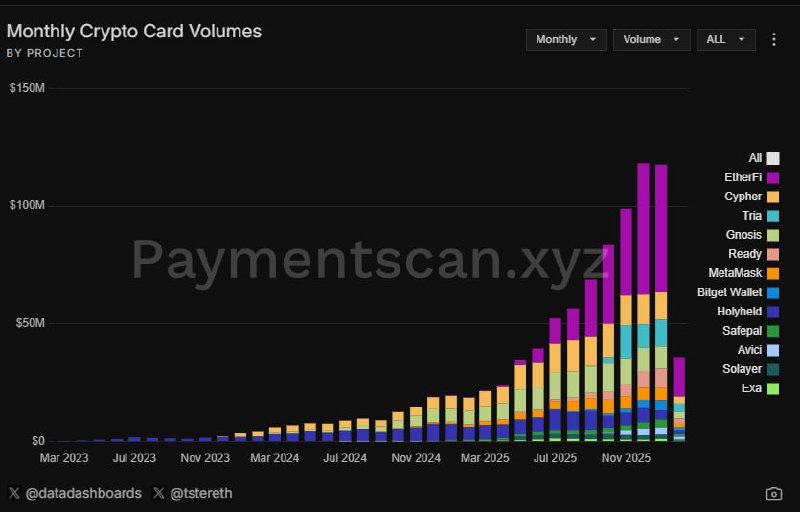

✔️Tria Neobank Still Sees Light FDV in the Sector It's been over a week since Tria launched. With the recent surge in listings, including the Banaan Futures, the market has been stagnant for a while. 1️⃣ TRIA's Position in the Neobank Competition (Based on PaymentsCan) • 1st: ETHFI • 2nd: TRIA • 3rd: GNO 2️⃣ Core to Growth: 'Self-Custodial Neobank' • Structure that Does Not Entrust Assets to the Platform • Self-Custodial System with User Control • Adopts a Crypto-Native Architecture While Maintaining a Bank-Style UX 3️⃣ FDV Comparison TRIA's current FDV is approximately $160-$170M • TRIA: ~$160M • ETHFI: ~$450M • GNO: ~$380M 4️⃣ TRIA's Performance in Numbers, Five Months After Launch • Cumulative Project Revenue: $4M+ • Number of Users: 350,000+ (180 Countries) • Cumulative Transaction Volume: $170M+ • Global Ambassadors: 12,000+ users • BestPath cumulative processed revenue: $140M+ • In-app Earn and futures trading features already launched • Future expansion plans for airline and hotel payment services ✍️Tria is a project demonstrating both usage metrics and structure in the neobank sector. Its current FDV is lower than that of its competitors, suggesting room for improvement in relative comparison within the sector. I believe that once the market stabilizes, the neobank sector as a whole will likely receive renewed attention.

This article is machine translated

Show original

Telegram

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content