NOT ENOUGH MONEY LEFT IN THE SYSTEM AND THE MARKET IS CHANGING THE RULES OF THE GAME? We are entering a phase that many people haven't fully realized yet: the market has changed its mode of operation. The problem isn't the outdated narrative or weak psychology. The core of the story lies in a simple yet more difficult-to-accept reality: the global financial system no longer has the surplus of money it once did. 📌 From an era of Capital surplus… to an era of scarcity For over a decade, the market has become accustomed to living in an environment of cheap money and abundant liquidation . Web2, SaaS, and the growth models of the 2010s were all very low- Capital, allowing cheap money and abundant liquidation to spread throughout the system. When Capital cannot find an efficient place to be used, it naturally flows into speculative assets. Crypto is one of the most obvious destinations for that money. But this cycle is gradually coming to an end. 📌 AI capex: no longer "new money" The initial wave of AI spending felt like a new stimulus package. Hundreds of billions of dollars were poured into chips, data centers, and infrastructure, leading many to believe the market still had fuel for growth. This is only true when the system has surplus Capital . When that Capital runs out, every dollar invested in AI must be withdrawn from elsewhere. From here, the market no longer grows thanks to new money, but enters a direct liquidation crunch. 📌 When money is scarce, the market begins to filter out unsuspecting investors. When money is abundant, speculative assets are favored. When money becomes scarce, those very same assets are the first to be eliminated. Rising Capital costs are causing assets heavily revalued based on long-term expectations and distant cash flows. Conversely, assets generating clear cash flows in the short and medium term are becoming more attractive. That's why chip and AI infrastructure stocks have held strong, while crypto – which is extremely sensitive to liquidation – has come under significant pressure. 📌 Crypto always reacts the fastest to liquidation. Crypto isn't weakening because of technology or because the long-term outlook is wrong. Crypto is weakening because it's at the forefront of liquidation conditions. When money is cheap, crypto usually rises first. And when money becomes scarce, crypto also reacts sooner and more strongly than the rest of the market. The feeling of "falling to the Dip" is actually a manifestation of an environment where demand for money exceeds supply, margin trading is tightened, confidence is weakened, and Capital flows shift to a defensive state. 📌 This is not the time for complacency. The current market conditions are not conducive to passively going all-in. This is the time: > Play defensively > Very selective asset selection > Strict risk management This doesn't mean everything is bad. On the contrary, history has repeatedly shown that the biggest opportunities often emerge after periods of the most constrained liquidation . 📌 The long game continues The market is undergoing a process of revaluation and consolidation, forcing a clearer distinction between narrative and true value. It is during such periods that the most sustainable foundations are often built quietly. There's no longer enough money in the system. But the money won't disappear – it will just become more selective. The crucial question is: where do you stand in this screening process? (Source: @plur_daddy)

This article is machine translated

Show original

Upside GM

@gm_upside

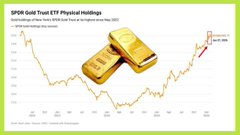

Nhà đầu tư vẫn đang đổ tiền vào các quỹ vàng với tốc độ kỷ lục

Quỹ ETF vàng vật chất lớn nhất thế giới $GLD hiện nắm giữ 34.9 triệu ounce (troy ounce), cao nhất kể từ 05/2022

Chỉ từ 06/2024 đến nay, lượng vàng nắm giữ của quỹ này đã tăng thêm 8 x.com/gm_upside/stat…

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content