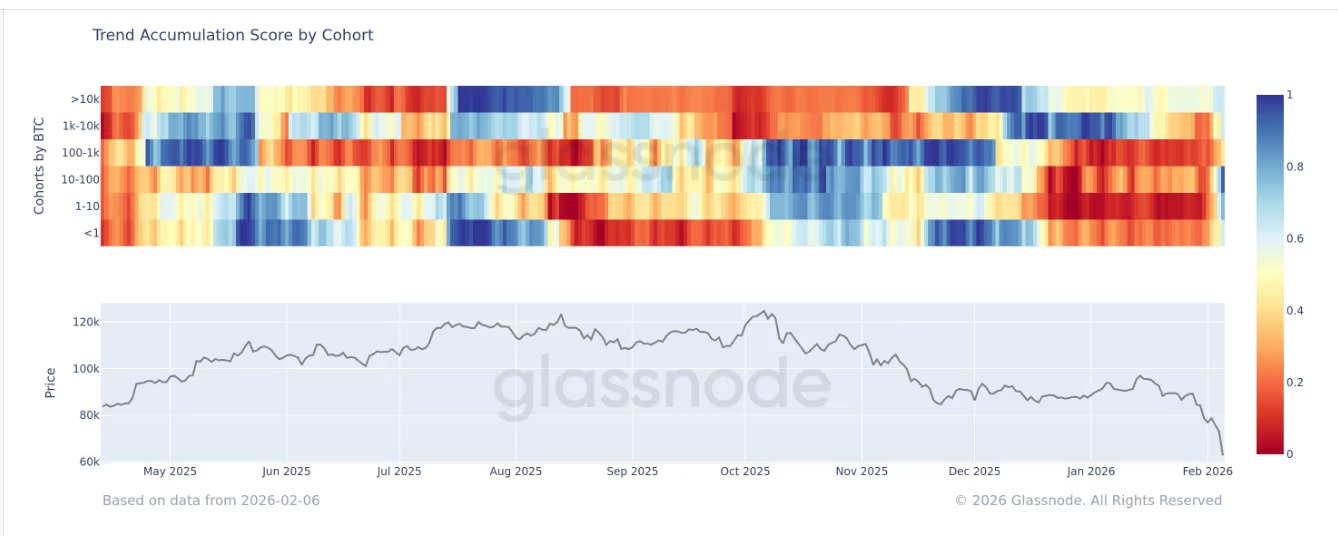

✅ Following the Bitcoin plunge, a general accumulation signal has been detected. 🔍Key Summary • Accumulation trends confirmed across Bitcoin's on-chain indicators following the recent sharp decline (capitulation). • Net inflows increased not only from short-term traders but also from medium- and long-term holders. • A pattern of structural demand returning from a fear zone. 📊On-chain Flows • Increased exchange outflows → Signal of easing selling pressure. • Accumulation spread evenly across small, medium, and large wallets. • After short-term holders cut losses, a relatively strong absorption zone formed. ✅Market Interpretation • Similar to a typical "sudden plunge → surrender selling → structural accumulation" cycle. • Rather than definitively predicting a price rebound, this suggests the possibility of entering a bottoming phase. • Spot-focused demand is recovering after leveraged position liquidation. ✍️ This accumulation is more likely a gradual position buildup following a market-wide risk reset than a short-term bet by a specific group. While short-term volatility remains, this can be interpreted as a sign of improving supply and demand structure from a medium-term perspective. #BTC #Bitcoin #On-ChainData #CryptoMarket

This article is machine translated

Show original

Sector:

Telegram

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share