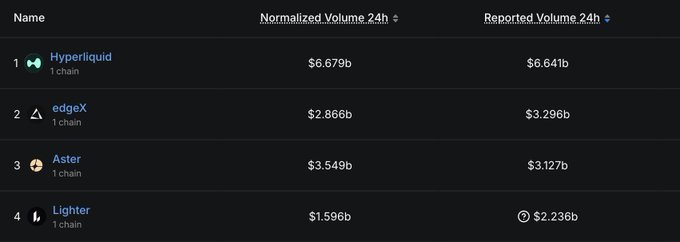

The news two days ago about @circle investing in @edgeX_exchange reminded me of a news item I saw last week: "Circle announces partnership with Polymarket to bring stablecoin infrastructure to prediction markets." Therefore, investing in edgeX is clearly not a simple financial investment, but rather a strategic move by Circle that echoes last week's news. (By the way, I checked Defillama and edgeX is still in second place this morning.) This matter can be viewed from two perspectives regarding Circle- The core idea is simple: Circle doesn't just want to be a USDC issuer, but rather to build its own USD financial network. The approach is straightforward: through partnerships and investments, it aims to embed native USDC into high-frequency, high-margin, and high-turnover core trading scenarios. PolyMarket - Replaces Polygon's bridged USDC with native USDC. edgeX - Integrating native USDC and its cross-chain transfer protocol CCTP into EDGEChain Circle clearly recognizes that if it only focuses on issuance without application control, USDC risks being marginalized in the future. The depth of scenario integration is more important than simply market capitalization or issuance volume, a point that is quite similar to the AI industry. Major model vendors are all developing front-end applications—Perplexity and OpenAI are personally developing browsers, ByteDance's Seedance is directly competing with and leading OpenAI's Sora, and Gemini was recently embedded in Chrome... Essentially, they are all vying for application entry points. As for payment? Based on current data, payments still account for less than 10% of daily stablecoin usage. The real battleground remains—trading and settlement on EdgeX. 1. Resources - This is easy to understand. The support from the world's second-largest and most compliant stablecoin brings not only liquidity, but also institutional channels, regulatory signals, and brand credibility, which is almost a qualitative leap for Boost. 2. Endorsement - Securing investment from Circle signifies that edgeX has passed scrutiny regarding its decentralized architecture, risk control system, liquidation structure, and stability under extreme market conditions. It is evolving from a retail-driven platform into an infrastructure acceptable to institutional investors. Finally, I'd like to mention a phenomenon I've personally observed, which I believe is one of the key reasons for Circle's collaboration with edgeX. Those who pay close attention will have noticed that in the past two months, Binance, Hyperliquid, and edgeX have all been actively launching commodity and US stock derivatives, with trading volumes steadily increasing, drawing significant liquidity and attention away from Altcoin. Taking edgeX as an example, the platform offers derivatives such as XAUT (gold), SILVER (silver), and COPPER (copper), as well as derivatives for approximately 20 US-listed stocks including NVIDIA, Apple, Tesla, Coinbase, and Robinhood. With 24/7 trading, its recent trading volume for gold, silver, and copper is second only to BTC, ETH, SOL, and BNB, while its overall commodity trading volume is second only to Hyperliquid, with even better trading depth. Therefore, Circle's investment is not only an endorsement of edgeX's product capabilities but also a clear assessment that decentralized derivatives are becoming one of the core application scenarios for stablecoins. Through edgeX, USDC begins to participate more deeply in the continuous pricing process of global risk assets, evolving from a payment and settlement tool into a fundamental liquidity unit in the high-frequency financial system—this is Circle's true ambition. P.S. - I'm currently experiencing some PTSD with "not...but rather." Sometimes after I finish writing, if I happen to see a sentence that uses "not...but rather," I compulsively change it. It's not that it doesn't flow well, but it just looks too much like GPT!

This article is machine translated

Show original

Lao Bai

@Wuhuoqiu

我去,居然是Circle投资,有点东西! @edgeX_exchange

看了下过去24小时的Dex Perp Volume,从过去几个月一直稳在的三四名,现如今也杀到了榜眼位 x.com/edgeX_exchange…

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content