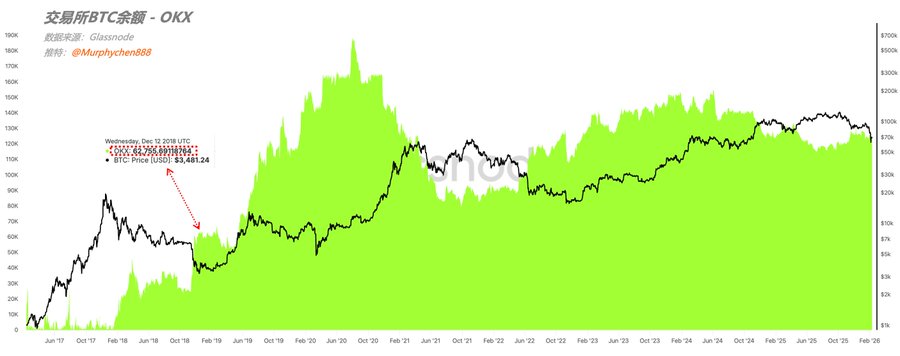

When I first saw the news of 50,000 BTC long contracts being liquidated, I was genuinely shocked! Given the current market's fragility, it couldn't withstand such a blow. But upon closer inspection, thankfully… that happened in 2018. Anyway, the market is incredibly boring right now; we can only pass the time by watching the drama unfold. If all else fails, we can dig into history and write a historical drama—that would be entertaining. What did 50,000 BTC mean back then? I actually looked up some relevant data with great interest: 1. In 2018, OKX's highest BTC balance was 62,755; 2. In 2018, OKX's on-chain BTC reserves had a USD value of $34.18 million, roughly equivalent to 8,500 BTC at the time. These figures are insignificant now, but back then they were top-tier in the industry. Against this backdrop, no exchange would allow something with such exceptionally high potential risk to occur. After all, this isn't about making or losing money; it's about revolution—a revolution in the exchange industry itself. As the saying goes, "once bitten, twice shy," and with the development of the industry, after experiencing a series of sudden risk events, all exchanges have now raised their standards for "risk reserves" and "on-chain reserves." For platforms, security, stability, responsive service, and the ability to maintain continuous liquidity during periods of high volatility are the core competitive advantages that will allow them to gain more user trust in the future.

This article is machine translated

Show original

海腾

@Haiteng_okx

这个事件发生在2018年,该用户当年通过高杠杆短时间内建立异常大量的BTC多头仓位,并在平台基于风控多次提出“减仓要求”后拒绝配合,对市场的稳定产生重大影响。根据用户协议对相关账户执行冻结,后续由于杠杆倍率过高和BTC价格下降最终爆仓。如果,当时没有及时制止这种市场操控行为,会对所有交易用户

Sector:

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share