Author: CryptoSlate

Compiled by: TechFlow TechFlow

Original link:

TechFlow Guide:

After a violent rebound from $60,000 to $70,000 within 24 hours, Bitcoin appears to have recovered its losses. However, the underlying logic reveals that this was not due to strong spot buying, but rather forced portfolio adjustments and short squeezes triggered by a macro market recovery. This article delves into the causes of this "terrifying turmoil" in early February 2026: from the anticipated liquidity contraction following Trump's appointment of Kevin Warsh to the pressure of miners' profits hitting historic lows. Although prices have returned above $70,000, options traders are heavily betting on a potential second dip to $50,000-$60,000 at the end of February, revealing the fragile sentiment and complex financial games hidden beneath the surface of the "violent rebound."

Bitcoin surged from $60,000 to above $70,000 in less than 24 hours, erasing the 14% plunge that had previously tested all "buy the dips" theories in the market.

The speed of this reversal—a 12% rebound in a single day, and a 17% recovery from the intraday low—was so dramatic that it felt like the dust had settled after a reckoning. However, the mechanism behind the rebound tells a different story: it was more a combination of cross-asset stabilization and forced position rebalancing than a massive demand for physical assets driven by conviction.

Meanwhile, the derivatives market remains crowded with put protection positions, and pricing suggests that $70,000 may just be a transit point rather than a true bottom.

Strong tides encounter macroeconomic pressures

On February 5th, the market opened near $73,100, briefly rallied before collapsing and closing at $62,600. According to CoinGlass data, the single-day drop resulted in the liquidation of approximately $1 billion in leveraged Bitcoin positions.

This figure alone is enough to illustrate the chain reaction of forced selling, but the overall environment is actually worse.

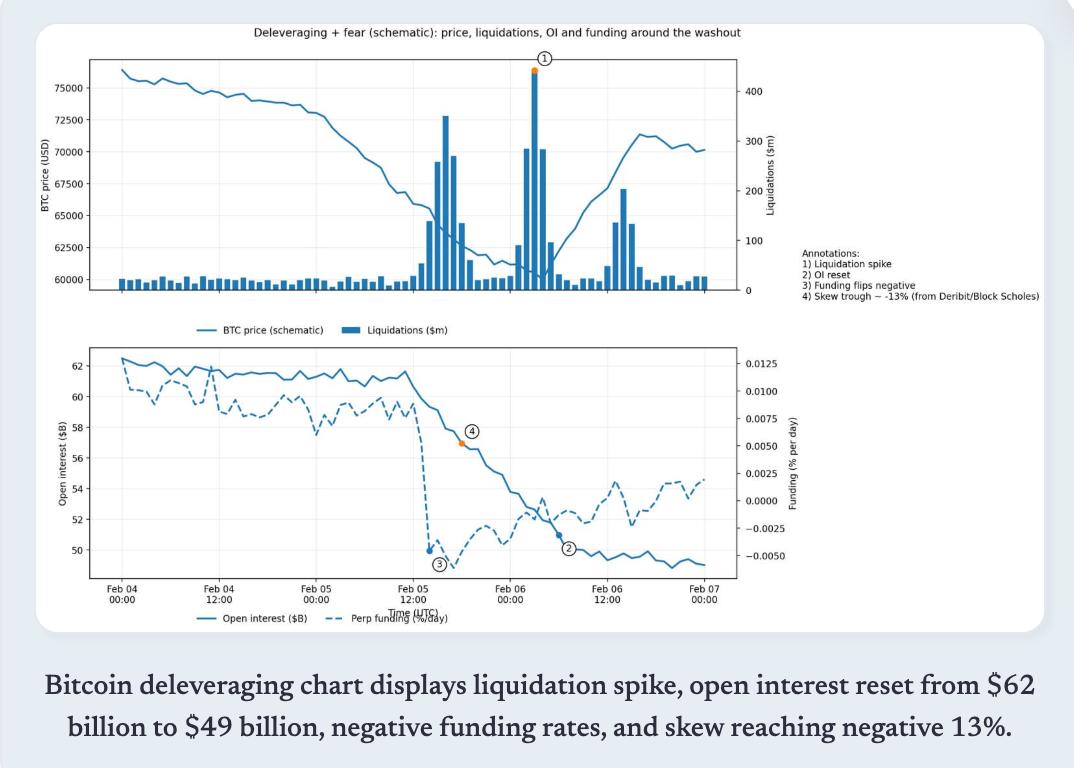

CoinGlass data shows that Bitcoin futures open interest fell from approximately $61 billion to $49 billion last week, indicating that the market has begun deleveraging before the final shock.

The trigger was not cryptocurrency itself. Media reports characterized the sell-off as a deterioration in risk sentiment, primarily driven by a sell-off in tech stocks and volatility in precious metals—silver once plunged 18% to around $72.21, dragging down all related risk assets.

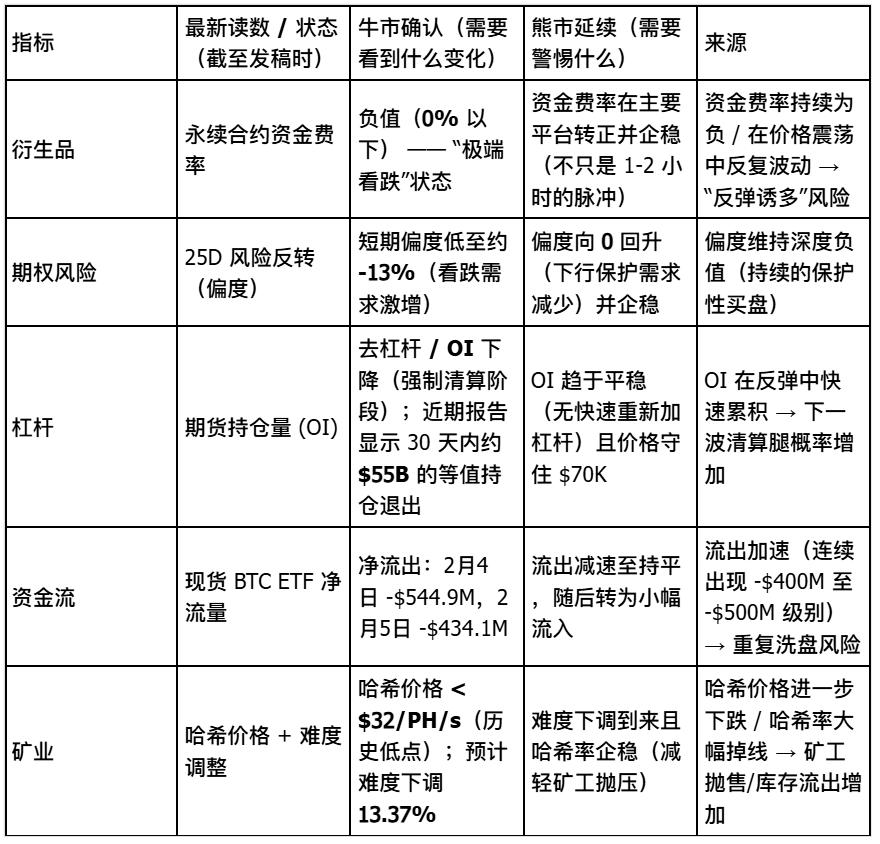

Deribit 's research confirms this spillover effect, pointing out that derivatives sentiment has turned extremely pessimistic: funding rates are negative, the implied volatility term structure is inverted, and the 25-delta risk-reversal skew has been suppressed to approximately -13% .

This is a typical state of "extreme fear," in which position allocation will amplify two-way price fluctuations.

The policy narrative further fueled the fire. According to Reuters, the market reacted sharply to President-elect Donald Trump 's selection of Kevin Warsh as Federal Reserve Chairman, with traders interpreting it as a signal of future balance sheet contraction and tightening liquidity.

Meanwhile, miners are facing significant profit pressure. According to TheMinerMag, the hash price has fallen below $32 per PH/s, and the network difficulty is expected to decrease by approximately 13.37% within two days. However, this mitigation mechanism has not yet taken effect before the price breaks through the support level.

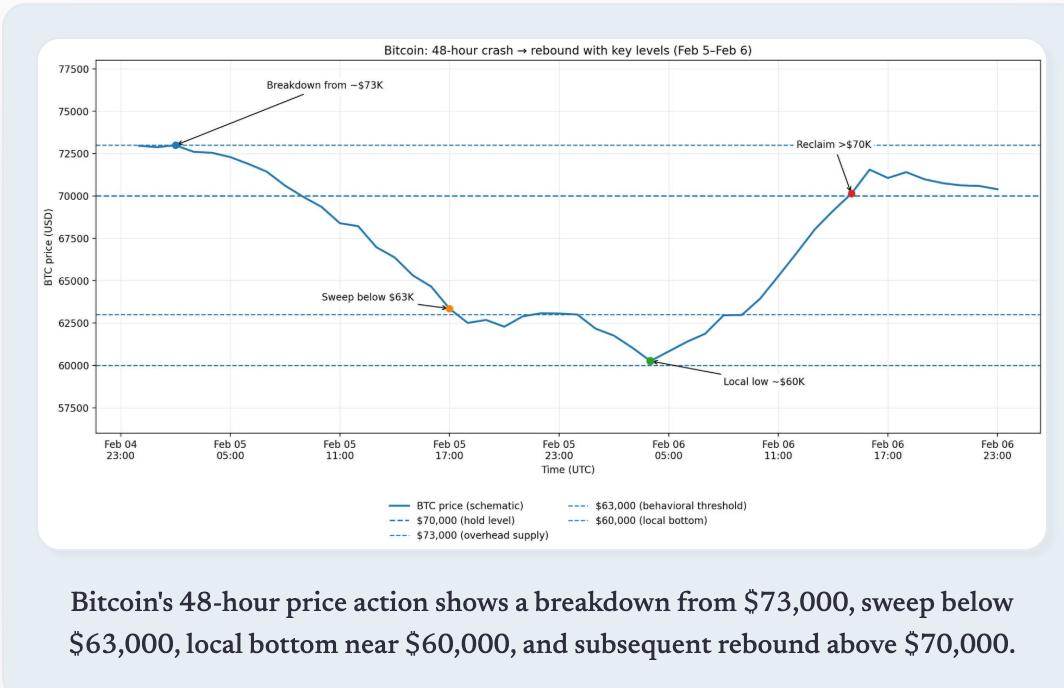

Bitcoin's price action over the past 48 hours shows a crash from $73,000, a stop-loss sell-off below $63,000, a local bottom near $60,000, and a subsequent rebound back above $70,000.

Macroeconomic reversal and squeeze mechanism

The price opened at the previous day's closing price on February 6th, then fell to an intraday low near $60,000 before surging to a high of $71,422. After three unsuccessful attempts to break through that level, the price retreated back below $70,000.

The catalyst didn't originate within the crypto industry, but rather from a sharp turn in cross-asset trends. Wall Street performed strongly: the S&P 500 rose 1.97%, the Nasdaq rose 2.18%, the Dow Jones Industrial Average rose 2.47%, and the Philadelphia Semiconductor Index (SOX) surged 5.7%.

Metal prices rebounded sharply, with gold rising 3.9% and silver rising 8.6%, while the US dollar index fell 0.2%, signaling a loosening of financial conditions.

Bitcoin fluctuates mechanically in response to this shift. The correlation is quite evident: when tech stocks stabilize and metals rebound, Bitcoin is pulled up through shared risk exposure.

However, the ferocity of this rebound also reflects the positioning of derivatives. A near -13% skewness, negative funding rates, and an inverted volatility structure create a condition where any positive macroeconomic news can trigger short-covering and forced rebalancing.

This rebound was essentially driven by liquidity events and amplified by the unwinding of crowded short positions.

Nevertheless, forward signals remain bearish. Derive data shows that among options expiring on February 27, open interest in put options is heavily concentrated at strike prices between $60,000 and $50,000.

Derive's Sean Dawson told Reuters that the demand for downside protection was "extreme." This wasn't hindsight, but rather traders clearly hedging against the risk of another decline, even after the rebound.

The Bitcoin deleveraging chart shows a surge in liquidations, a reset of open interest from $62 billion to $49 billion, negative funding rates, and a skewness that hit -13%.

Can it hold its ground at $70,000? Analytical Framework

The logic of holding $70,000 is based on three conditions.

First, the macro rebound needs to be sustained, tech stocks need to continue stabilizing, and US Treasury yields and the dollar need not to tighten again. This rebound is clearly cross-asset-linked; if US stocks turn downward again, Bitcoin will not be able to remain unaffected.

Secondly, leverage needs to continue to cool down and no new forced sell-offs should occur . Positions have already decreased significantly, reducing the risk of a "vacuum drop."

Third, when the difficulty adjustment takes effect, miner pressure needs to be substantially alleviated. If prices can remain stable within the adjustment window, the expected 13.37% difficulty reduction will decrease marginal selling pressure and allow the hashrate to stabilize.

There are three reasons supporting the view that there will be another market correction:

First, option positioning remains bearish. At the end of February, the largest put options were concentrated in the $60,000-$50,000 range, which is a forward-looking signal embedded in the market's implied probability, rather than a lagging sentiment.

Secondly, derivatives signals remain fragile. Extreme skewness, the recent frequent occurrence of negative funding rates, and inverted volatility structures are more in line with the characteristics of a "relief rally" under a fear-driven system than a trend reversal.

Third, ETF flow data shows continued outflows. As of February 5, the monthly net outflow from Bitcoin ETFs had reached $690 million. Although data for February 6 has not yet been released, existing patterns suggest that institutional allocators have not yet shifted from "de-risking" to "re-engagement".

signal board

The true meaning of $70,000

This price level itself has no magic. Its significance lies in the fact that it sits above Glassnode's established on-chain absorption cluster range of $66,900 to $70,600 .

Holding above $70,000 suggests the cluster has absorbed enough supply to temporarily stabilize prices. However, maintaining this level requires not only technical support but also a return to spot demand, the liquidation of derivatives hedging positions, and a stabilization of institutional flows.

The rebound that started at $60,000 is real, but its composition is crucial. If macroeconomic conditions change, cross-asset stability could reverse.

The forced liquidation of positions created a mechanical bounce, which does not necessarily translate into a sustained trend. Options traders are still pricing in a significant possibility of a drop to $50,000-$60,000 within the next three weeks.

Bitcoin has reclaimed $70,000, but is currently consolidating below that level. This suggests a pause before the next test, the success or failure of which depends on the sequential occurrence of three conditions: sustained macro risk appetite, a slowdown or reversal in ETF outflows, and a return to normalcy in derivatives sentiment.

The market delivered a sharp pullback, but forward curves and flow data suggest that traders haven't yet begun betting on its sustainability. $70,000 is not the end game; it's merely the baseline that will determine the outcome of the next phase of the debate.