) of 6.39%, and a historical cumulative net inflow of $54.689 billion.

Source: https://sosovalue.com/zh/assets/etf/us-btc-spot (Source: ME)