Bitcoin traders are heading into a week heavily influenced by macroeconomic factors, with four key US economic events expected to shape sentiment across the crypto market.

Bitcoin traders are heading into a week heavily influenced by macroeconomic factors, with four key US economic events expected to shape sentiment across the crypto market.

With Bitcoin trading in a highly volatile range and macroeconomic narratives dominating market sentiment, traders are increasingly viewing economic data as short-term catalysts that can trigger sharp movements in either direction.

What US economic signals should Bitcoin and crypto investors watch this week?

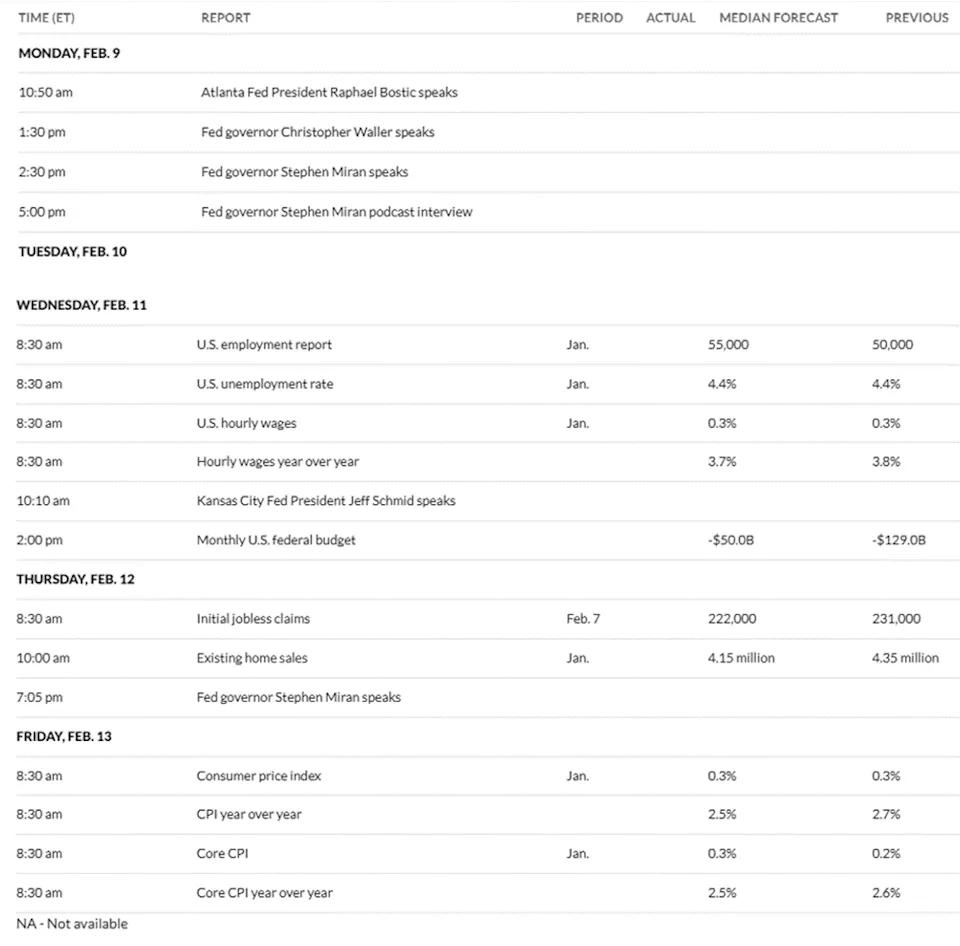

A media appearance by a Federal Reserve Governor, key labor market data, weekly jobless claims figures, and January inflation data can all influence expectations about interest rates and liquidation —two of the strongest drivers in Bitcoin's price cycles.

The interview with Fed Governor Stephen Miran has attracted attention.

The market will first be watching for statements from Federal Reserve Governor Stephen Miran, who is scheduled to appear in a podcast interview on Monday, February 9th. Ahead of the 5:00 PM ET broadcast, sentiment within the crypto community has been mixed, particularly amidst a generally cautious market.Some market participants point to Miran's relatively positive view of stablecoins, arguing that legal clarity and digital assets pegged to the USD could indirectly support Bitcoin by strengthening the overall crypto ecosystem and institutional participation.

Others see the risks. Speculation that Miran might take on a larger Vai on the Fed's future leadership has coincided with periods of significant volatility in both precious metals and crypto markets. This reflects concerns that tighter policy could put pressure on inflation hedging arguments.

Meanwhile, some macroeconomic analysts describe Miran as more dovish than many of his peers, citing his previous arguments in favor of significant interest rate cuts to support the labor market.

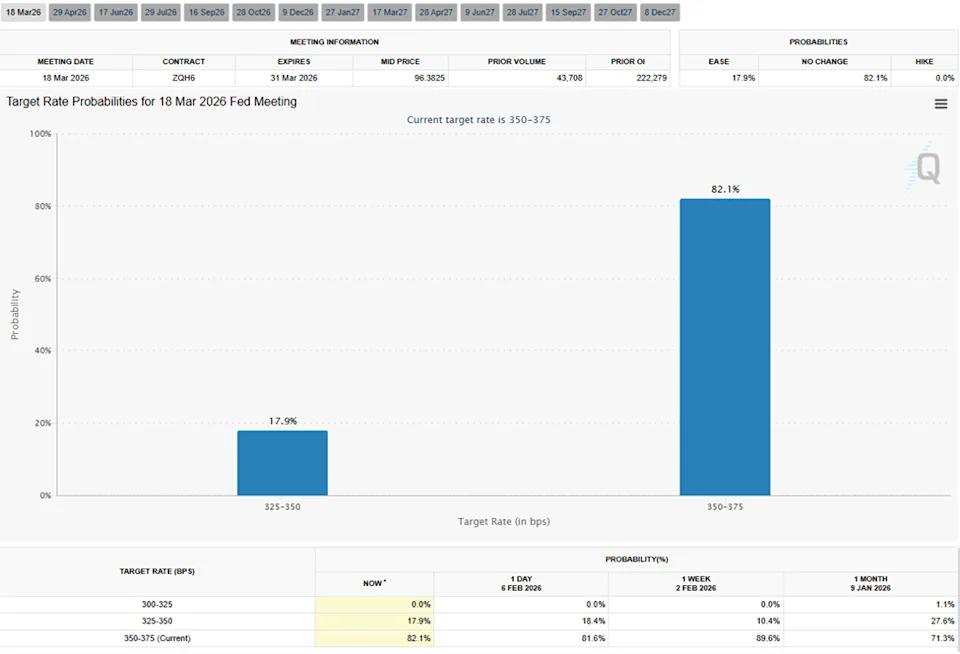

Any signals in that direction could improve sentiment toward risk assets, particularly Bitcoin, which remains highly sensitive to liquidation expectations.

The US jobs report could fuel the "bad news is good news" narrative.

Attention will shift to Wednesday, February 11th, with the US jobs report — one of the most closely watched indicators of economic health and monetary policy direction.Forecasts suggest relatively modest job growth, possibly reaching 55,000 jobs, compared to the previous estimate of 50,000. Weaker-than-expected data could paradoxically support Bitcoin. Cooling labor conditions would increase pressure on the Fed to ease policy, potentially improving liquidation for risky assets.

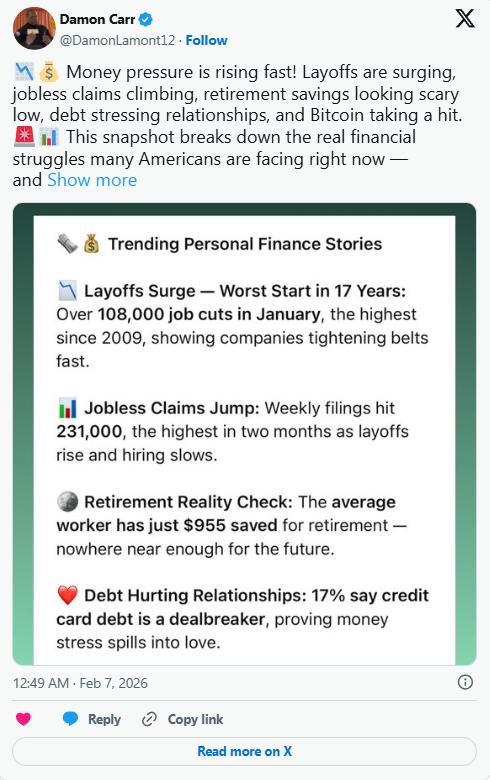

Recent labor market indicators have shown signs of slowing down. Reports of rising layoffs and stagnant hiring have reinforced expectations that interest rate cuts may come sooner than previously anticipated.

However, the jobs report also carries downside risks. A sharp decline in employment data could raise concerns about economic growth, prompting investors to shift to defensive positions. Such a result could trigger short-term sell-offs in the crypto market, similar to what has happened during previous macroeconomic shocks.

Unemployment benefit data could either reinforce or challenge the trend.

The report on initial jobless claims on Thursday will provide a more immediate glimpse into the state of the labor market. Therefore, it could reinforce or challenge the narrative established by Wednesday's employment and unemployment reports.Recent surges in unemployment benefit applications have coincided with “risk-off” reactions in the crypto market, including liquidation events and rapid price swings. Some traders XEM the increase in applications as a signal that economic conditions are weakening enough to necessitate monetary easing — a positive long-term factor for Bitcoin.

Others warn that in the short term, worsening employment data could destabilize the market, especially given liquidation and high leverage.

This very dynamic has made unemployment benefit reports an increasing source of volatility, even though they rarely move the market on their own.

CPI and core CPI are XEM the key catalysts of the week.

The most important data will likely come out on Friday, February 13th, with the release of the CPI and core CPI for January.Inflation data remains a key driver shaping Fed policy expectations and is therefore a crucial factor in crypto market sentiment.

Lower-than-expected indicators in recent months have supported risk assets by undermining the "long-term high interest rates" narrative.

A further softening inflation report could accelerate expectations of interest rate cuts in 2026, thereby bolstering Bitcoin's bullish momentum and strengthening the argument for its potential to reach six-figure price levels over time.

Conversely, Dai or rising inflation is likely to have the opposite effect, pushing up US Treasury yields and putting pressure on speculative assets, including cryptocurrencies.

“If the data heats up, interest rates are likely to remain high and risky assets could struggle. If the data cools down, expectations of interest rate cuts could return and the market will breathe easier. This week will give us the answer,” analyst Kyle Chasse commented.

In summary, the week's events represent a focused test of the macroeconomic narratives currently driving Bitcoin: inflation, employment, and the timing of monetary policy easing.

While long-term adoption trends such as ETF Capital , institutional participation, and stablecoin growth continue to bolster optimistic forecasts, short-term price movements remain closely tied to economic data.