New data from Artemis shows that Hyperliquid, an on-chain Derivative platform, has surpassed Coinbase in nominal volume . Notably, Coinbase has long been XEM the largest exchange by volume in the US.

Hyperliquid's growth is forcing the crypto industry to XEM long-held assumptions about where large-scale trading activity actually takes place.

Hyperliquid surpasses Coinbase in volume.

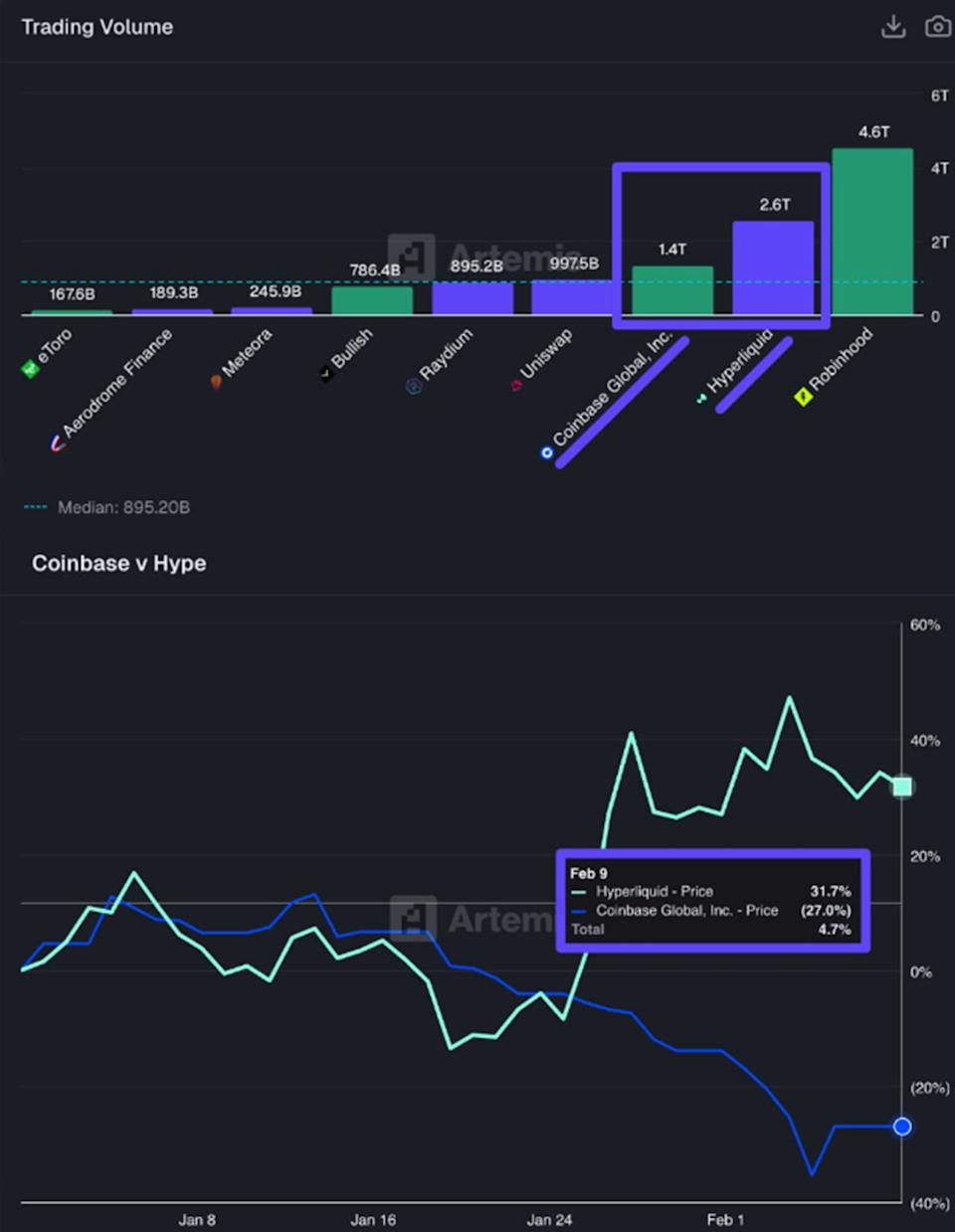

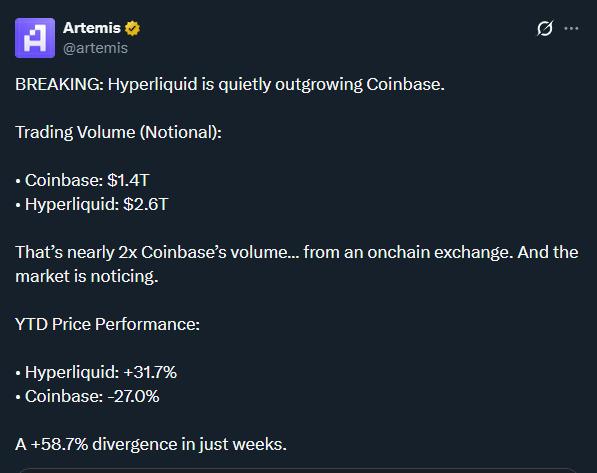

According to Artemis, Hyperliquid recorded approximately $2.6 trillion in notional volume , compared to Coinbase's $1.4 trillion – almost double. This is one of the clearest signals that high-performance on-chain platforms are gaining increasing market share in the global Derivative market.This milestone has sparked debate about whether decentralized exchanges are beginning to compete with centralized exchanges in terms of scale and influence.

“Hyperliquid is quietly overtaking Coinbase. (Nominal) volume : Coinbase $1.4 trillion, Hyperliquid $2.6 trillion – nearly double Coinbase… all from an on-chain exchange. And the market is paying attention,” Artemis observed.

The gap isn't just in volume. YTD performance data shows a strong divergence: Hyperliquid has risen 31.7% , while Coinbase has fallen 27.0% , creating a performance difference of 58.7% in just a few weeks.

According to analysts, this divergence reflects deeper structural changes rather than short-term volatility. Anthony, a data analyst at Artemis, emphasizes that fundamental indicators are playing an increasingly significant Vai in shaping market sentiment.

This observation reflects the growing belief that liquidation, order execution quality, and user activity levels are influencing valuation and investment narratives, rather than relying solely on brand name.

One question that arises is why Binance – the world's largest crypto Derivative exchange – wasn't included in the comparison. The reason lies in the measurement methodology and the narrative the data tells. Artemis's analysis focuses on Hyperliquid outperforming Coinbase, a large centralized exchange with a focus on Spot Trading and tightly regulated markets.

Therefore, this milestone reflects a shift in market structure , rather than a direct challenge to the largest Derivative exchange.

Binance remains the dominant player in the perpetual Futures Contract , with over $53 billion in daily Derivative volume according to data from Coingecko, far exceeding Hyperliquid's $6.4 billion .

Hyperliquid's surge has sparked a new debate about the control of crypto trading.

This data has sparked strong reactions within the crypto community, highlighting the long-standing tension between centralized and decentralized trading models.For some, the rise of Hyperliquid is proof of the potential of the on-chain market; while others are taking advantage of this moment to criticize centralized exchanges. This perspective reflects the belief that transparent on-chain systems reduce counterparty risk and improve market fairness.

Conversely, defenders of centralized exchanges argue that they still have an advantage in terms of fiat gateways, legal integration, and accessibility for retail investors.

The most significant consequence of Hyperliquid's growth is a shift in the competitive landscape. Instead of simply being compared to other DEX platforms, the platform is increasingly being pitted against large, centralized Derivative exchanges.

Hyperliquid Hub, a community account that monitors the ecosystem, claims that Hyperliquid has surpassed most decentralized competitors.

“Hyperliquid currently absolutely dominates the on-chain Derivative market. At this point, Hyperliquid is only comparable to large centralized exchanges like Binance, OKX , and Bybit. Other DEX perps have been left far behind in terms of technology, liquidation depth, and overall performance,” they wrote.

If this view continues to spread, it could mark a turning point in how traders evaluate order execution locations: whether centralized or decentralized will no longer be as important as liquidation, speed, and reliability .

While Coinbase remains one of the largest and most tightly regulated crypto platforms globally, Hyperliquid's surge demonstrates just how quickly the structure of the digital asset market can change.

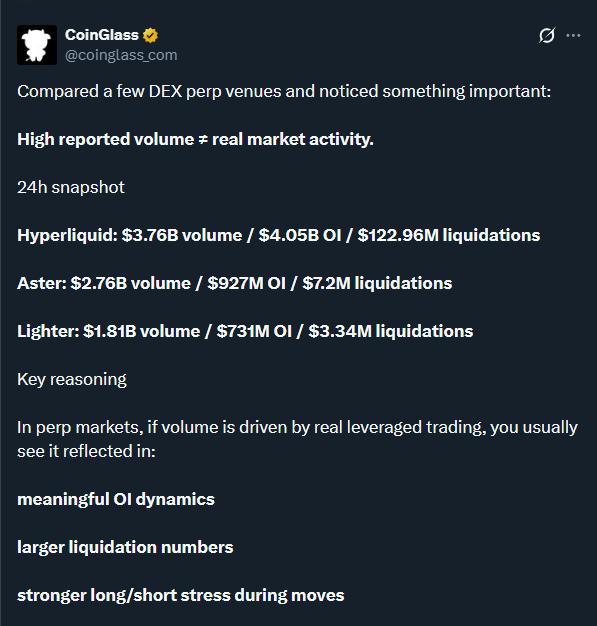

However, challenges remain, as data from Coinglass shows significant discrepancies between volume, open interest, and liquidation across DEX platforms.

As BeInCrypto has reported, the industry remains divided on the standards for defining “real trading activity” in the decentralized Derivative market. Furthermore, some industry leaders, such as Kyle Samani, have expressed doubts about the integrity of Hyperliquid, arguing that the DEX “in many respects represents the worst aspects of crypto.”