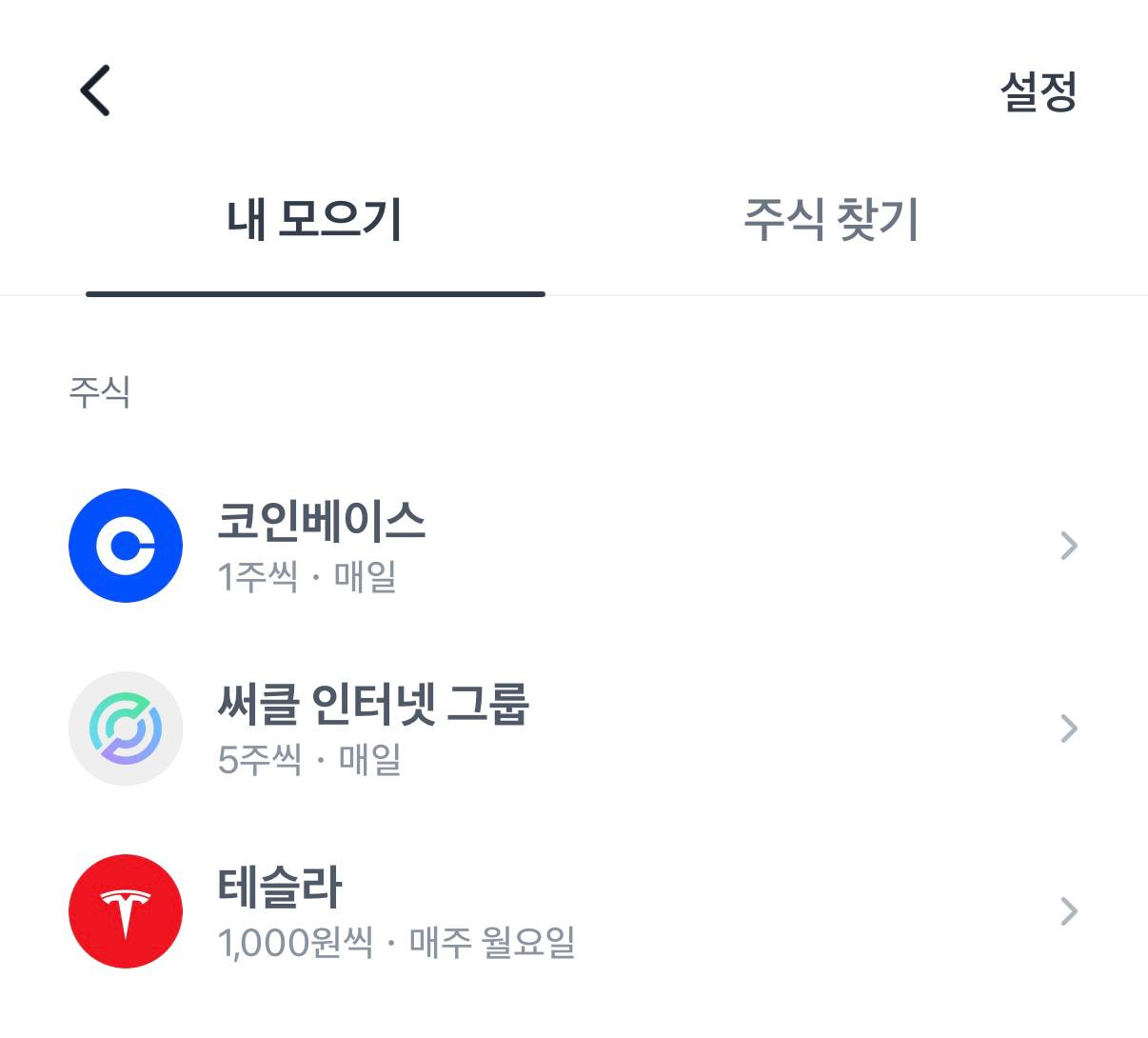

😡 I started a DCA with Coinbase and Circle. Currently, the most popular coin-related stocks worth investing in include $MSTR, $COIN, $CIRCLE, and $BMNR. $MSTR offers dividends and could be considered a viable alternative to Bitcoin, but due to taxes, I recommend against buying $BMNR directly, as it's more profitable to buy Ethereum and hold it. That leaves Coinbase and Circle. In the short term, their prices are likely to rise if the Clarity Act passes. In the long term, considering the future of blockchain as a stablecoin infrastructure, I think it's only natural that the prices of stocks that share the USDC pie should rise. Therefore, I started a DCA with Coinbase's $COIN and Circle's $CIRCLE. I've set it to buy $500 a day. The rationale is to aim for a short-term pump thanks to the passage of the Clarity Act. If it overshoots, I'll sell and then revert to the DCA strategy. Of course, in the long term, I'm lowering the DCA amount to truly invest in the vision that the future of blockchain is on-chain banking. I'm not suggesting you buy in the same way. I just had this thought and wrote this. Now that the coin tax is starting, it's time to learn how to diversify your stock portfolio. So, investing indirectly in stocks when the coin tax is introduced doesn't seem like a bad idea.

This article is machine translated

Show original

Sector:

Telegram

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content