Kevin Warsh , a candidate for the position of Chairman of the Federal Reserve ( Fed ), proposed establishing a new agreement between the Fed and the Treasury Department, inspired by... The 1951 agreement.

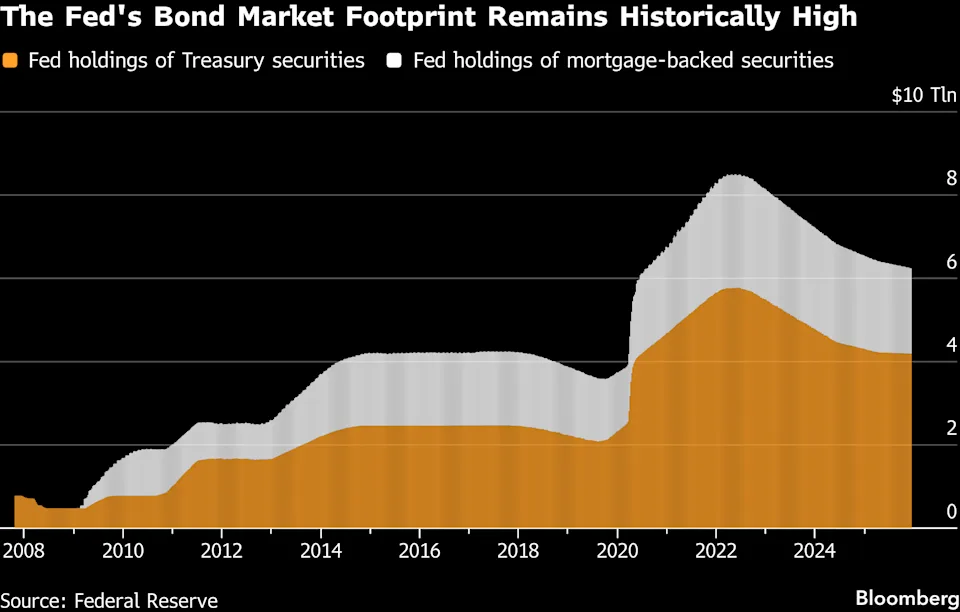

The goal is to clearly define the boundaries and principles for the Fed's participation in the government bond market, given that the US central bank has expanded its balance sheet to over $6 trillion following the financial crises and the Covid-19 pandemic.

According to Warsh, a new framework would help clarify the size of the Fed's balance sheet, while more closely linking the central bank's bond purchases to the Treasury Department's debt issuance plans.

Kevin Warsh wants to reinstate the Fed-Treasury agreement.

"The Fed is moving away from the spirit of independence."

The 1951 Agreement The agreement between the Fed and the US Treasury Department is XEM a historic milestone, restoring the independence of the US central bank. During World War II and the post-war period, the Fed was forced to maintain bond yield caps to reduce borrowing costs for the government. This policy helped control the burden of public debt in the short term, but at the same time contributed to soaring inflation.

Subsequently, the administration of President Harry Truman agreed to return autonomy to the Fed in managing interest rates and the bond market, separating monetary policy from the need to finance budgets – the foundation of the Fed's credibility for decades.

However, Warsh argues that this spirit has been eroded by the Fed's large-scale bond purchases during recent crises. According to him, QE (quantitative easing) programs not only aim to stabilize markets but also indirectly facilitate government borrowing at lower costs, thereby blurring the lines between monetary and fiscal policy.

This view is particularly sensitive given that the U.S. government's interest expenses currently stand at around $1 trillion per year, equivalent to nearly half of the federal budget deficit.

The size of the Fed's holdings of mortgage-backed securities (MBS) from 2008 to the present (Source: Bloomberg)

The size of the Fed's holdings of mortgage-backed securities (MBS) from 2008 to the present (Source: Bloomberg)Fed-Treasury Agreement: 3 Main Scenarios

Analysts have outlined three main options for a potential agreement between the Fed and the U.S. Treasury Department:

1. The 'cautious' approach

Under this model, the agreement between the two agencies would be primarily administrative and directive. The Fed would still conduct monetary policy independently, but would only implement large-scale Treasury bond purchase programs with the consent of the U.S. Treasury Department.

At the same time, the Fed committed to ending quantitative easing (QE) and shrinking its balance sheet (QT) as soon as market conditions allow.

However, granting the Treasury Department a “consensus” Vai could lead the market to believe that the agency has soft veto power over Fed decisions, particularly during quantitative tightening.

2. The 'adjustment' option

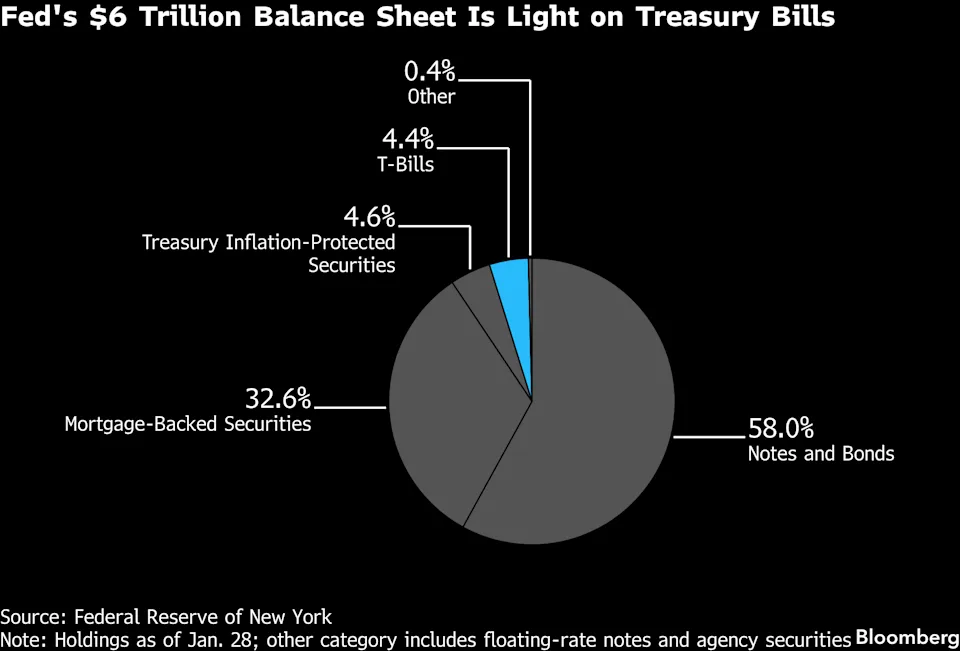

At a more advanced level of intervention, the Fed could adjust its asset portfolio structure, reducing its holdings of medium- and long-term bonds and shifting to purchasing more short-term Treasury bills (T-bills). This approach helps the Treasury Department reduce pressure to issue long-term bonds, thereby curbing long-term yields and government borrowing costs.

Some signs indicated that such coordination was beginning to take shape, as the Treasury Department began closely monitoring the amount of Treasury bills held by the Fed as it developed its debt issuance plan.

The structure of the Fed's $6 trillion balance sheet: Short-term bonds account for a very small proportion (Source: Bloomberg)

The structure of the Fed's $6 trillion balance sheet: Short-term bonds account for a very small proportion (Source: Bloomberg)3. The 'expansion' option

This scenario goes beyond the scope of Treasury bonds. Accordingly, the Fed Fungible approximately $2 trillion of mortgage-backed securities (MBS) in its portfolio for short-term Treasury bills issued by the Treasury Department.

The goal is to lower mortgage interest rates and support the housing market – a major priority of the Trump administration. This move could be accompanied by agencies like Fannie Mae and Freddie Mac increasing their purchases of mortgage securities.

Policy impact

Regarding monetary policy: If the Fed coordinates more closely with the U.S. Treasury Department, the lines between monetary and fiscal policy risk narrowing. Monetary policy could then be dominated by the need to finance budget deficits, rather than focusing purely on controlling inflation and stabilizing the macroeconomy.

For the financial markets: Investors are concerned that the Fed could become a tool for the government to control borrowing costs, rather than an independent central bank. This could increase volatility in the bond market, push inflation expectations higher, and undermine confidence in the Fed's policy direction.

The worst-case scenario is that the market loses confidence in the Fed's independence. In that case, US bonds could... Losing its status as a "safe haven asset" could lead to the risk of international Capital shifting to other markets and weakening the central Vai of the USD in the global financial system.

Many experts warn that while coordinated efforts to curb interest costs may be effective in the short term, in the long term it will lead investors to seek diversification away from US assets – a potential cost to the Fed's credibility and the financial strength of the US.