Over the past 24 hours, there has been a massive liquidation of positions in the cryptocurrency market. This liquidation was particularly concentrated in long positions, driven by the price declines of Bitcoin and major altcoins.

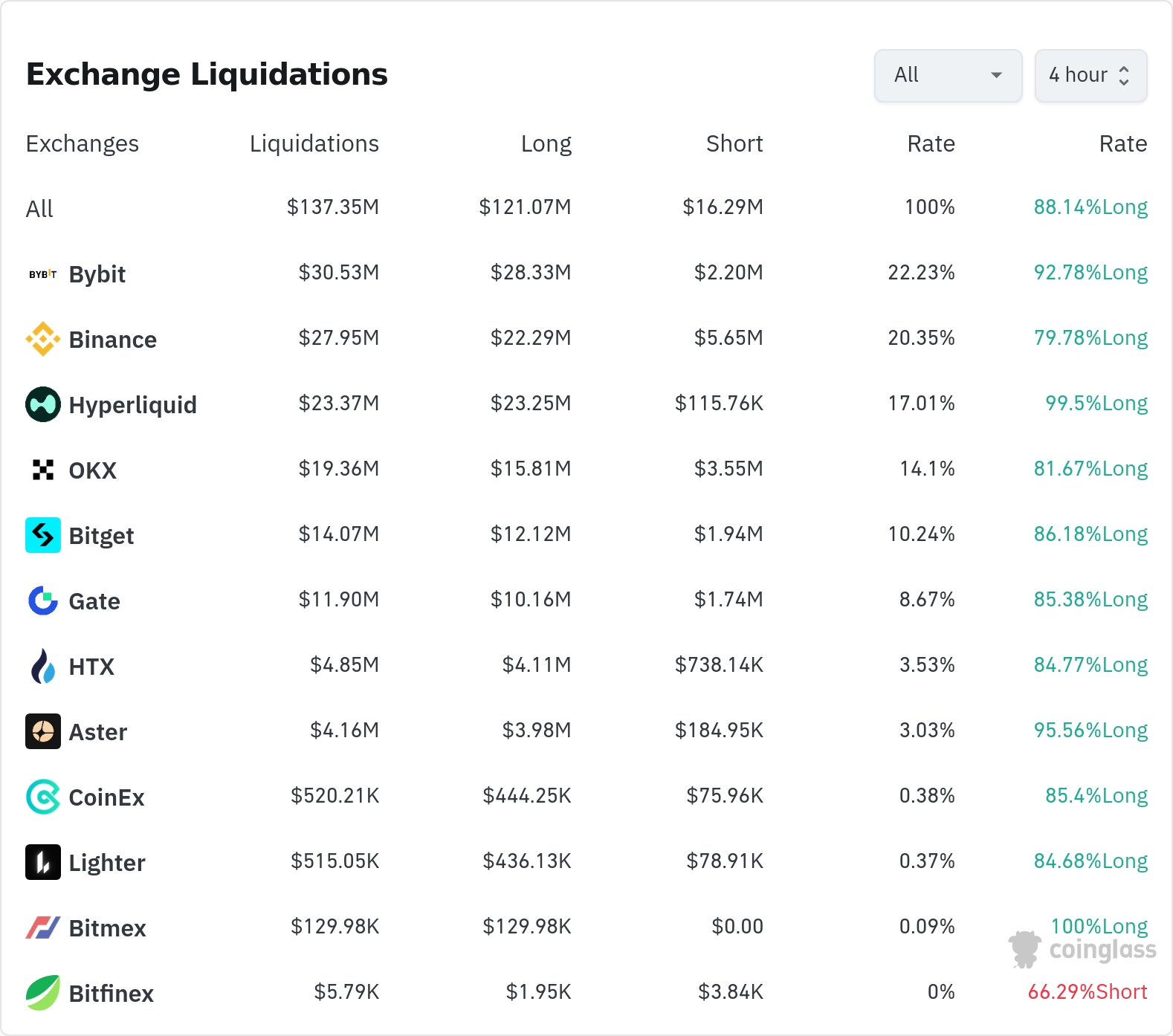

According to currently aggregated data, long positions account for an overwhelming majority over a 4-hour period, with Bybit, Binance, and Hyperliquid experiencing the most liquidations.

Looking at liquidation data by exchange, Bybit liquidated approximately $30.53 million in positions over a four-hour period, 92.78% of which were long positions. Binance liquidated approximately $27.95 million, 79.78% of which were long positions.

Specifically, on Hyperliquid, $23.37 million worth of positions were liquidated, a whopping 99.5% of which were long positions. OKX and Bitget also saw liquidations of $19.36 million and $14.07 million, respectively, with long position ratios of 81.67% and 86.18%, respectively.

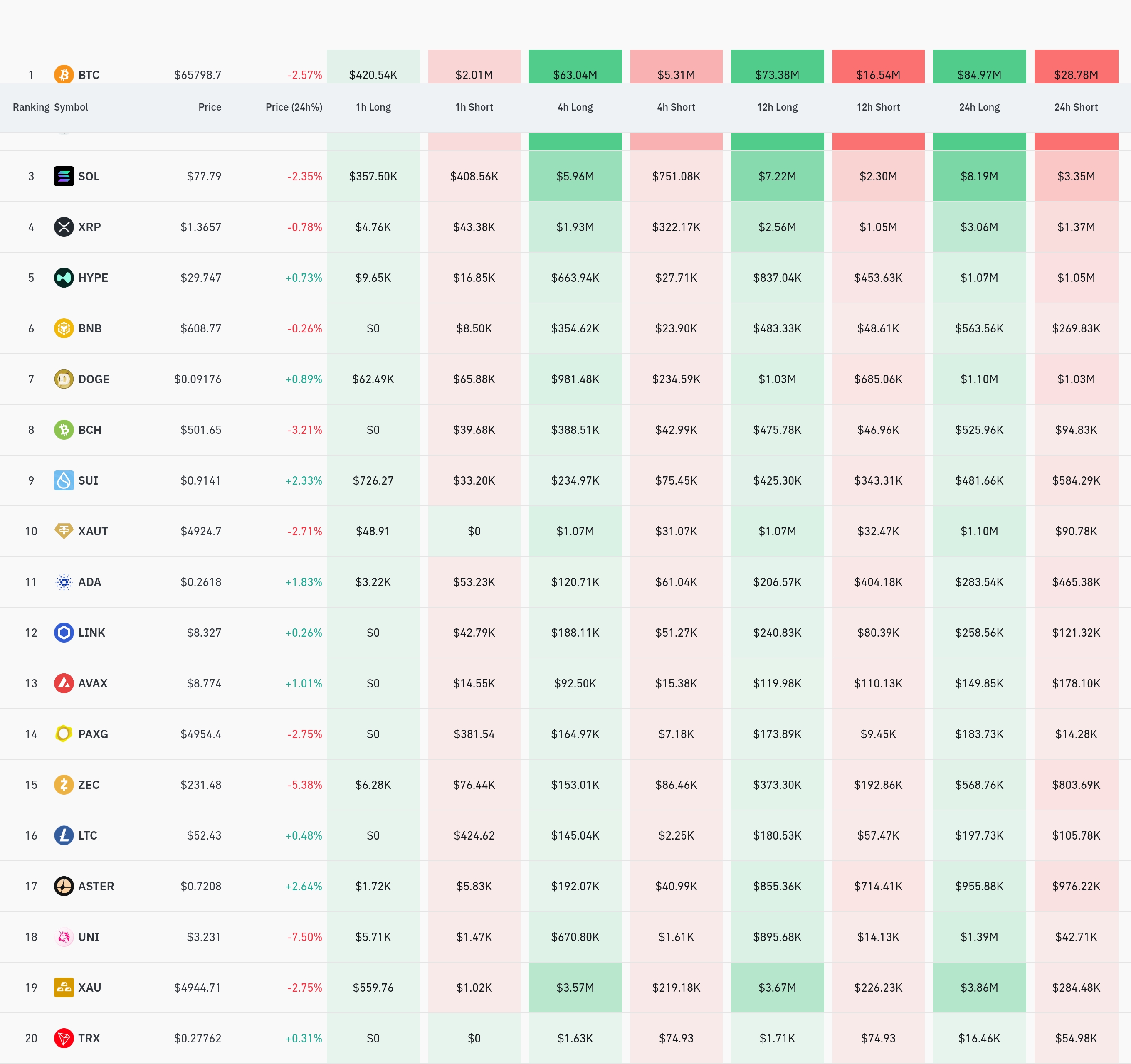

By coin, Bitcoin (BTC) saw the most liquidations. Over the past four hours, $63.04 million worth of long positions and $5.31 million worth of short positions were liquidated, resulting in a total of $113.74 million in liquidations over the past 24 hours. The current Bitcoin price is $65,798.7, down 2.57% over the past 24 hours.

Ethereum (ETH) saw the second-highest number of liquidations after Bitcoin, with approximately $60.17 million worth of positions liquidated over the past 24 hours.

Solana (SOL) saw $5.96 million in long positions and $750,000 in short positions liquidated over the past four hours, resulting in $11.54 million in liquidations over the past 24 hours. The SOL price fell 2.35% to $77.79.

Notably, the UNI token experienced a relatively large decline of 7.50% over 24 hours, which resulted in the liquidation of $670,000 worth of long positions over a 4-hour period.

Gold-linked tokens such as XAUT and XAU also saw significant liquidations, with price drops of 2.71% and 2.75%, respectively. XAU, in particular, saw $3.57 million worth of long positions liquidated over a four-hour period.

Dogecoin (DOGE) saw $980,000 worth of long positions and $230,000 worth of short positions liquidated over the past 4 hours, with the price dropping by 0.89%.

Conversely, some altcoins, such as SUI (+2.33%), ADA (+1.83%), AVAX (+1.01%), and ASTER (+2.64%), saw long positions liquidated despite rising prices. This suggests high short-term price volatility.

This mass liquidation occurred alongside a general downtrend in the cryptocurrency market, dealing a particularly heavy blow to traders holding leveraged long positions. Liquidation refers to the forced closure of a position when margin requirements are not met in leveraged trading. This liquidation data once again highlights the high volatility of the market and the risks of using leverage.

Article Summary by TokenPost.ai

🔎 Market Interpretation

- Large-scale liquidation of long positions in the cryptocurrency market over a 24-hour period (long positions account for more than 85% of total positions)

- The main cause of liquidation was the decline in the prices of major altcoins, centered around Bitcoin (-2.57%) and Ethereum.

- The most liquidations occurred on Bybit, Binance, and Hyperliquid.

- Some altcoins are experiencing high volatility, with long positions liquidated despite price increases.

💡 Strategy Points

- High leverage trading increases risk in a volatile market like the current one.

- Gold-related tokens (XAUT, XAU) also showed a downward trend, confirming their correlation with traditional safe assets.

- Differences in liquidation rates across exchanges reflect differences in liquidity and user composition across exchanges.

The overwhelmingly high rate of long position liquidation demonstrates the market's one-sided direction.

📘 Glossary

- Liquidation: Forcibly closing a position when the margin requirement is not met in a leveraged transaction.

- Long Position: A position purchased in anticipation of an asset price rise.

- Short Position: A position sold in anticipation of a decline in asset price.

- Leverage: A method of borrowing that allows you to trade on a larger scale than your own capital.

TokenPost AI Notes

This article was summarized using a TokenPost.ai-based language model. Key points in the text may be omitted or inaccurate.

Get real-time news... Go to TokenPost Telegram

Are you hesitating about when to buy or sell and missing the timing?

Determine your investment direction with real-time positive and negative signals analyzed by TokenPost AI.

Copyright © TokenPost. Unauthorized reproduction and redistribution prohibited.