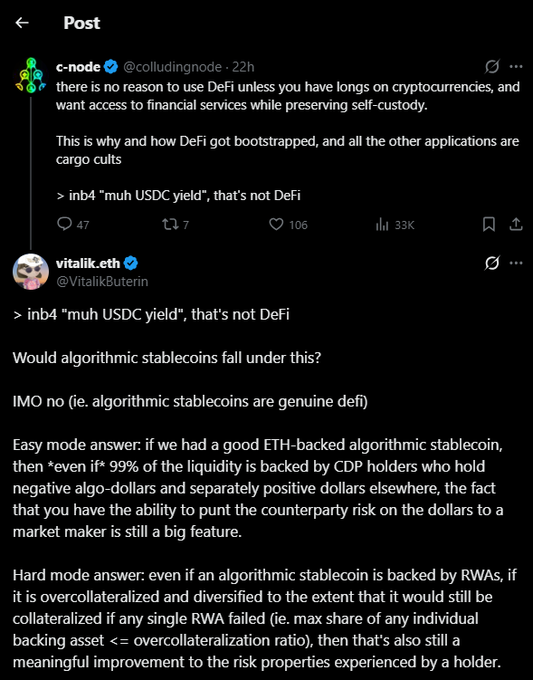

Vitalik Buterin warns that the Ethereum DeFi ecosystem is overly reliant on centralized stablecoins like USDC, creating a “single point of failure” risk. Vitalik criticizes “USDC yield” products for chasing returns without offering true decentralized risk management capabilities. Vitalik advocates for alternative models such as ETH backed stablecoins or highly collateralized, risk-diversifying real-world asset stablecoins. He cites AAVE as an example, where billions of USDC dominate lending operations, to illustrate the current issue. Vitalik's message is that DeFi needs to reduce its reliance on centralized institutions and build a more autonomous and sustainable system in the long term.

This article is machine translated

Show original

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content