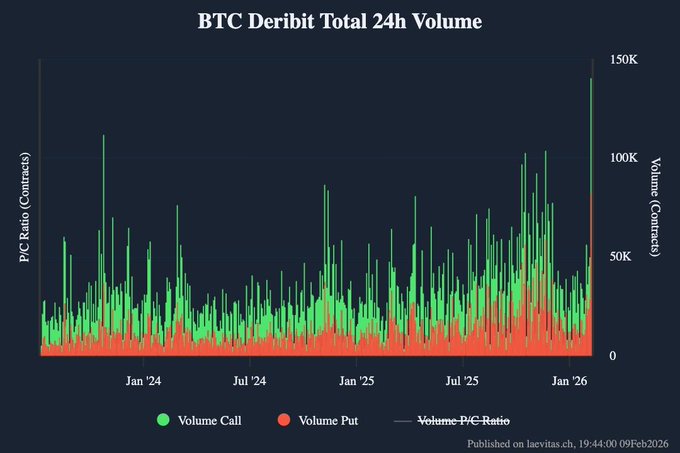

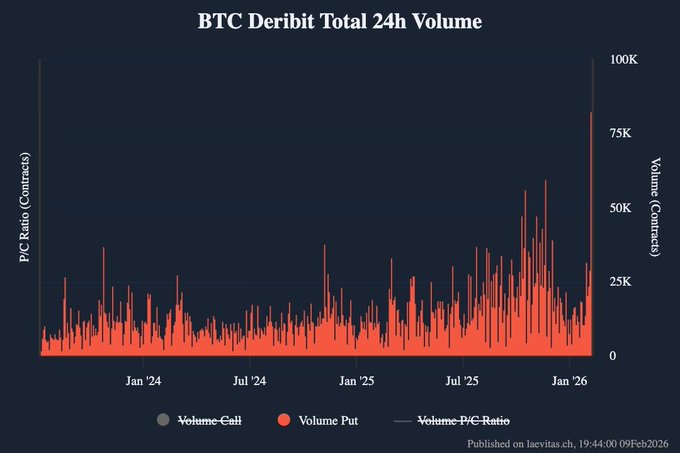

BTC options 24h volume on Deribit surged to a record 140.31k contracts on Feb 5, with 82.08k puts and 58.23k calls. This spike in options activity coincided with a sharp market selloff, as BTC fell nearly 15% to around $62k on Feb 5 before extending losses toward $60k on Feb 6. Put volume reached the highest level on record.

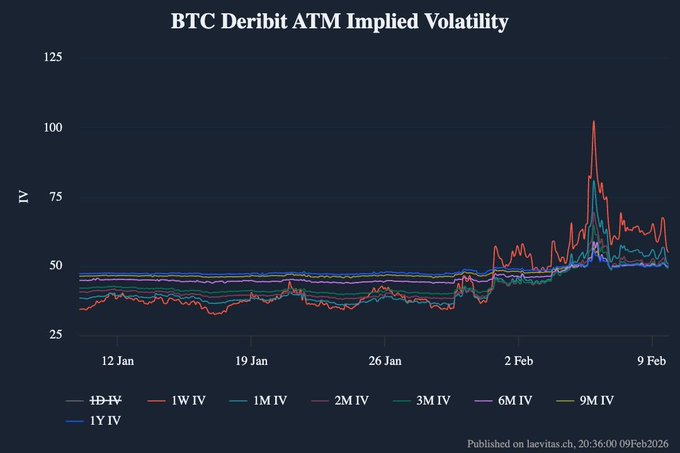

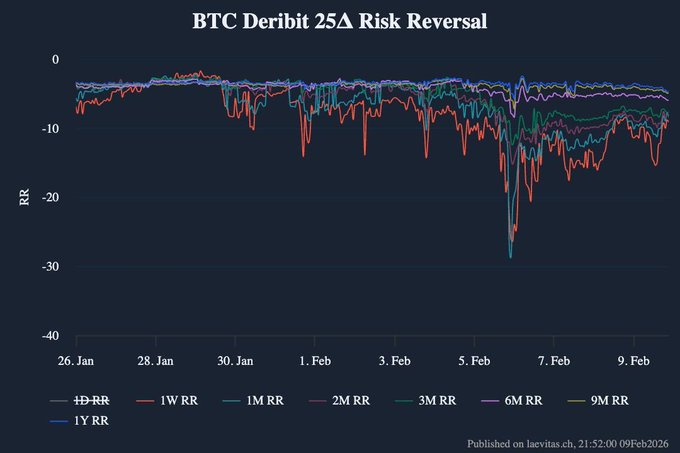

Volatility jumped sharply, with 1-week implied volatility rising to 103.8 vols (about an 82% intraday increase) and 1-month implied volatility climbing from 51 to 80.8 vols. The 1-week 25-delta risk reversal declined sharply to levels last seen in November 2022, with the 1-month skew RR also falling to around –29 vols, reflecting increased demand for downside protection.

Sector:

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content