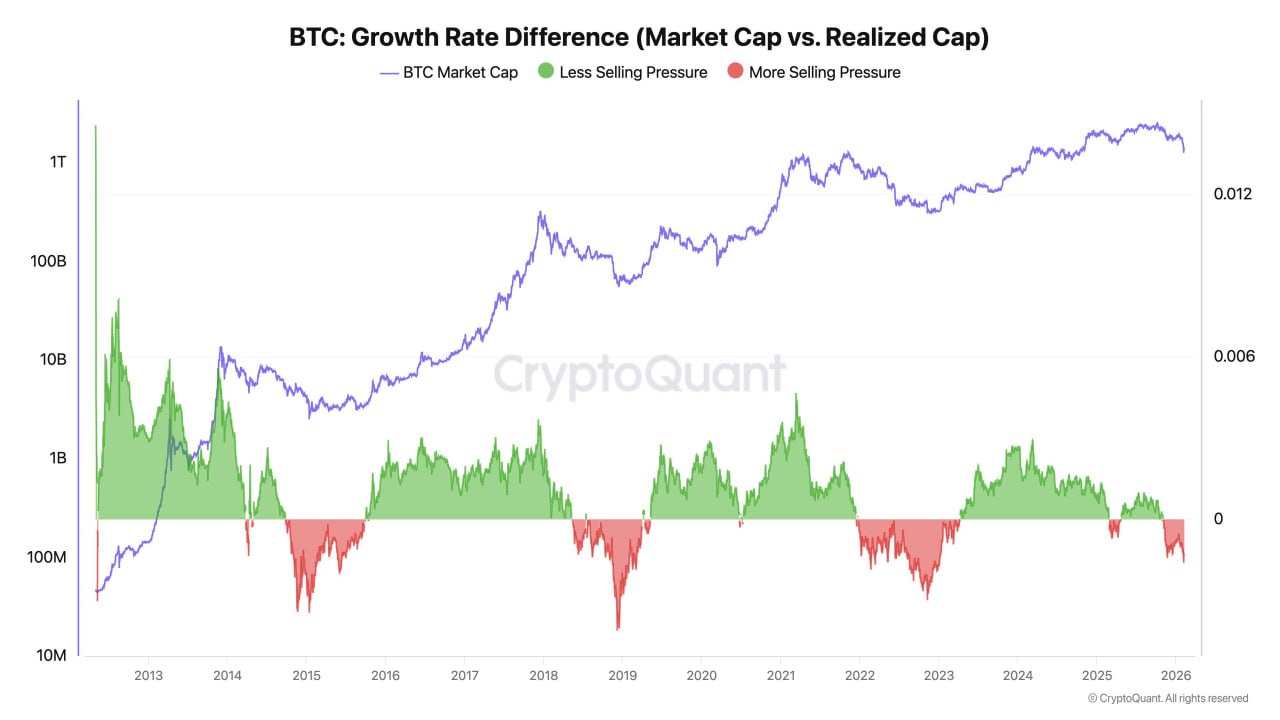

CryptoQuant CEO Ki-Young Joo's Perspective on BTC Bitcoin's Current Structure: "Pumping is Not Possible" 1. Key Conclusion - The current BTC market is experiencing a price slowdown despite capital inflows. - This is because selling pressure exceeds inflows. 2. Changes in Numbers 1) 2024 - $10 billion inflows - BTC market capitalization +$26 billion → Leverage effect occurs when capital inflows. 2) 2025 - $308 billion inflows - BTC market capitalization -$98 billion → Selling volume exceeds inflows. 3. Interpretation of On-Chain Indicators - Green zone: Low selling pressure → Good price response - Red zone: High selling pressure → Price stagnation despite capital inflows. * Currently in the red zone → Pumping is blocked. MSTR-style buying strategies or institutional/financial BTC buying (DATs) are currently not likely to lead to price increases. The effect is limited. Therefore, more important than buying is whether selling pressure has been exhausted! As selling by long-term holders and miners slows, the selling pressure indicator needs to transition from red to green. After that, capital inflow = a return to a rising price structure is possible. The above is CEO Ki-young Joo's perspective. It's not 100% accurate, so please consider it as just another perspective based on on-chain data. (He's the CEO of an on-chain data platform, making a living analyzing this.) Original tweet

This article is machine translated

Show original

Sector:

Telegram

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content