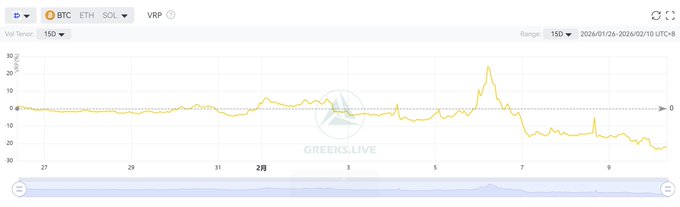

The market has stabilized somewhat, with a significant decrease in implied volatility (IV) for major maturities. However, the actual volatility (RV) over the past week remains high, resulting in a record average decline of 45% for weekly VRP. Specifically, the drop from +20% last week to -25% currently is quite rare. This indicates that the market is rapidly reducing its volatility expectations, perhaps too quickly, given the highly concentrated nature of Bitcoin's volatility. Institutions are overly optimistic, and this lack of caution could leave them vulnerable to a second round of decline. The irrationality in the options market has clearly increased, and institutions are bewildered by recent market movements. Historically, such occurrences often indicate that the bottom has not yet been reached.

This article is machine translated

Show original

Sector:

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content