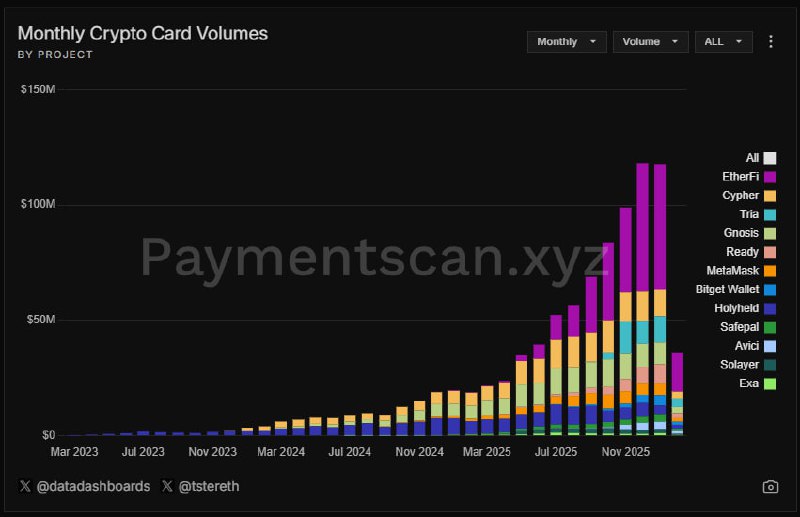

TRIA Neobank Achieves 2nd Place, But Still Half the Market Cap of Its Competitors ✅ Just five months after its launch, TRIA has become the world's second-largest neobank, following Ethereum, but its FDV still appears significantly lower than its benchmarks. Based on FDV, $TRIA is around $160-170M, which is still less than half the market cap of similarly positioned projects like $ETHFI ($450M) and $GNO ($380M). This is especially true considering that its identity as a self-custody-based neobank has a significant impact on users. This may be due to the fact that the TGE took place during the peak of Bitcoin's price decline. - Hits Binance, Kobe, Bybit, and OKX - $4M in cumulative revenue, 350,000 users, and $170M in trading volume in five months - Over 60 protocols connected - Earn and futures trading available within the TRIA app - Flight and hotel booking features coming soon - Team from Binance, Polygon, and Intel - Backers include Ethereum Foundation C-level, P2 Ventures, Wintermute, Polygon's $12M investment, and Polychain Advisors This project has been a source of confidence and support since its inception, but I still think it's undervalued.

This article is machine translated

Show original

Sector:

Telegram

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content