This article is machine translated

Show original

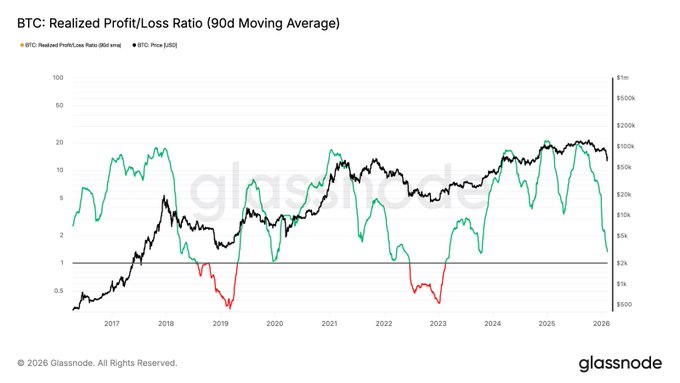

Pay attention to the 90-day moving average profit-taking/loss-cutting ratio indicator on Glassnode. This market crash is mainly eliminating profitable positions, not the mass sell-offs and capitulation seen in Q4 2018–Q1 2019 and Q2 2022–Q1 2023. In other words, if we're just trying to salvage the situation by clinging to outdated methods, BTC's profitable positions are far from being cleared out, and the bear market hasn't truly begun yet. 🤪

glassnode

@glassnode

🔄UPDATE:

The Realized Profit/Loss Ratio (90D-SMA) continues to trend lower (~1.32), approaching 1, echoing diminishing liquidity.

Historically, a sustained break below 1 has overlapped with broad-based capitulation, where realized losses outpace profit-taking across the market. x.com/glassnode/stat…

Bro, I'm scared 😱

It's the same cut sooner or later, it's the same cut either way.

Sector:

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content