Grayscale Bitcoin Mini Trust ranks first with $130.5 million, while BlackRock IBIT sees $20.9 million in outflows.

Ethereum ETFs led by Fidelity FETH with $67.3 million, while BlackRock ETHA saw $45 million in outflows.

Grayscale BTC dominates with $130.5 million

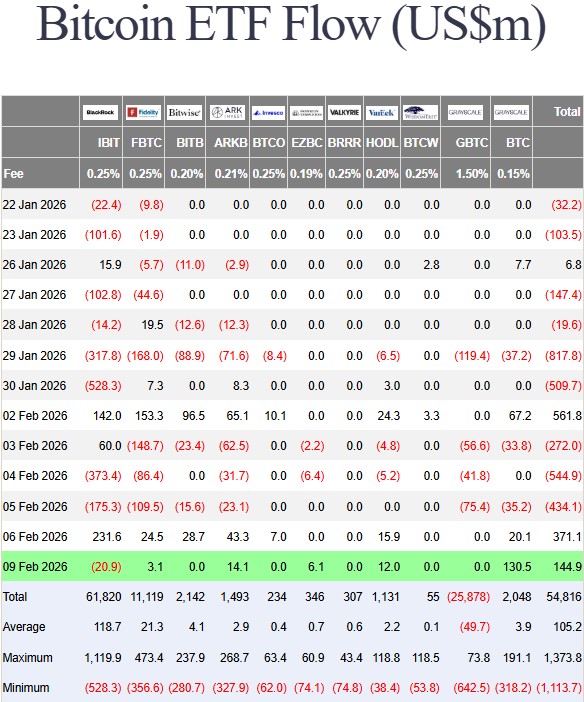

Looking at the flow of funds into US Bitcoin spot ETFs on the 9th, Grayscale's Bitcoin Mini Trust (BTC) took the overwhelming lead, recording a net inflow of $130.5 million (KRW 191.1 billion). This represents approximately 90% of total Bitcoin ETF net inflows, demonstrating that investors are focusing their funds on Grayscale's low-cost products.

Ark Invest's ARKB ranked second with $14.1 million (KRW 20.6 billion), while VanEck's HODL ranked third with $12 million (KRW 17.6 billion). Franklin Templeton's EZBC and Fidelity's FBTC each recorded net inflows of $6.1 million (KRW 8.9 billion), and $3.1 million (KRW 4.5 billion), respectively.

BlackRock IBIT suffers net outflows of $20.9 million, marking the sixth consecutive day of outflows.

Meanwhile, BlackRock's iShares Bitcoin Trust (IBIT) recorded a net outflow of $20.9 million (KRW 30.6 billion). According to data from Farside Investors, IBIT has been recording net outflows for six consecutive trading days, from the 2nd to the 9th. On the 6th, it experienced a massive outflow of $231.6 million (KRW 339 billion), the largest single outflow in recent history.

IBIT has led the Bitcoin spot ETF market since its launch, but has recently seen continued outflows as investors shift their funds to lower-cost alternatives. BlackRock remains the largest Bitcoin ETF operator, but its market share is gradually declining due to intensifying competition.

Fidelity FETH, the Ethereum ETF, ranked first with $67.3 million.

On the same day, US Ethereum spot ETFs recorded net inflows of $57 million (KRW 83.4 billion). According to data from Farside Investors, Fidelity's FETH attracted the most funds, with $67.3 million (KRW 98.5 billion).

Grayscale's Ethereum Mini Trust (ETH) saw a net inflow of $44.6 million (KRW 65.3 billion). Conversely, BlackRock's ETHA saw net outflows of $45 million (KRW 65.9 billion), and Bitwise's ETHW saw net outflows of $9.9 million (KRW 14.5 billion). BlackRock saw significant investor outflows from both its Bitcoin and Ethereum ETFs.

Bitcoin ETFs See Increased Volatility in February

Bitcoin spot ETFs have seen significant fund flow volatility this month. While they recorded a massive net inflow of $562 million (KRW 822.8 billion) on the 3rd, this shifted to a net outflow of $544.9 million (KRW 797.8 billion) on the 4th. Since then, they have experienced volatility, with inflows of $369.8 million (KRW 541.4 billion) on the 5th and outflows of $144.2 million (KRW 211.1 billion) on the 6th.

Joohoon Choi joohoon@blockstreet.co.kr