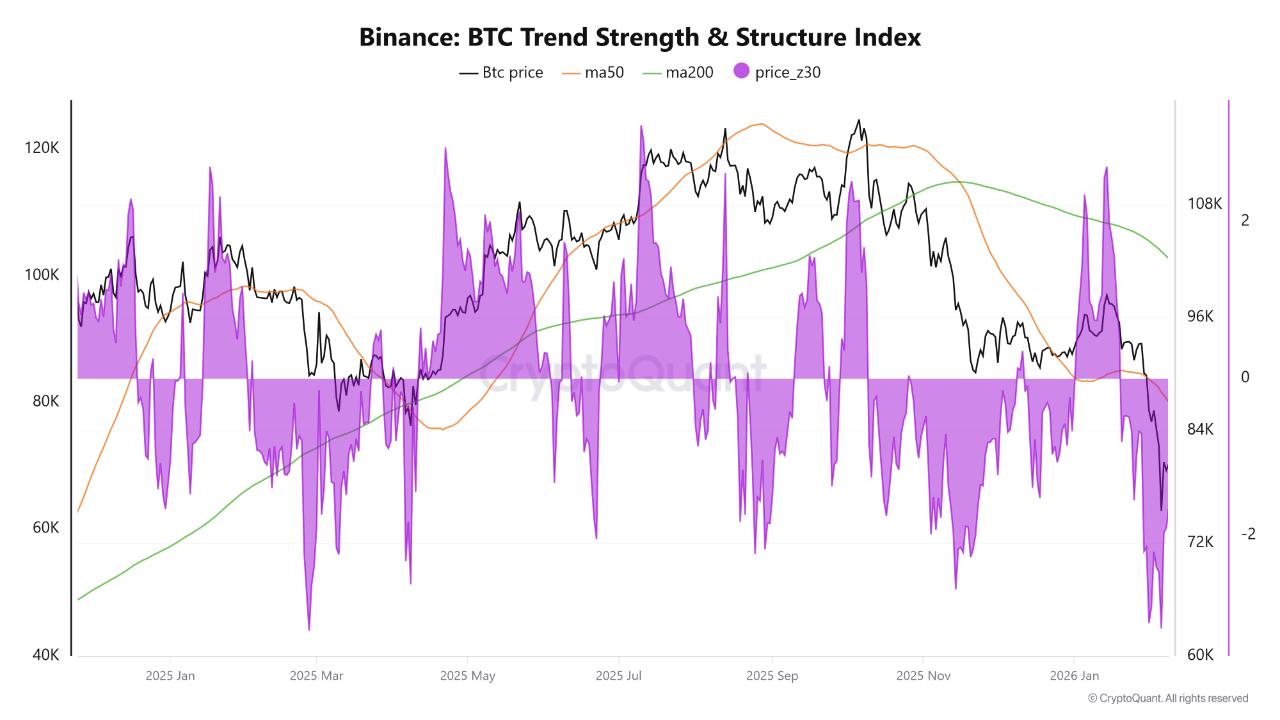

According to TechFlow TechFlow, on February 10th, CryptoQuant data showed that the price of Bitcoin has fallen below the 50-day and 200-day moving averages. The large price difference between the moving averages suggests that the correction after the previous upward trend may be entering a longer "repricing" phase.

In addition, CryptoQuant's Price Z-Score is currently -1.6, indicating that Bitcoin's price is below the statistical average, which usually means increased selling pressure and weakening trend momentum. Historically, similar ranges have more often corresponded to a longer period of bottoming out rather than a rapid rebound.

In the derivatives market, crypto analyst Darkfost pointed out that the seller-dominated pattern is strengthening. Data shows that the net active trading volume on Sunday turned negative to -$272 million last week. At the same time, the active buy/sell ratio on Binance fell below 1, indicating that the selling pressure in the market has increased significantly. Currently, the futures trading volume is still significantly higher than the spot inflow, and the market needs stronger spot buying to trigger a rebound.