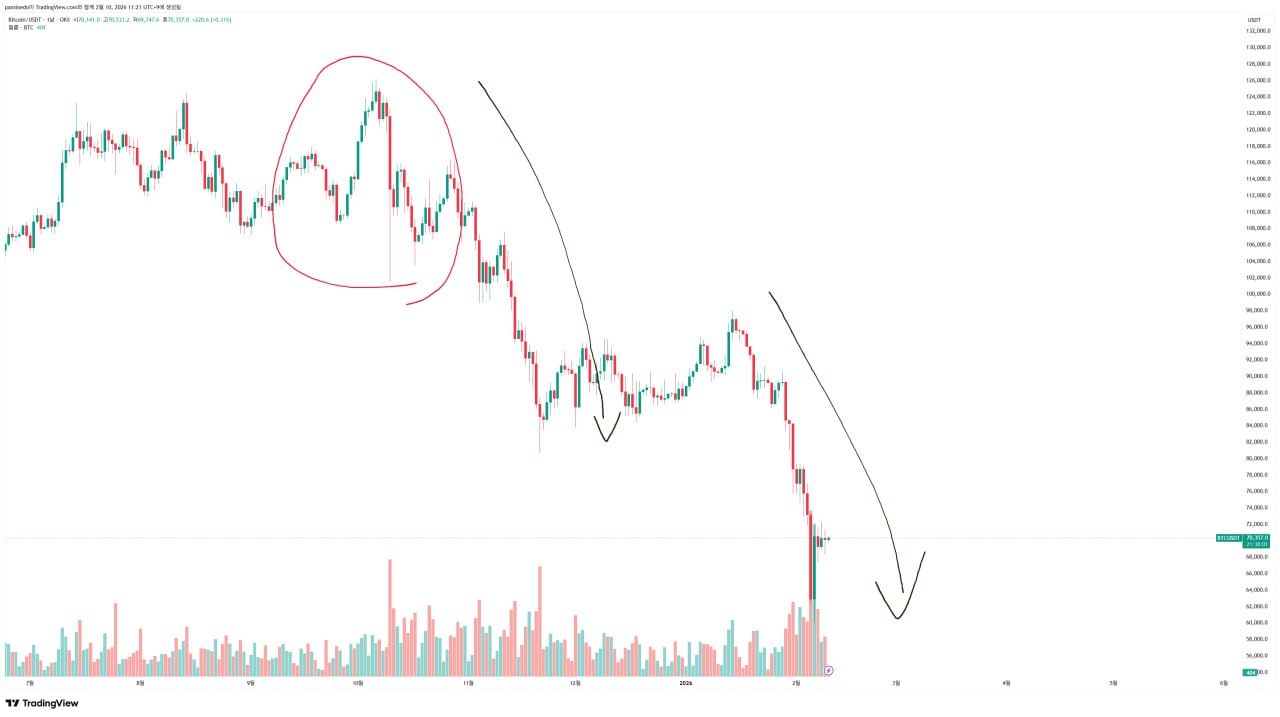

🐈⬛ Regarding the movement of Perpetual DEX after the BTC Crush Now, various reasons are being proposed for the significant drop in October, but none have been clearly identified. At the time, one of the reasons was believed to be the clearing of an excessively high O.I. The excessively high O.I. was due to the trading volume of the Perpetual DEX, which was very popular at the time. While trading volume was important, maintaining the O.I. was also a significant factor, so many people used it to hedge long and short positions. And that was all destroyed by the crush in mid-October. I also remember ADL being a hot topic at the time. (For the record, ADL was a system that had been around for a long time, so I didn't quite understand why it was being talked about.) The interesting thing is the second attached data. After the crush in October, the volume of Perpetual DEX fell by approximately 35% until the end of December. But fear still lingers, as the O.I. value in the third photo has yet to recover since the October crush. (Interestingly, Aster's O.I. rose significantly on the day of the crush.) So, has everything been resolved and the market is now clear? The current O.I. value is similar to that of May last year. Back then, Bitcoin's price was around 100,000. Now, it's around 70,000. This could mean several things, but it clearly indicates that the market has entered a deleveraging phase. As you can see in the fourth photo, Bitcoin's O.I. on CEX has actually fallen quite a bit. Compared to previous O.I levels, the price is similar to the O.I. value around 60,000. In other words, the gap between O.I and price is not significant at present. The market has indeed entered a deleveraging phase. It's unclear whether this is a bearish or normalizing sign. Interpretations of this unpaid commitment will vary from person to person, but we'll have some more interesting information to share with you soon.

This article is machine translated

Show original

Sector:

Telegram

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content