This article is machine translated

Show original

SOL's Top-Selling Review: This drop saw SOL fall to a low of 67, a true leg-slashing move from its high point 🤧. I'd like to take this opportunity to review my trading.

I'd give myself an 85 out of 100 for how well SOL managed to escape the top in this round.

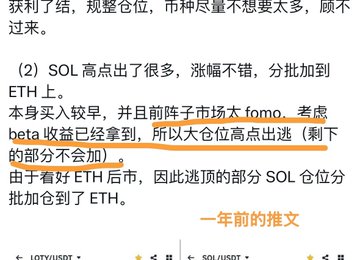

I sold 70% of my position at around 245, the average price at the peak.

This portion of the position was rotated, and subsequent low-level purchases were made all the way to ETH.

(I tweeted about this before, so I won't go into detail here.)

I have a love-hate relationship with SOL this round 🤣

Love: This round of SOL did indeed bring me good results. Hate: Because of certain technical flaws in this chain, I, as someone with a technical background, am not satisfied with it, so I am unwilling to hold it for longer.

Looking back, it was precisely this caution that allowed me to steel myself and take profits at the peak (although I didn't sell everything).

Actually, for a while when SOL was at its peak, I was bearish on it and bullish on Ethereum. Because at that time, based on a comprehensive assessment, I thought Ethereum at 2000 was cheaper and safer than SOL at 260, so I wanted to switch positions to capture the later gains in Ethereum.

Although many group members were more optimistic about SOL at the time, especially regarding Trump's interpretation of issuing tokens on SOL, which I thought was too optimistic and not enough to convince me, I still believed in my own judgment and took profits and switched positions.

Looking back now, it was the right decision.

The remaining 30% position was intended to see if it could break through 300 in a FOMO (Fear of Monetary) wave.

The fact is, it wasn't broken...

I wouldn't say I'm disappointed, after all, its overall gains in this round have been substantial.

Based on the cyclical analysis, retaining this small portion of the position was essentially a gamble. However, position management taught me how to gamble more effectively so as not to be a loser, and in hindsight, it was the right thing to do.

After all, the pain I experienced with BCH in the last round was too profound, and I am unwilling and will not fall into the same trap twice, which is also my advantage.

A while ago I told everyone to sell all kinds of cryptocurrencies, which for me included SOL.

The remaining position lost its profits, so I have to accept the loss 🤧.

Regarding my successful exit strategy on SOL, here are some points I'm satisfied with:

1. Able to take profits in batches, retaining most of the profits.

2. Be able to admit defeat in time and retain the remaining profits.

Actually, at that time, everyone on the internet was waiting for 500, and some were even calling for 1000. Many Ethereum KOLs switched cross margin to SOL, and then SOL started to plummet.

I think my more rational point is to stick to my principles. I won't force myself to overcome technical hurdles that I can't overcome in my mind. I'll earn money within my understanding.

At the same time, take profits in batches and exit at the top, without being fomomaginated because of the fomomagination across the entire network.

Looking at it this way, 80 points seems like I didn't give myself enough points 🤧

最爱吃兽奶的兔

@0xMilkRabbit

02-05

OKB 喊大家逃顶成功!

随着大盘吐血 ,

OKB 从高点 258 跌回 77,

回头看,这轮 OKB 逃顶逃的相当漂亮🤤

兔三桂在拉盘过程分三批落袋,

去年 8 月底全部跑路(之前推文发过这里不再赘述)。

兔三桂的碎碎念: x.com/0xMilkRabbit/s…

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content