Brian Armstrong, co-founder and CEO of Coinbase, has dropped out of Bloomberg's list of the world's 500 richest people.

Brian Armstrong, co-founder and CEO of Coinbase, has dropped out of Bloomberg's list of the world's 500 richest people.

Armstrong's wealth has decreased by more than $10 billion since July 2025. According to the Bloomberg Billionaires Index, his net worth has fallen from a peak of $17.7 billion to approximately $7.5 billion.

Armstrong's fortune plummeted as Coinbase and Bitcoin shares fell sharply.

The latest decline comes after JPMorgan lowered its price target for Coinbase stock by 27% on February 10, citing weakening crypto prices, declining volume , and slowing stablecoin adoption.

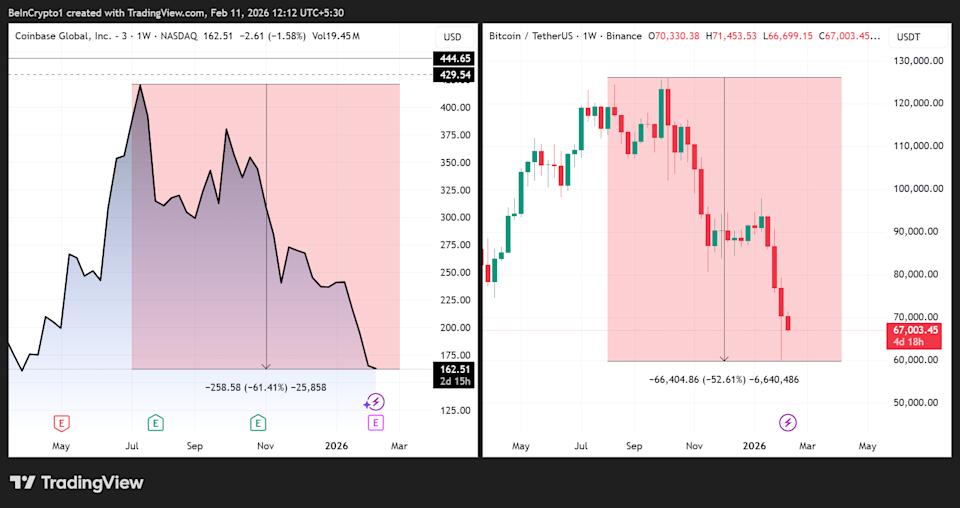

Coinbase stock has moved in tandem with Bitcoin, falling 60% from its peak on July 18th, while Bitcoin has dropped nearly 50% from its all-time high of around $126,000 in early October 2025 to below $63,000 as of early February 2026.

Armstrong's wealth is tied to his 14% stake in Coinbase, the New York-based crypto trading platform he co-founded with Fred Ehrsam in 2012.

He also holds investments in NewLimit, a biotech startup focused on longevity, and has previously sold off a portion of his Coinbase stake over time.

Despite incurring significant losses on the books, Armstrong remains a billionaire, with an estimated net worth of around $7.5 billion.

The impact of the crypto downturn didn't just affect Armstrong. Cameron and Tyler Winklevoss, co-founders of Gemini, saw their net worth drop to $1.9 billion each from $8.2 billion in October 2025.

Gemini recently announced plans to cut approximately 25% of its workforce and scale back some international operations.

Michael Novogratz, CEO of Galaxy Digital, saw his net worth drop from $10.3 billion to $6.2 billion after a larger-than-expected $500 million loss in the fourth quarter of 2025.

Strategy Inc. co-founder Michael Saylor also lost about two-thirds of his fortune, bringing his net worth down to $3.4 billion.

Coinbase navigates market challenges while Armstrong remains optimistic.

Coinbase itself is also facing operational challenges amidst a declining market. Volume has dropped sharply, and Q4 2025 trading revenue is projected to decrease by 33.5% year-on-year.

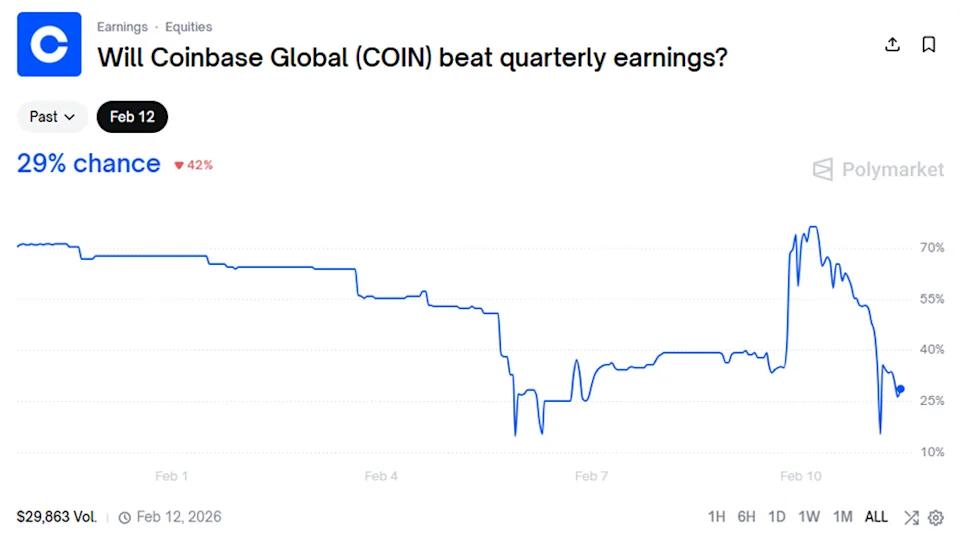

Meanwhile, those betting on Polymarket believe there is a 29% chance that Coinbase Global's GAAP earnings per share (GAAP EPS) for the relevant quarter will exceed $0.61.

During the sell-off, the "Coinbase premium"—the price difference between BTC on Coinbase and other exchanges—turned negative. This indicates weaker institutional demand in the US and the potential for capital outflows.

This exchange also faces additional challenges from regulatory oversight and competition from other crypto platforms such as Hyperliquid.

Despite the volatile environment, Armstrong maintained a long-term optimistic outlook. He publicly described crypto as "devouring financial services at an incredible pace" and viewed market downturns as opportunities to build new products.

Armstrong also predicted that Bitcoin could reach $1 million by 2030, XEM the digital asset as a tool for asset balancing and financial innovation.

However, despite the significant impact on Armstrong's assets, his position as founder and major shareholder is likely to be strengthened over time.

Historically, periods of recession often strengthen the power of surviving platforms, and Coinbase could emerge more streamlined and dominant if adoption from individual and institutional investors recovers.

However, a prolonged weak market or a full-blown “crypto winter” could put pressure on growth and challenge leadership strategies.

The recent wave of losses reflects the high volatility of the crypto market. Armstrong's drop out of the Bloomberg Top 500 indicates a sharp contraction in his book value, but long-term crypto pioneers like him have weathered numerous market cycles since 2012.